Ripple CBDCs (Central Bank Digital Currencies) promise to reinvent how everyday people live their everyday lives. Imagine all your typical daily transactions, like a cup of coffee, being handled in split seconds using official, government-approved digital assets.

One of the most hotly discussed real-world applications of blockchain technology, Central Bank Digital Currencies (CBDCs), awaits trial in dozens of countries worldwide. As a resounding leader in efficient blockchain payments, it is no surprise that Ripple Labs is leading the charge on CBDC adoption worldwide.

What about Ripple Labs’ CBDC offering gives it an edge over rival providers?

Table of Contents

What Is the Ripple CBDC Platform?

The Ripple CBDC Platform aims to be an all-in-one solution that provides governments with everything they need to deploy and maintain a secure and reliable Central Bank Digital Currency.

Sponsored

The protocol allows financial authorities to launch their own private networks using XRP Ledger technology, offering an efficient and scalable solution. The benefit of using a private network means that governing bodies can mitigate the risk of unexpected network congestion while also exercising control and authority over the network.

Sponsored

With 130 countries currently pursuing Central Bank Digital Currency solutions, Ripple has established itself as one of the leading contenders to dominate the market share of CBDC providers.

What Makes the Ripple CBDC Protocol so Effective?

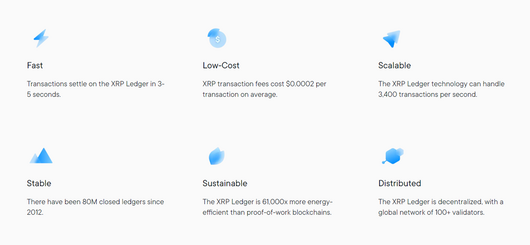

If you’ve ever used the XRP Ledger, you’ll be well aware of just how efficient the protocol truly is. Capable of executing transactions in a matter of seconds at a fraction of a penny, the XRPL is inherently designed to handle thousands of transactions per second without breaking a sweat.

Beyond that, the Ripple CBDC Platform has plenty of other perks, making it an attractive option for governments looking into Central Bank Digital Currency services. The underlying technology, the XRP Ledger, is one of the most sustainable blockchains in the crypto market and is estimated to use around 60,000 times less energy than Proof-of-Work blockchains like Bitcoin (BTC).

The platform also features simple mint and redemption functions. Users can redeem their on-chain funds for fiat currency, and vice versa, at a 1:1 rate.

However, one of the greatest benefits of the Ripple CBDC Platform is its interoperability. By design, the Ripple Labs protocol will integrate not only with local and domestic payment systems but also with an international network of other Ripple-based CBDCs.

Finally, a fully-fledged and integrated Ripple CBDC platform is expected to boost financial inclusion rates. End users can hold, store, and transact using government-approved digital currencies from their own blockchain-based wallet.

What are the Possible Use Cases of Ripple CBDCs?

Central Bank Digital Currencies are a delicate blend of crypto and fiat currency. While cryptocurrency acceptance is slowly growing worldwide, many cases still don’t accept crypto assets.

CBDCs aim to bridge the gap, using blockchain technology to streamline payments and give users another way of managing their funds. In theory, anything that you pay for using fiat currency will be able to be paid for using an official, government-approved digital currency.

Ripple CBDC Barriers to Adoption

While everything looks good on paper, a few hurdles still need to be overcome before millions of people across the planet start transacting on private Government blockchains.

According to the Ripple CBDC Platform Whitepaper, one of the biggest barriers to adoption is the lack of consistent frameworks for regulating CBDCs. Given Ripple Labs and XRP’s turbulent and long-winded history with the law, it’s safe to say that clear global regulations around CBDCs won’t happen quickly.

Other issues stifling CBDC development include a lack of education about Central Bank Digital Currencies and their work. This, in turn, could lead to a disappointing end-user adoption rate.

Additionally, Central Bank Digital Currencies are laced with privacy and security concerns. One of the suggested features of CBDCs is that they could have programmed expiry dates, suggesting that funds need to be redeemed before a certain date.

While proponents believe this may stimulate a free-flowing and expansive economy, it could also leave large population groups unable to save money effectively.

On top of that, CBDCs are inherently anti-crypto. The foundational ethos of cryptocurrency is that users have complete control over their funds on a decentralized network. If a Government body privately owns the blockchain, that gives them explicit authority over how the network is used.

Which Countries Are Exploring Ripple CBDCs?

One of the largest CBDC providers in the crypto market, Ripple Labs has certainly got its fingers in plenty of pies. Working with over 20 global central banks on CBDC initiatives, Ripple has eagerly made their mark on one of crypto’s most discussed use cases.

Ripple Labs is confirmed to be currently involved in CBDC pilots in the following nations:

- Colombia

- Bhutan

- Pulau

- Montenegro

Ripple CBDC Pros and Cons

The Ripple CBDC Platform is one of the most comprehensive Central Bank Digital Currency offerings in the blockchain industry, but it’s far from perfect. Let’s review the pros and cons.

Pros

- Efficient – The Ripple CBDC Platform is everything it needs to be to support mass adoption. The underlying technology is well-equipped to handle huge amounts of users and is fast, sustainable, and affordable.

- Trustworthy – Ripple Labs is one of the largest and most recognizable companies in the crypto world. Governments are far more likely to choose known and trusted names over unproven platforms from smaller teams.

- Boosts Financial Inclusion – The Ripple CBDC promises to be accessible and as easy to use as traditional payment methods.

Cons

- Barriers to Adoption – Despite its perks, many obstacles must be overcome before CBDCs are commonplace.

- Security and Privacy Concerns – CBDCs are anti-crypto by nature. They give centralized authorities greater control over user’s funds.

On the Flipside

- Giving financial authorities control over the network doesn’t sound particularly cohesive with the ethos of cryptocurrency and blockchain technology.

Why This Matters

Central Bank Digital Currencies are expected to be one of the biggest sources of blockchain adoption soon. Understanding how Ripple’s CBDC Platform works will help you to stay informed in this contentious corner of the crypto world.

FAQs

Colombia, Bhutan, Montenegro, and Pulau are all confirmed to have been working on CBDC pilots with Ripple.

You can buy Ripple (XRP), as well as other popular digital assets like Ethereum (ETH) and Cardano (ADA), on crypto exchanges like Binance and Coinbase.

The cryptocurrency projects leading the charge on CBDC development are Ripple (XRP) and Ethereum (ETH).