- The original White Paper on Bitcoin was released 15 years ago.

- Bitcoin currently boasts hundreds of billions in market capitalization.

- The anniversary of the launch of Bitcoin differs from the commemoration of the Bitcoin whitepaper.

Since its inception in 2008, Bitcoin has become the world’s largest digital asset, igniting a technological revolution reverberating through the global financial system.

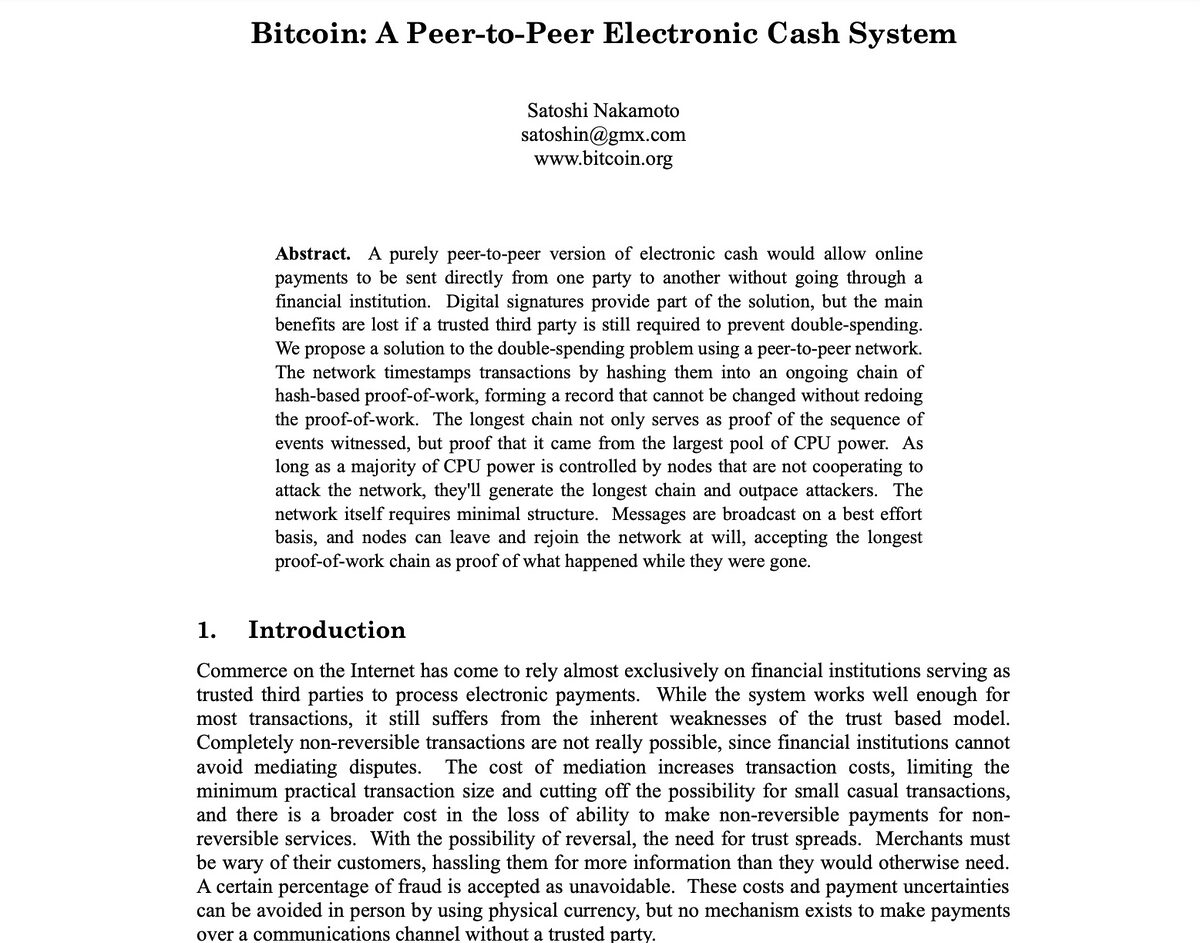

On October 31, 2008, the official Bitcoin whitepaper was published, titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

Today, October 31, 2023, we celebrate the 15th anniversary of the Bitcoin whitepaper, a catalyst for the now decentralized finance system.

From White Paper to $670B Market Capitalization

The Bitcoin whitepaper was anonymously introduced in response to the ‘Global Financial Crisis of 2008’, offering a decentralized digital currency that relied on blockchain technology.

Sponsored

In the nine-page document, Satoshi Nakamoto, the pseudonymous founder or group of founders of Bitcoin, proposed a transparent financial system where transactions were recorded in a public ledger, and consensus was achieved through a proof-of-work mechanism.

The Bitcoin White Paper’s “permissionless innovation” nature eradicates the need for intermediaries such as financial institutions, restoring power to individuals and allowing participation regardless of background or status. Now, Bitcoin has evolved in multiple ways than its founder(s) might have foreseen, inspiring a myriad of other cryptocurrencies and blockchain projects.

Bitcoin’s 15-Year Journey

Over the years, Bitcoin has crossed several significant milestones throughout its history, including all-time high prices that garnered worldwide attention.

Sponsored

Originally designed to be a decentralized peer-to-peer payment network, the Bitcoin network was used to send and receive funds anonymously online. However, the digital currency has grown beyond its initial use cases and is now considered a store of value, like gold, making it a popular investment choice.

Additionally, Bitcoin has gained recognition as a legal tender in various regions, with El Salvador leading the way as the first country to officially make it a parallel currency alongside the U.S. dollar. Furthermore, Bitcoin has been adopted widely as a payment gateway, promoting global financial inclusivity.

Bitcoin has fostered an ecosystem valued at $1.2 million, currently boasting of a market capitalization surpassing $670 billion. Nearly 19.5 million BTC have been issued, representing approximately 93% of its total supply. The Bitcoin community continues to develop the network, to keep up with the growth of the wider blockchain industry.

On the Flipside

- The true identity of Bitcoin’s founding father, Satoshi Nakamoto, remains unknown.

- The first Bitcoin block, the Genesis Block, was mined on January 3, 2009, and Satoshi made the first transaction to Hal Finney, who received 10 BTC on January 12, 2009.

- In April 2023, the Bitcoin White Paper was discovered to be embedded in Apple computers.

Why This Matters

The 15th anniversary of the Bitcoin White Paper underscores the resilience and impact of Bitcoin in the history of decentralized finance, reinforcing its scalability and sustainability.

To dive into the latest developments in Bitcoin’s market activity, read here:

Unpacking the Bitcoin Rally: What’s Driving the Surge?

Read more on the ongoing legal entanglement involving Terraform Labs, Do Kwon, and the U.S. SEC:

TerraForm Labs and Do Kwon Hunt SEC Lawsuit Dismissal