- Polygon (MATIC) attracted a large number of developers in 2023 despite price struggles.

- The project’s Ethereum alignment narrative got a boost as it saw many shared developers with Ethereum.

- The influx of developers came as the project unveiled its multichain evolution.

Despite underperforming most leading crypto assets, 2023 was not all bad for Polygon (MATIC). According to Electric Capital’s most recent report, amid price struggles, the Polygon (MATIC) ecosystem could still attract more developers than almost any other blockchain within the year.

Polygon (MATIC) Shows Dev Appeal

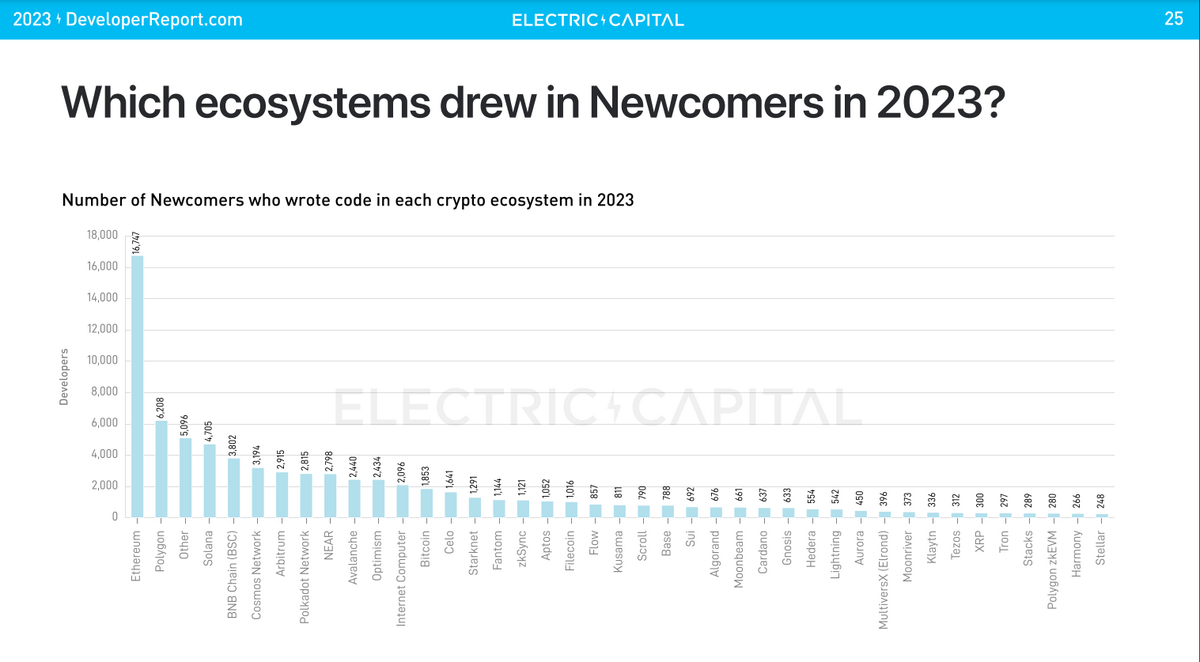

Per a Wednesday, January 17 report released by Electric Capital, in 2023, Polygon attracted over 6,200 new developers, the second-largest of any blockchain behind only Ethereum and ahead of competing projects like Solana, BNB, and Arbitrum, highlighting the project’s strong appeal within the developer community.

Another finding from the report that has Polygon proponents excited is the network’s high percentage of shared developers working on Ethereum, feeding into Ethereum alignment narratives. Polygon shared 36% of its multichain contract deployers with Ethereum, second only to BNB, which shared 39%. “Polygon is Ethereum,” Today in Polygon Founder “Narb” quipped, responding to the report.

