- An Onchain report shows that 78 percent of the circulating Bitcoin supply is illiquid

- The data reveals that only 4.2 million Bitcoin is in constant circulation.

- The amount of illiquid Bitcoin increases with price rallies.

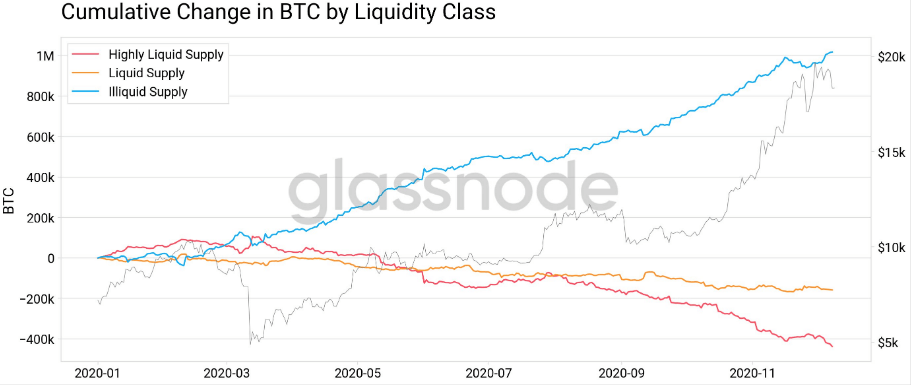

A recent Onchain research carried out by blockchain analytics firm, Glassnode, shows that the illiquidity of Bitcoin has risen to 78 percent. Satoshi Nakamoto, the creator of Bitcoin, designed the digital asset with a max supply of 21 million coins, to date 18.5 million BTCs have been issued.

According to the data, Bitcoin which has an existing supply of 18.5 million coins, has a circulating supply of 14.5 million. However, only 4.2 million of the Bitcoins classified as illiquid in constant circulation. The blockchain analytical firm reported:

Bitcoin liquidity is defined as the average ratio of received and spent BTC across entities. We show that currently 14.5M BTC are classified as illiquid, leaving only 4.2M BTC in constant circulation that are available for buying and selling.

The report noted that not only is the percentage of illiquid Bitcoin at an all-time high, the amount of illiquid Bitcoin is also increasing. According to the research data in 2020, a total of 1 million additional BTC have become illiquid.

On the Flipside

- A January report shows that PayPal bought up to 70 percent of all the newly mined Bitcoin in December.

- This comes after the payment giants first announced its moves to offering cryptocurrencies to their 350 million users.

- Also, popular Bitcoin mining equipment maker, Ebang, announced on Thursday, December 31, 2020, that it is preparing to launch a cryptocurrency exchange in the first quarter of 2021.

Is the Price Rally Fueled by the Illiquidity?

The report released by Glassnode shows that as the price of Bitcoin rises its illiquidity rises alongside. A pattern that can be observed during Bitcoin’s runup in 2017.

Another possible reason for the increased liquidity could be as a result of institutional interest in Bitcoin. In 2020, we saw large financial institutions and hedge fund managers invest in cryptocurrencies in large quantities.

Over the course of the year, we saw investments Massachusetts Mutual Life Insurance, MassMutual and Grayscale also reported its highest ever investments in Bitcoin-focused products, the company now has $6.3 billion in Bitcoin holdings. Ruffer Investment also confirmed a massive $744 million investment in Bitcoin.

Sponsored

All round, 2020 was a great year for Bitcoin. Bitcoin treasuries in 2020 included 29 well-known companies holding approximately 1.1 million Bitcoins in their reserves.