- Nigerian crypto trading volume surges.

- Cryptocurrency adoption in Nigeria leads the Sub-Saharan region.

- Nigerian authorities are warming to digital assets.

Grassroots adoption of digital assets has been losing traction as global markets struggle under crypto winter. Going against the grain, Nigeria has surged into second place on the Global Adoption Index in 2023, climbing from the 11th spot the year prior.

Nigeria’s ongoing economic woes have played a significant role in the growing popularity of cryptocurrency. With the naira’s continued weakness in international markets and the soaring cost of living, Nigerians are hedging their bets against a failing system as crypto trading volumes rise in the region.

Crypto Usage in Nigeria Soars

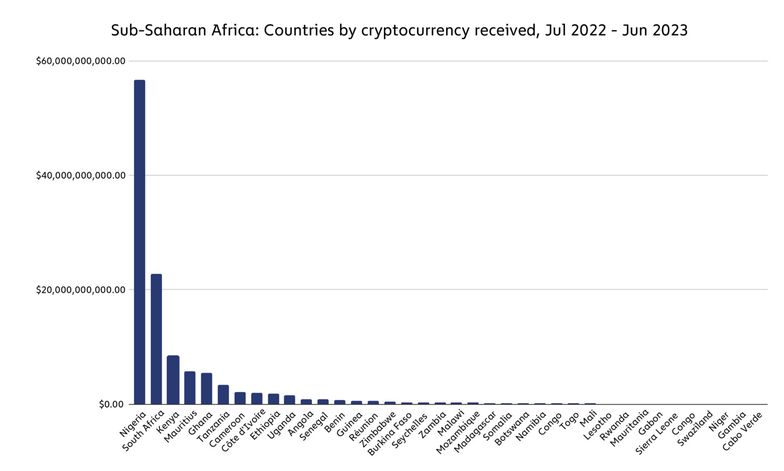

A recent report by blockchain data firm Chainalysis revealed that Nigerian cryptocurrency trading volume jumped to $56.7 billion between July 2022 and June 2023, from approximately $20 billion in the previous period. This was by far the highest trading volume in the Sub-Saharan African region, outpacing second-placed South Africa’s $22 billion by a significant margin.

The Chainalysis report noted interest in Bitcoin and stablecoins spiked when the naira hit new lows in June and July 2022. Moyo Sodipo, the co-founder of Nigerian exchange Busha, highlighted that locals favor stablecoins over Bitcoin due to the leading asset’s ongoing price weakness. However, Sodipo stated that the overarching objective was whether to use Bitcoin or stablecoins, seeking shelter from the naira’s decline.

Sponsored

“People are constantly looking for opportunities to hedge against the devaluation of the Naira and the persistent economic decline since COVID,” Sodipo remarked.

Recently elected Nigerian president Bola Tinubu has enacted sweeping economic reforms, including ending petrol subsidies and ousting the former central bank governor Godwin Emefiele. However, inflation hit an 18-year high in August while the naira floundered.

The uptake of alternative solutions should come as no surprise under such economic conditions, even despite the Central Bank of Nigeria’s (CBN) protests.

Banking Ban

Nigeria’s strong rate of crypto adoption seems counterintuitive, given the restrictive stance of the country’s central bank. In 2021, the CBN prohibited banks and financial institutions from dealing with crypto activities, even ordering the closure of personal accounts linked to digital asset trading.

Sponsored

At the time, the former Paxful CEO Ray Youssef remarked that the CBN’s hostility toward cryptocurrency will not deter adoption in Nigeria. Youssef explained that the confluence of tough economic conditions, inadequate banking infrastructure, and the intersection of drive and business savvy among Nigerian youth create prime conditions for crypto adoption to flourish, regardless of any regulatory roadblocks.

By 2022, Nigeria’s Securities and Exchange Commission had revised its stance, publishing guidelines for digital asset regulation. This position was later ratified by an amendment to the ‘Investments and Securities Act 2007’ to recognize cryptocurrency as capital for investment.

On the Flipside

- Nigeria’s crypto trading volume represents a small proportion of the country’s $2.024 trillion GDP.

- The popularity of private cryptocurrencies contrasts sharply with the eNaira CBDC, which has been branded a failure following low demand usage.

- Chainalysis ranked African nation Kenya third for Sub-Saharan crypto trading volume at $8 billion between July 2022 and June 2023.

Why This Matters

Cryptocurrencies are often used for speculative purposes in developed nations with stable currencies and robust financial systems. Nigeria demonstrates how crypto can serve as a real-world lifeline amid economic instability.

Learn more about Google’s involvement in blockchain and its other ventures here:

Google Play Pushes for Blockchain Support. Will Apple Respond?

Find out the results of Chainalysis’ latest Global Crypto Adoption Index here:

Grassroots Crypto Adoption Takes Lead in Central & South Asia