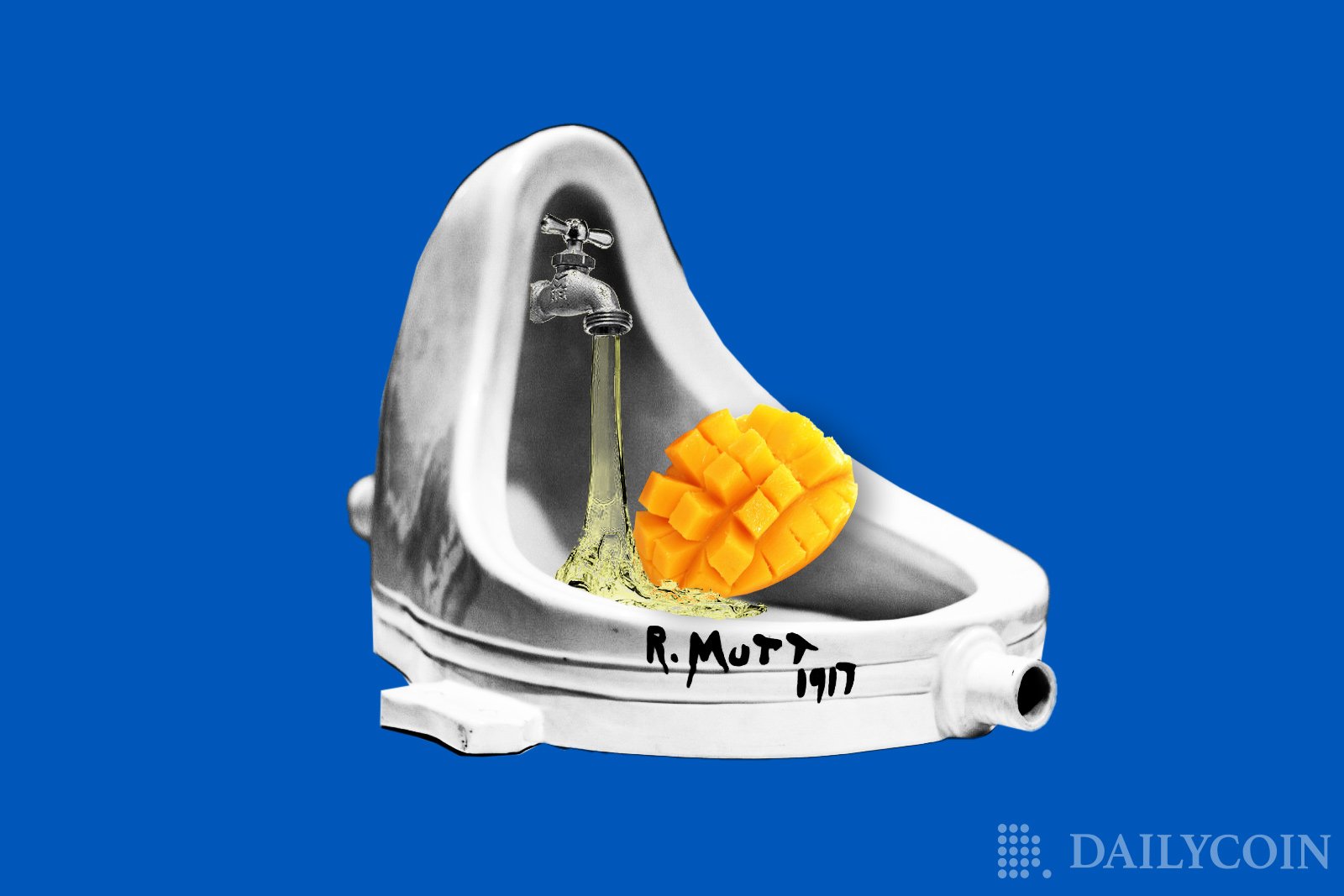

Avraham Eisenberg, the self-proclaimed mastermind behind the attack of Solana-based, decentralized finance platform Mango Markets (MNGO), has once again become the center of attention after another controversial move.

In a tweet shared by Eisenberg on Sunday, October 23rd, the infamous Mango Markets exploiter revealed that he had created, deployed, and rug-pulled a new meme coin called “Mango Inu”. Eisenburg claims to have made no effort to promote the coin, but investors, and allegedly bots, still invested $250,000 into the token within just half an hour.

Sponsored

Eisenberg disclosed that he had “only” managed to make $100,000 because “bots front ran the liquidity pull”. He then went on to warn users on Twitter not to buy the coin, emphasizing: “To be clear, if you buy this you will definitely lose all your money”.

As with the Mango Markets attack, Eisenberg was quick to defend his actions and insist on their legalality because the coin “is definitely not a security (no marketing, etc), no promises were made, just open market liquidity transactions”.

As with Eisenberg’s initial reveal, the event was met with mixed reactions. One user jabbed at the Mango manipulator, saying “you’re literally asking for jail”. Another questioned his morals, asking whether he possesses “a single bit of ethics”, to which Eisenberg answered: “Avraham did nothing wrong”.

Sponsored

However, there are those that have applauded Eisenberg for his exploit of bots, seeking tips on how to do it for themselves. “Teach me master lol,” one user said.

Eisenberg originally entered the spotlight after allegedly draining Mango Markets of $114 million in early October. the exploit was achieved by temporarily spiking Mango’s collateral value before taking out a series of massive loans from the Mango treasury.

The attacker then then put forward a proposal for the return of approximately $67 million if Mango agreed to repay its users without bad debt and any remaining debt. The proposal, which passed, also granted Eisenberg’s bold assertion that he would get to keep $47 million as a bounty reward, and immunity to criminal charges. Revealing himself as the perpetrator, Eisenberg justified his actions “a highly profitable trading strategy” that was “legal”.

October has been the worst month in crypto history in terms of stolen funds. According to data from Chainalysis, hackers have stolen $718 million in just the first half of October.

On the Flipside

- Eisenberg has yet to face any legal action for his illicit crypto adventures;

- Any entity or individual looking to press charges would likely find a lot of potential confessional evidence on Eisenberg’s Twitter.

Why You Should Care

The Mango Inu story serves as a reminder that anyone can create a crypto coin or token. As always, investors should be wary of speculative projects, and do their due diligence before investing.

You Might Also Like:

Mango Markets (MNGO) Initiates a Vote to Reimburse Victims of $114M Exploit