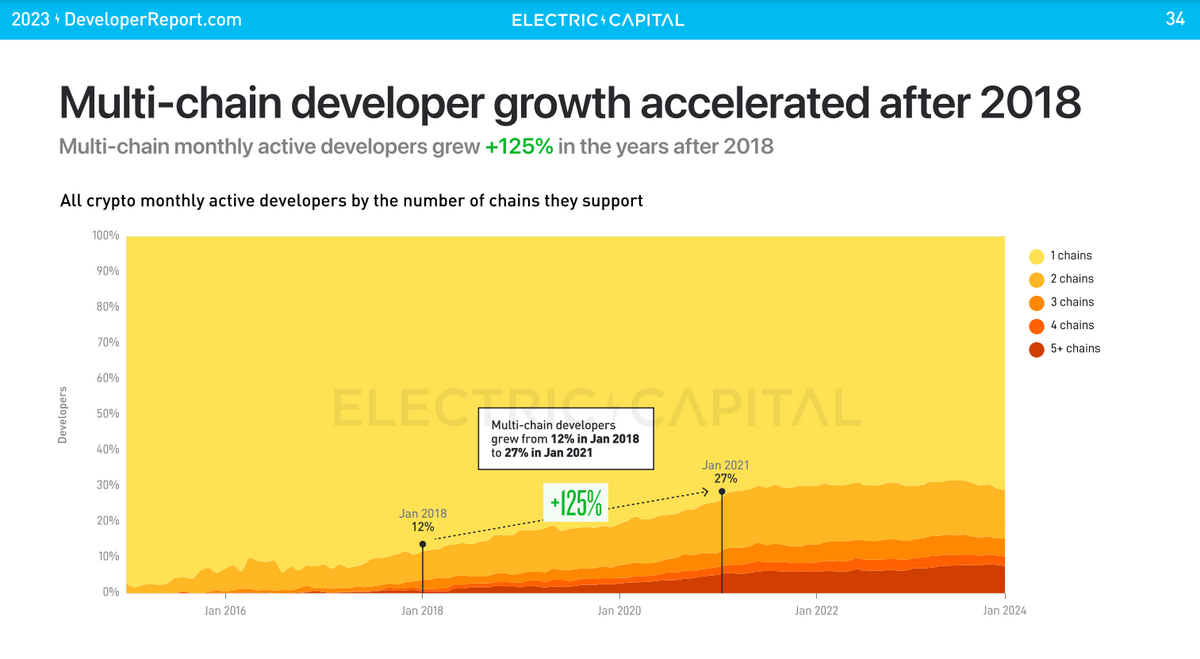

The large influx of developers to the Polygon (MATIC) ecosystem follows the project’s unveiling of its multichain evolution with its 2.0 roadmap. Electric Capital noted that multichain development was a big theme for developers in 2023, old and new alike.

The Year of Multichain Development?

Per the recent report, 34% of all developers in 2023 built for multiple chains, with over 8% building for five or more chains. According to Electric Capital, 2023’s figures represent a 10 times growth in the percentage of multichain developers since 2015. The size of this class of developers has enjoyed an accelerated growth spurt since 2018.

Per the data, 87% of these multichain developers build for EVM chains like Polygon. In 2023, Polygon unveiled a zero-knowledge focus with plans to create an ecosystem of application chains that shared liquidity and infinitely scaled the Ethereum network. So far, the vision has seen buy-in from over 20 projects, including Manta Network, Palm Network, and OKX, following the launch of the CDK.

On the Flipside

- Despite Polygon’s developer appeal, the project lost about 42% of its developers in 2023. However, Electric Capital attributes this to the project’s high growth in 2022, being amongst the projects that had brought in the most developers but had been unable to retain them due to bear market conditions.

- Ethereum attracted nearly three times as many new developers as Polygon in 2023.

Why This Matters

The influx of new developers to Polygon in 2023 highlights the project’s appeal within the developer community, significantly increasing the chances of more novel projects being built within the ecosystem.

Sponsored

Read this for more on Polygon:

Polygon MATIC Founder Reveals Details Around POL Transition

Learn about how Celsius’ latest move is affecting Polygon (MATIC):

Celsius Shakes up Polygon MATIC Price with 26M Exchange Move