- Nvidia’s Q4 earnings surpass analyst predictions, spotlighting AI’s importance.

- Following Nvidia’s report, AI-related cryptos surge.

- Experts caution about potential corrections and AI token hype.

NVIDIA, known for its graphics processing units (GPUs), has recently seen a significant surge in its stock value, largely attributed to the increased adoption and development of artificial intelligence (AI) technologies.

This surge is not just a win for NVIDIA but has also had a positive ripple effect on various AI tokens in the cryptocurrency market. These tokens have seen increased interest and valuation in parallel with NVIDIA’s success. However, traders are now asking

NVIDIA’s Surge Boosts AI Tokens

In the wake of NVIDIA’s announcement of its fourth-quarter earnings, the tech giant reported a monumental 769% surge in net income, with revenues soaring to $22.1 billion, far surpassing Wall Street expectations. This financial windfall was primarily attributed to the exponential growth in the company’s AI data center revenues, fueled by robust global demand for generative AI technologies.

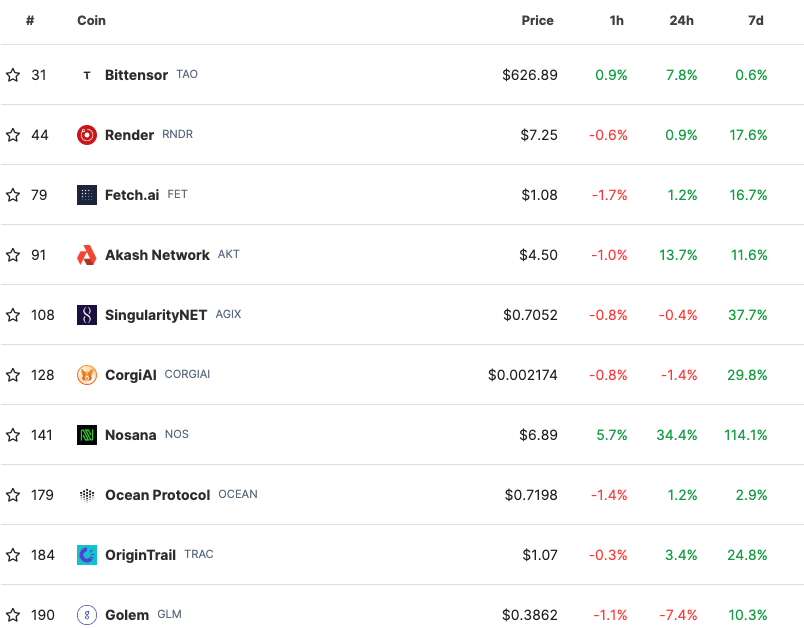

This financial success story had an immediate and notable impact on the AI token market. Prominent AI-related cryptocurrencies, including SingularityNet (AGIX), Fetch.AI (FET), Render (RNDR), and others, experienced significant price increases. The overall market capitalization of AI and big data tokens, according to CoinGecko, surpassed $17 billion.

Is NVIDIA’s AI Token Boost Sustainable?

Given the impressive surge in AI tokens following NVIDIA’s groundbreaking earnings report, the question of sustainability arises. Several industry participants have suggested that the AI token hype could be shortlived, unless projects develop meaningful use cases for the technology.

Ken Bassig, Head of Research at a crypto trading firm, Magnus Capital, suggests that many of the use cases in AI tokens seem forced. He suggests that many projects ride the narrative hype and lack clear utility and business models.

Moreover, Vy, co-founder and CEO of an AI crypto project, RoboInu, highlights the technical challenges and expertise required to develop meaningful AI solutions. They suggest that success in the AI token space is not merely about following trends but about contributing substantive value to users.

Sponsored

Together, these viewpoints underscore a critical takeaway for investors and enthusiasts in the AI and blockchain sectors. While the tokens are currently riding the hype wave, sustainable growth lies in the development of technologies and platforms that offer tangible benefits and solve real problems.

On the Flipside

- The rapid increase in the value of AI tokens, while exciting, could lead to equally swift corrections, impacting investors who enter the market at peak valuations.

- As with any burgeoning field within crypto, AI tokens could face future regulatory scrutiny. Changes in legislation or policy could impact the development and trading of these tokens, introducing uncertainty and risk.

Why This Matters

NVIDIA’s surge and its impact on AI tokens underscore the potential for AI to transform various sectors. However, for this potential to be fully realized, the focus must shift towards sustainable growth, emphasizing projects with strong fundamentals.

Read more about NVIDIA’s surge and its effect on AI tokens:

Hedera’s HBAR Rides Nvidia Hype Wave to Inspire Top 20 Rally

Read more about Indonesia’s Web3 initiatives:

Indonesia’s 1000 Startup Program Embraces Web3 with Lisk