- Terraform Labs and co-founder Do Kwon have filed a new motion against the Securities and Exchange Commission(SEC).

- The claim is rooted in insufficient evidence to back the commission’s allegations.

- The court had previously dismissed a similar motion.

Since the 2022 collapse of Terra, which resulted in a domino effect on the whole crypto industry, Terraform Labs, its downtrodden co-founder Do Kwon, and the U.S. Securities and Exchange Commission (SEC) have been ensnared in a year-long conflict.

On February 16, 2023, the SEC launched a probe into Terra Labs and Do Kwon, alleging the orchestration of a multi-billion dollar crypto asset securities fraud. The legal battle has now taken a new turn, as Terraform Labs and Kwon file a motion to quell the storm.

Defendants Demand Dismissal

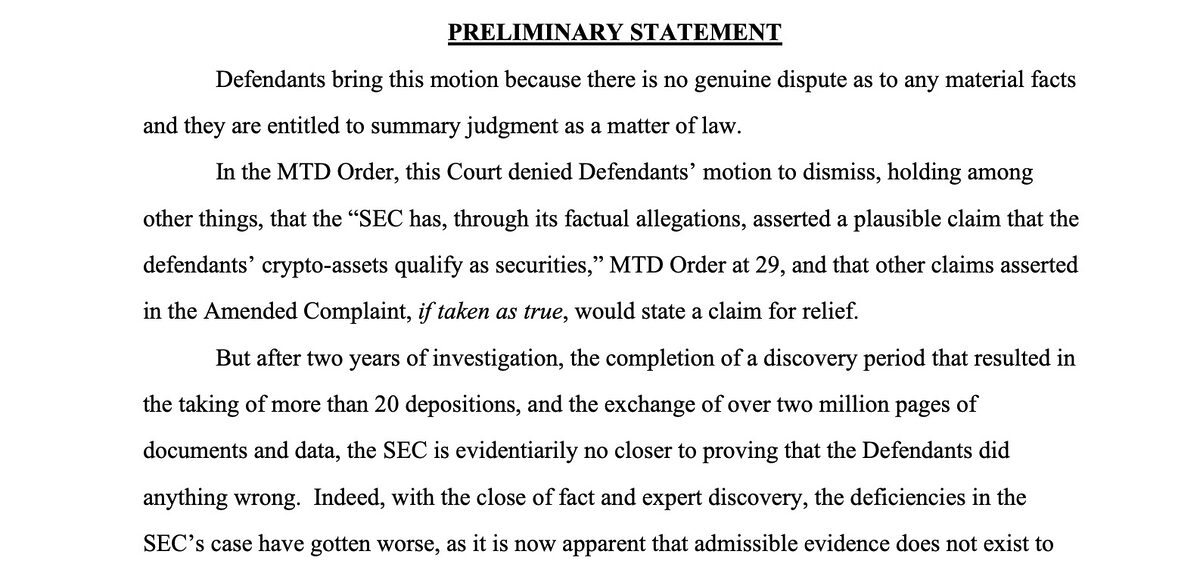

On October 27th, Terraform Labs and Do Kwon filed a motion for a summary judgment in the United States District Court for the Southern District Of New York, aiming to dismiss the allegations of the Securities and Exchange Commission.

Sponsored

The 56-page motion argued that the SEC has failed to provide sufficient evidence to support their claims of securities fraud despite a two-year investigation. The defendants contended that the commission’s allegations are fraught with deficiencies and have relied on witnesses, rumors, and innuendos without credible firsthand knowledge relevant to the case.

Terra Labs and Do Kwon further addressed the allegations of illegal funds transfers, emphasizing that the SEC’s attempt to draw parallels with other cases involving the theft of customer funds is unfounded.

They underlined that the SEC “knowingly made false allegations” regarding Terraform Labs and its founders moving millions of dollars into Swiss bank accounts for personal gain and refuted this by highlighting the absence of customers and, consequently, any customer funds.

Sponsored

The parties now demand that the Court grant a summary judgment in its entirety, as the SEC cannot meet its burden of proof to support its case.

SEC vs. Terraform Labs and Do Kwon

In its February lawsuit, the SEC alleged that Terraform Labs and Do Kwon had been selling unregistered cryptocurrency tokens since April 2018, all deemed as securities.

The complaint added that the failed UST stablecoin’s price was manipulated by the founders, stripping the United States retail and institutional investors of more than $40 billion.

While the defendants initially sought to dismiss the lawsuit in June, the court denied their motion, emphasizing that the SEC had presented factual allegations supporting the plausibility of the defendants’ crypto-assets being classified as securities.

On the Flipside

- On October 13th, Terraform Labs accused Citadel Securities of orchestrating the May 2022 UST depeg.

- Do Kwon has repeatedly rejected extradition requests by the SEC, stating that their demand to question him in the U.S. is “impossible” due to his detainment in Montenegro.

- Recently leaked documents have revealed Do Kwon’s admission of artificially inducing trading volume on Terra’s blockchain.

Why This Matters

The outcome of the Terraform Labs-Do Kwon-SEC fiasco is not only crucial for the involved parties but also significant for the broader cryptocurrency industry. The case may set a precedent for how regulatory bodies view and regulate crypto assets, impacting the legal framework and practices within the industry.

Read more on the legal saga between the SEC and Terraform Labs:

SEC Targets Terra Co-Founder with LUNA, USTC Collapse Lawsuit

Global regulations are strengthening within the cryptocurrency industry as major regulators unite. Read more:

Singapore, UK, Japan, Switzerland Ally For Global Regulation