- Two massive ETH transfers to Coinbase have raised eyebrows in the crypto community.

- Santiment reveals that the transfers have led to the highest on-chain transaction spikes since June 13.

- At the moment, ETH’s price is holding steady.

The last few weeks have been rocky for most crypto assets, including Ethereum (ETH). The asset’s price is down 10.8% in the past 30 days, struggling to reclaim the $1,700 price level, according to data from CoinGecko at the time of writing.

Sponsored

Amid the asset’s price struggles, significant ETH transfers to Coinbase have stoked the flames of uncertainty. Is a price dump incoming?

Routine Internal Movement of Funds or Impending Selloff?

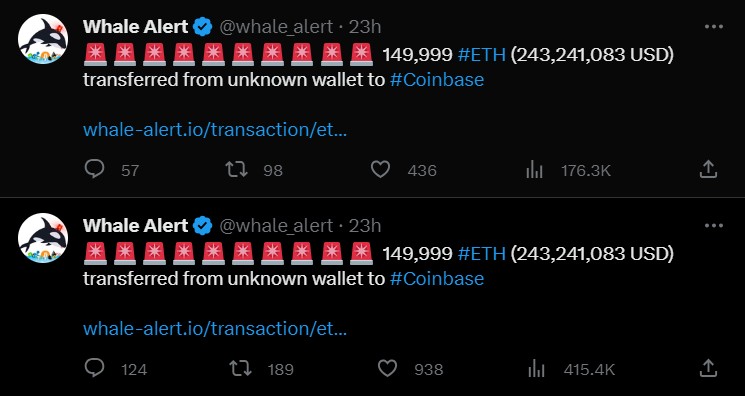

On Monday, September 4, blockchain tracker Whale Alert sent ripples through the crypto community by revealing that unknown whales had sent approximately 300k ETH to Coinbase in two equal transactions of about 150k ETH.

Reporting the huge and startling transfers on Tuesday, September 5, Wu Blockchain revealed that Arkham Intelligence data labeled the wallets as Coinbase cold wallets, noting that after the initial deposit to the exchange, the funds had been split into tranches of 4282 ETH sent to multiple addresses. While this increases the likelihood that it is a routine internal movement of funds, doubts remain.

Chiming in, Santiment noted that the transfers are among the largest of 2023 and have led to the most significant on-chain transaction spike since June 13. Still, the firm maintained that the move might not impact the price action of ETH.

ETH’s Price Reaction

Despite initial fears, ETH’s price has yet to react to the development. The asset is trading for $1,637 at the time of writing, up 0.7% in the last 24 hours, per data from CoinGecko.

At the same time, the asset’s market cap has also experienced a mild bump. At $197.17 billion, it represents a 0.59% increase in the past 24 hours, per data from CoinMarketCap.

Sponsored

Users had initially feared a selloff as exchange transfers usually indicate an interest to sell.

On the Flipside

- The reason for the transfers remains unclear.

- ETH’s price remains unfazed.

Why This Matters

Crypto transfers to exchanges typically indicate an intent to sell. The recent large ETH transfers to Coinbase had sparked fears of an impending selloff.

Read this to learn more about a recent ETH transfer from an ICO wallet that sparked uncertainty in the market:

How ETH ICO Whale’s $116M Movement Warns of Bearish Signal

Learn more about Casio’s Web3 venture on Polygon:

Casio Tips Polygon for G-Shock NFTs Amid Big Brand Partnership Spree