- Paypal launched its stablecoin named PayPal’s stablecoin (PYUSD).

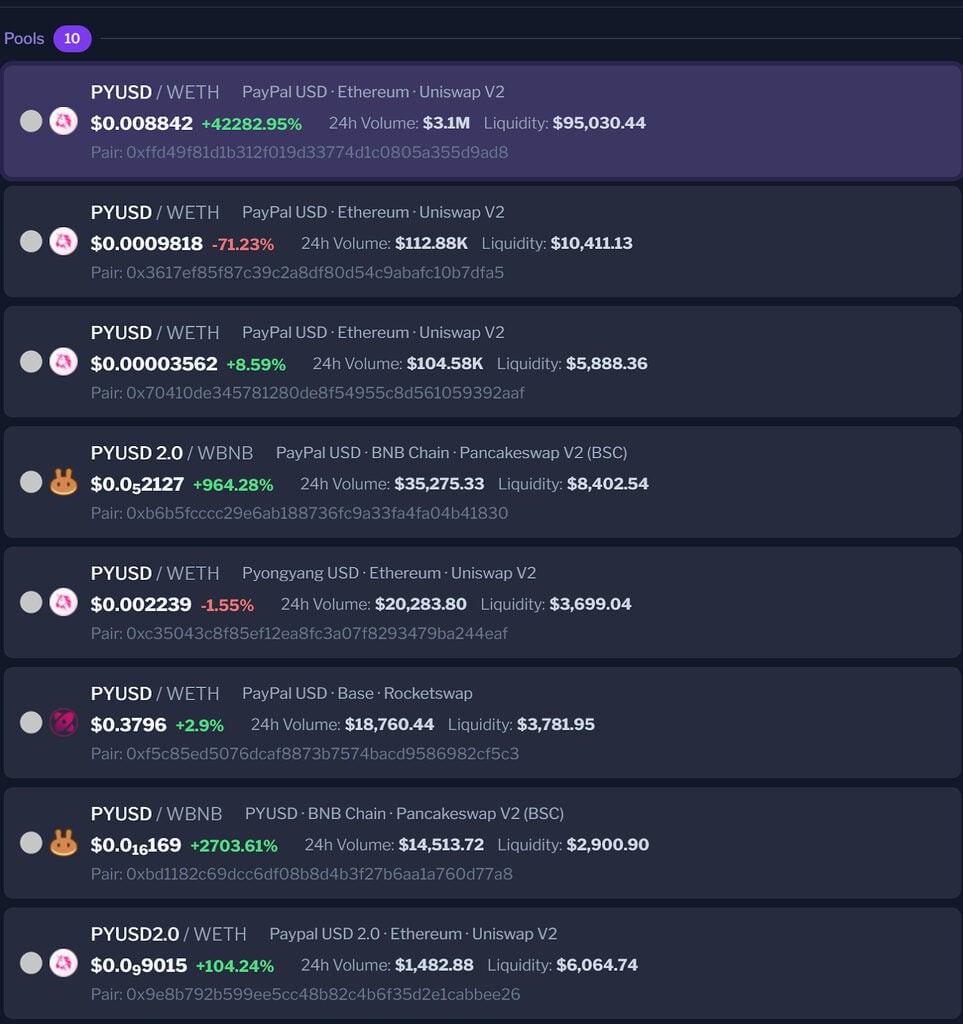

- Paypal’s announcement spawned a series of imitation tokens across various blockchains and platforms.

- This article delves into the mechanics of fake PYUSD tokens and provides guidance on steering clear of them.

The PayPal USD stablecoin was initially proposed by PayPal in November 2022, designed for secure, asset-backed payments. However, its ultimate launch on August 7 triggered a series of fraudulent activities as bad actors looked to take advantage of investors.

What Are the Counterfeit PYUSD Tokens?

Nearly 30 new tokens sporting the “PYUSD” ticker have been minted across various blockchains, including Ethereum, Coinbase Layer-2 Base, and BNB Chain, following PayPal’s stablecoin launch.

The tokens aim to exploit the hype surrounding PayPal’s new stablecoin and mislead investors into thinking they are peddling genuine PYUSD tokens. These imitations have appeared on decentralized exchanges (DEX), including the highly popular Uniswap.

How Do Fake PYUSD Tokens Function?

Many of the false PYUSD tokens appear to be “honeypot” schemes. The scam tricks users into purchasing tokens they cannot sell, effectively trapping their funds later. These deceptive schemes often remain undetected until investors attempt to sell their holdings. The fraudulent tactic is difficult to detect unless the users themselves can audit smart contracts.

How to Discern the Real PYUSD Token

Differentiating the authentic PYUSD from impostor tokens is vital for crypto investors. PayPal has explicitly stated in its press release that PYUSD can only be sent between verified PayPal accounts, compatible wallets, and exchanges. To validate the legitimacy of the PYUSD, individuals should verify that the token uses the contract address provided by PayPal.

On the Flipside

- Fake PYUSD tokens harm the crypto industry’s credibility, reinforcing the perception of scams and impeding trust in genuine projects.

- Fake tokens undermine trust in decentralized exchanges and blockchains, complicating newcomers’ entry into the crypto space.

Why This Matters

The introduction of PayPal’s PYUSD stablecoin has inadvertently unleashed a wave of imposter tokens in the crypto market, posing a significant risk to unwary investors. Given blockchain immutability’s fund recovery challenges, navigating this intricate landscape necessitates vigilance and a discerning mindset.

In other stablecoin news, read about Tether’s vision for crypto mining:

Sponsored

Tether Unveils Vision for Advanced BTC Mining Software

PYUSD’s launch sparked some controversy about its centralized nature. Find out more:

PayPal’s stablecoin sparks centralization concerns in crypto