- Crypto arbitrage is a trading strategy that exploits the price differences of an asset.

- Different types of arbitrage allow trading across different platforms or trading pairs.

- Arbitrage trading is relatively low-risk but requires quick action and decision making.

When cryptomarkets are booming and volatile, liquidity plays a key role in unbalancing asset prices across trading platforms. This brings new opportunities for smart crypto traders – arbitrage trading.

Buy the same cryptocurrency on platform A and sell it on platform B for a higher price. This is what crypto arbitrage is about in a nutshell. It’s a way of simultaneous buying and selling that allows benefiting from these price differences (spreads).

Crypto arbitrage comes with relatively low risk, however requires quick reaction and immediate decisions.

Sponsored

In this article, we’ll review a few crypto arbitrage trading strategies, simple enough to start reaping benefits from inefficiencies in cryptocurrency markets. But before jumping to trading strategies, first, have a look at how arbitrage works.

What is crypto arbitrage?

Arbitrage is a long known way of trading in securities, commodities, or foreign trade markets. Crypto arbitrage or Bitcoin arbitrage is just the most recent form of it.

However, the essence remains the same: exploit the price differences between the different exchanges and take your reward. Bitcoin may cost $19.800 on Binance, while at the same time its price on Coinbase might be $20.000.

Sponsored

Differences occur because:

- Asset prices are based on trading. There is no single common standard to price them. Most cryptocurrencies are worth what buyers agree to pay for them.

- Exchange liquidity. Trading volumes, differences in supply and demand affect the asset price on a certain platform.

- Location. Crypto exchanges operate in various geographical regions. The time zone defines their opening and closing times and thus the opening and closing prices of assets.

Arbitrage traders seek to buy a cheaper version of the asset while selling a more expensive form of it. Excluding the exchange rates and trading fees, the remaining price difference is their profit.

How does crypto arbitrage work?

Profitable arbitrage trading is about finding the right opportunities, or arbitrage spreads. The spread is a price difference between the Bid (buying) and Ask (selling) prices of the same asset.

- Start looking for coins with a higher volume or price fluctuations. The fast growth in volumes creates inefficiencies within the exchanges, as the less liquid platforms are slower to catch up with the bigger and more liquid ones. This creates a nice opportunity for arbitrage traders.

- Calculate the transaction and transfer costs. Different cryptocurrency exchanges apply different fees. In total, they can be higher than the price difference and even cause losses.

- Evaluate the rate and amount on each Ask and Bid offer. This helps to avoid slippage when your buying order is bigger than the available selling order. In such a case, the part of the Bid order is unfulfilled or accomplished at a different price.

- Keep in mind the potential profit. The spread might look profitable even after the fees. However, the profit is tiny. To avoid that look for the assets with higher prices or trade with the larger amounts of assets to get tangible results.

There are multiple asset price trackers online that can help you identify arbitrage opportunities. Here are just a few of them to start with: Coingapp, Crypto Arbitrage Scanner, Crypto Arbitrage.

Accordingly, a lot of traders use arbitrage automation software instead of manual trading. The software (bots) like Cryptohopper or ArbiSmart can be programmed to scan the markets, detect opportunities and conduct trades at the correct times.

Bots help to save both time and effort, however, they also come with their own risks. Unless coded to adapt to varying market conditions, bots tend to struggle and miss trades when these conditions change.

Ways of crypto arbitrage trading

There are different strategies for crypto arbitrage trading. Each of them has its own advantages and risks.

I. Spatial arbitrage

Spatial (aka Regular) arbitrage is one that involves trading across two exchanges. Simply saying, you buy Bitcoin on Bitstamp exchange, transfer it to Kraken, and sell it here for the higher price.

Arbitrage traders can implement the spatial strategy in two different ways:

- Transferring assets from exchange to exchange

- Buying on one exchange, selling on other

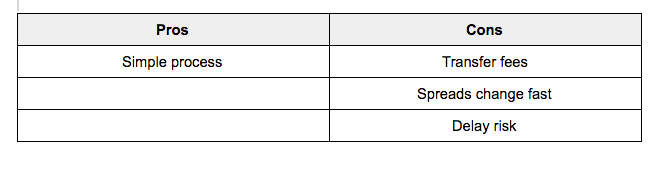

The first way is the easiest to execute, but the least effective. Asset price differences are highly short-lived, the spreads may continue for seconds. Thus buying on one exchange, transferring assets to another, and selling them here has a risk of losing the spread. Including the fact that transactions can get delayed especially when the markets rally and there are thousands of them.

