- The Securities and Exchange Commission filed a new lawsuit against Coinbase.

- The commission has requested the judge to dismiss the exchange’s countermotion.

- Coinbase remains resolute and plans to file a response in opposition.

Crypto giant Coinbase has been navigating a storm of regulatory challenges since the United States Securities and Exchange Commission (SEC) accused the exchange of violating laws and conducting illegal operations within the country.

While Coinbase sought to dismiss the notion, the legal tussle has taken a new turn with the SEC vehemently opposing the exchange’s motion, further complicating the case.

SEC’S Latest Arguments

In a court filing on October 3rd, the SEC presented a counterargument advocating for the dismissal of Coinbase’s motion, doubling down on its stance against the exchange.

Sponsored

Coinbase’s motion, filed on June 29th, emphasized that “investment contracts must include common law contractual undertakings to deliver future value or a contractual right to the profits, income, or assets of a business.” It asserted that none of its services satisfy these criteria and, therefore, should not be subject to regulation.

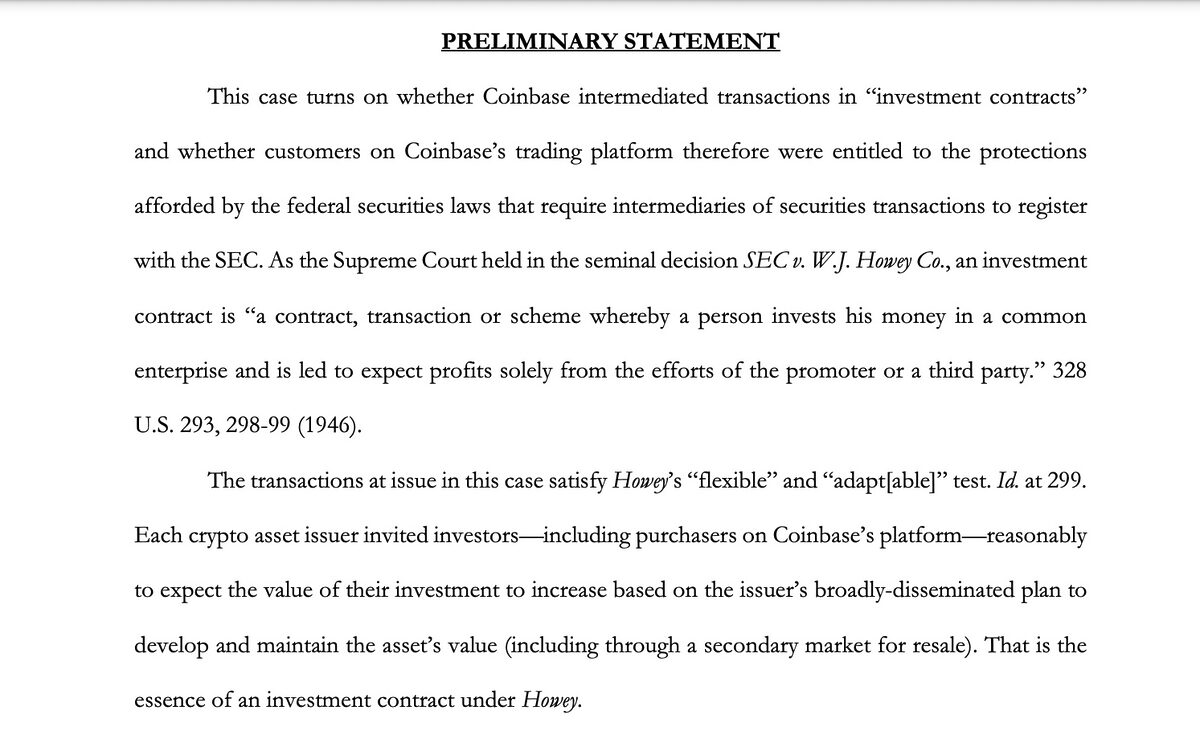

Responding to the exchange’s claims, the SEC argued that Coinbase’s product offerings are investment contracts, which provide investors with a reasonable expectation of value appreciation. According to the SEC, this meets the flexible and adaptable criteria of the Howey test, a key precedent in securities law.

Furthermore, the commission added that Coinbase’s motion is flawed, maintaining that courts have considered an array of factors in determining the application of Howey, including contractual commitments, but have never decreed a formal contract as a prerequisite.

Sponsored

The SEC also rebutted Coinbase’s assertions that the commission had previously approved its conduct as a public company and argued against the exchange’s contention that it lacked the jurisdiction to oversee securities. The regulators emphasized that the lawsuit should not have “come as a surprise,” as the exchange has been cognizant of the possibility of assets traded on its platform being classified as securities.

In response to the recent filing, Coinbase’s Chief Legal Officer, Paul Grewal, turned to Twitter to address the SEC.

Coinbase’s Response

Grewal emphasized that the commission’s arguments lack legal citations and maintained that the exchange’s offerings are not securities and are not subject to the regulations.

He added that the commission’s approach ignores the larger crypto constituency’s call for clearer regulations within the U.S., adding that the exchange will file an opposition on October 24th.

On the Flipside

- On October 3rd, the SEC lost its motion to appeal Ripple’s XRP victory in the U.S. Southern District Court.

- The SEC was recently accused of overstepping authority in its legal case against Binance.

- Amid the ongoing legal tussle, Coinbase announced the acquisition of a full payment institution license in Singapore.

Why This Matters

The SEC’s case against Coinbase is yet another in the growing list of the regulator’s recent jabs at exchanges in the crypto industry as part of its ongoing regulatory measures. The outcome of the case could serve as a significant milestone in outlining regulations governing assets in the industry.

Read more on the SEC’s legal battles against Binance:

USDC’s Circle Takes a Stand in SEC Lawsuit Against Binance

LayerZero enters Asia with a new CoinFlux and China Telecom partnership. Read more:

LayerZero’s BSIM to Boost Interoperability Across Asia