AshSwap, the first stable-swap DEX on the MultiversX blockchain (previously Elrond Network), is officially launching on the MultiversX Mainnet on February 17. The DEX will seamlessly bridge critical DeFi functions and provide tighter spreads with a fraction of the liquidity on MultiversX.

In November 2021, AshSwap successfully raised $2.5 million in a private sale led by Elrond. The initial offering of ASH tokens on Maiar Launchpad sold out, with 70,000,000 ASH (7% of the total supply) valued at $2.8 million. AshSwap has since released all of its core features, which have been available on MultiversX Devnet since October 2022.

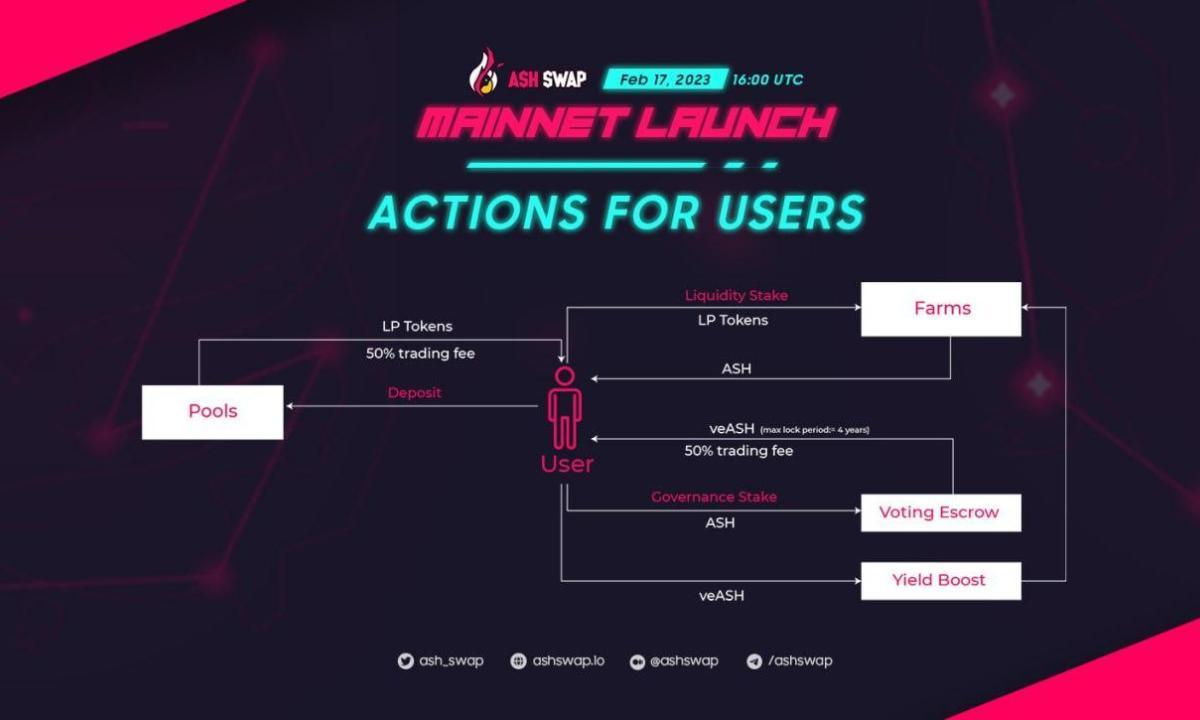

Following more than a year of rigorous testing and development, AshSwap will go live on the mainnet with the following functions:

- Pool V1 (Stable-swap)

- Pool V2 (Non-stable swap)

- Liquidity Provision

- Liquidity Staking (Farming)

- Governance Staking

- Yield Boosting

On and after the launch date, AshSwap will open three pools:

- USDC/UDST/BUSD (Stable-swap)

- ASH/USDT (V2)

- EGLD/BUSD (V2)

By staking ASH in Governance Staking, users receive veASH (voting escrow ASH) in return and unlock multiple benefits. There will also be Emission Voting, giving veASH holders governance control over ASH emissions for each pool. The more votes a pool gets, the more ASH rewards will be allocated. Hence, the APR will be higher for that particular pool, attracting deeper liquidity.

Another core feature: Bribe, will allow anyone to bribe veASH holders to vote for their farms. For example, if the owner of a project with token AAA wants to increase the liquidity of the pool AAA/USDT on AshSwap, they may provide incentives, called bribes, to encourage more veASH holders to vote for their pool.

Neil Nguyen, AshSwap CEO, said: “We have chosen to develop our product on the MultiversX because we think the team has laid out the most compelling vision for onboarding the next billion people into web3, and the technology, development philosophy, achievements, and especially the community, are a strong indication of their ability to execute on that vision.”

AshSwap believes that adding greater DeFi interoperability will boost capital efficiency for liquidity providers and maximize returns over time. That is why the AshSwap team intends to develop more trading products besides stable-swap in the future while still delivering a seamless and user-friendly interface to trade and manage assets.

Sponsored

Additionally, AshSwap’s native token, ASH, is designed to serve the sustainable growth of the protocol with actual use cases and incentivize liquidity providers on the platform.

To celebrate the launch of its stable-swap DEX, AshSwap is hosting a series of incentivized warm-up activities including:

- ASH staking reward pool in which veASH stakers will share a pool of 2,000,000 ASH over 27 days beginning on January 21.

- AshSwap Launch Race, a referral program that awards up to $1,000.

- 250% APY (2.5x) boosted for all pools within 7 days starting from the launch. Enjoy the lucrative APY here.

- Ash Point Custom Quest, three events for users to obtain ASH points by completing the Gleam quest, trading on AshSwap DEX, and staking ASH. The more ASH points you own, the higher your chance of being whitelisted in the upcoming AshSwap airdrop.

More information on these programs can be found here. Join the AshSwap community and participate in the future of decentralized trading today on app.ashswap.io

This article contains a press release from an external source. The opinions and information presented may differ from those of DailyCoin. Readers are encouraged to independently verify the details and consult with experts before acting on any information provided. Please note that our Terms and Conditions, Privacy Policy, and Risk Warning have been recently updated.