- ProShares is eyeing new spot Bitcoin ETFs.

- The asset manager filed for five leveraged and inverse funds.

- Simultaneously, the NYSE filed a 19b-4.

Asset management company ProShares has filed prospectus materials, seeking to expand its spot Bitcoin ETF offerings with five new leveraged and inverse funds.

The development follows a landmark approval of 11 spot Bitcoin ETFs in the U.S. by the Securities and Exchange Commission (SEC) on January 10, subject to ongoing surveillance and compliance measures for “continued investor protection.”

ProShares to Expand Its Spot Bitcoin ETF Offerings

According to a filing dated January 16, ProShares has submitted to introduce five new funds to its spot Bitcoin ETF lineup, including ProShares Plus Bitcoin ETF, ProShares Ultra Bitcoin ETF, ProShares UltraShort Bitcoin ETF, Proshares Short Bitcoin ETF and ProShares ShortPlus Bitcoin ETF.

Sponsored

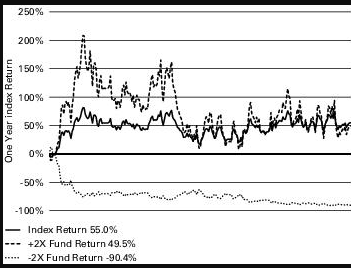

While one of the new funds “seeks daily investment results, before fees and expenses, that correspond to two times (2x) of the daily performance of the Bloomberg Galaxy Bitcoin Index,” two of them don’t directly invest in Bitcoin.

Unlike other spot Bitcoin ETF funds, three of ProShares’ funds do not take a direct short position on the cryptocurrency.

Sponsored

ProShares’ filing came as the New York Stock Exchange (NYSE) also filed to list options on spot Bitcoin ETFs.

NYSE Filing

On Tuesday, the NYSE filed a 19b-4, seeking approval for the listing and trading of options on Commodity-Based Trust Shares, as some of the newly approved spot Bitcoin ETFs are structured.

Bloomberg ETF analyst Eric Balchunas noted that all three exchanges that aim to list options on spot Bitcoin ETFs “had to file a 19b-4,” whereby the earliest approval will likely come in about two months.

If approved, the listings will likely improve trading volume and income for the exchanges, as well as boost liquidity for the new Bitcoin ETFs.

Read why spot Bitcoin ETFs won’t be available in Thailand:

Thai Regulator Rejects Spot Bitcoin ETF, Citing Policy Lacuna

Stay updated on Vanguard’s investment in Bitcoin mining:

Vanguard’s Investment in Bitcoin Mining Is Not What It Seems