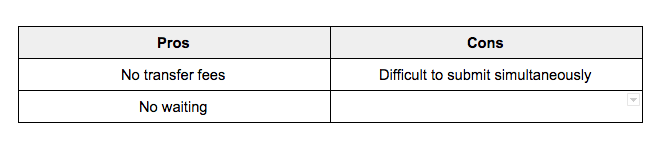

The second way of spatial arbitrage eliminates asset transferring between the cryptocurrency exchanges. Rather, it requires simultaneous trading on two different platforms. This approach, however, helps to act faster, save time and transfer fees.

Here is how to implement it:

- Open accounts on platforms X and Y at the same time.

- Deposit equal amounts of fiat on X and Bitcoins on Y.

- When the opportunity comes, buy Bitcoins on X, simultaneously selling them on platform Y.

Some cryptocurrencies are more volatile than others. Their prices change faster than we think. Using the second method of spatial arbitrage trading may help to act faster on nice spreads when they come. However, it requires skills and quick order filling.

II. Triangular arbitrage

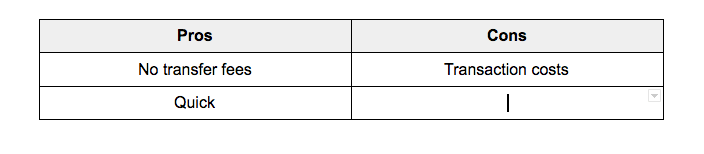

Triangular arbitrage is different from Spatial and proceeds on a single exchange. It does not rely on the asset’s price differences between trading platforms. Rather focuses on exploiting the price differences between trading pairs.

As the name conveys, triangular arbitrage involves three different assets, in our case, cryptocurrencies listed on the same exchange. The strategy is based on trading asset A for asset B, asset B for asset C, and finally asset C back to asset A to earn a profit.

Opportunities for triangular crypto arbitrage arise from price differences between three (or more) cryptocurrencies. Traders are looking for cases when a specific coin is undervalued compared to the other and overvalued compared to the third. They profit from the conversion differences.

Spreads between trading pairs are usually relatively small, thus a triangular arbitrage strategy works best when the transaction fees are low.

Key risks in arbitrage trading

Although crypto arbitrage is considered to be a less risky way of trading, it also has its downsides. The most frequent elements of risk in crypto arbitrage are listed below.

Trading volume

In crypto arbitrage trading liquidity is necessary. Opportunities here highly depend on trading volumes as volumes usually bring bigger price fluctuations. However, the lack of a depth volume can hinder successful trades or leave you stuck with the asset at a price level that is not profitable.

To avoid the risk look for a sufficient depth volume before making a transaction. Check up if the transactions are moving on a particular platform, how big they are and what is the market depth behind them.

Platforms fees

Cryptocurrency exchanges charge their fees for both tradings and transfers. This might significantly reduce the trader’s gains, especially when arbitrage spreads are low. The spread margins are often tight for the leading coins, which leads to trading with large amounts of capital to generate profit.

Thus is it essential to check up on those fees and add them to your total expenses before making any arbitrage transaction.

Transfer issues

Cryptocurrency prices change fast and so do the spreads. The opportunities for arbitrage trading are short-lived and harder to use, especially when arbitrage trading bots strengthen the competition.

When seconds and microseconds matter, risks of transfer delays, system glitches and other technical issues become critically important. On the other hand, trading across exchanges makes traders more vulnerable to hacker attacks. It is always recommended to move assets out from exchanges after making the trade.

Conclusion

Cryptocurrency markets are usually volatile. Liquidity disproportions often appear between different size trading platforms or different trading pairs. This brings multiple opportunities for crypto arbitrage traders.

On the other hand, the arbitrage opportunities are often short-lived as prices correct themselves quickly and their differences might be quite small. As a result, traders have to play fast and with higher amounts of capital in order to make high returns.