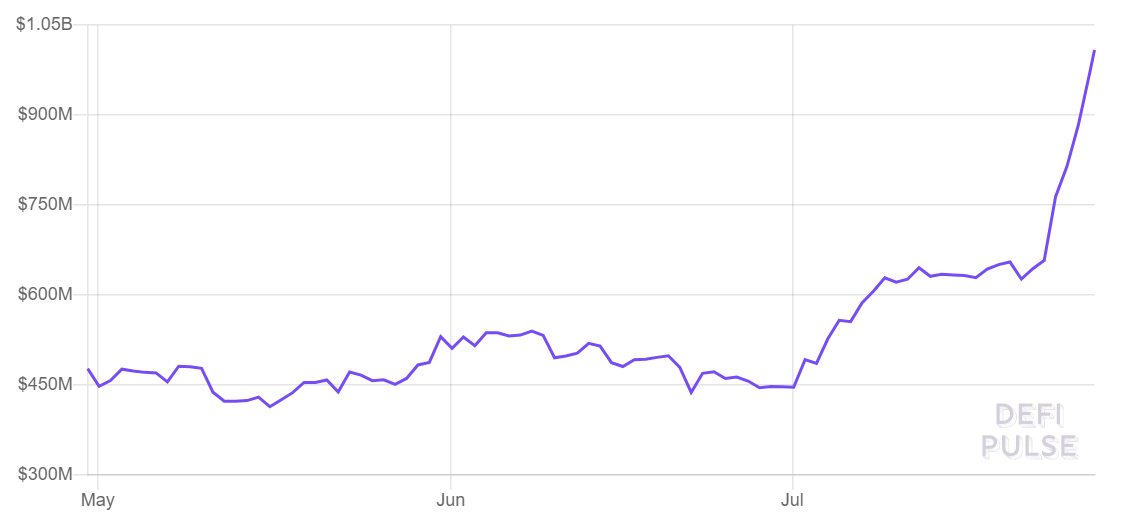

MakerDAO, a decentralized credit platform became the first-ever decentralized finance (DeFi) protocol that passed $1 billion in total value locked.

The protocol, which is also one of the first lending platforms built on the Ethereum network, crossed the $1 billion mark on July 27, according to the crypto data aggregator DeFiPulse.

The growth, inspired by the rise in Ethereum price this weekend, brought MakerDAO back to the leading position of the DeFi’s top protocols. Furthermore, it sealed the solid interest in the DeFi sector, which has been widely increasing within the last few months and passed its $3 billion mark of total value last week.

With over $1 billion of value locked in its lending protocol, MakerDAO becomes the dominant decentralized finance sector player with nearly 28% market share. The nearest competitors, the lending platforms Compound and Aave have around $778 million and $389 million respectively.

What is MakerDAO?

MakerDAO is the decentralized application running on the Ethereum blockchain. Created back in 2014, it aims to offer the background for cryptocurrency lending and savings. The decentralized Maker protocol allows taking loans in its native DAI stablecoin, built on Ethereum, and pegged to $1 USD.

Sponsored

Any user of the protocol is able to lock in collateral cryptocurrency such as Ethereum, BAT, USDC, or recently added Wrapped Bitcoin (WBTC) to generate DAI stablecoins. As the protocol allowed the lowest interest rates in the market, it quickly emerged as the clear market leader.

The protocol, however, stepped aside from the top DeFi position a month ago, when its competitor Compound listed its native COMP token on the digital asset exchange and the Compound lending protocol became the biggest DeFi project by market capitalization.

Sponsored

Since MakerDAO is one of the longest-running lending protocols in the industry, it is also one of the most widely used and has above 2.37 million Ethereum coins locked in it, which accounts more than 2% of Ethereum’s total supply.

The growth of the sector

Ethereum, which is the leading network for multiple decentralized finance protocols, has been on the rise the past week. The second-biggest digital asset by market capitalization increased by 37% since July 20 and trades at around $324 at the moment of publishing.

The sharp price growth may be mainly influenced by the launch of the Ethereum 2.0 testnet, which is announced to be released on August 4. The Ethereum protocol upgrade is one of the most anticipated crypto industry events as shifting from Proof of Work (PoW) to Proof of Stake (PoS) protocol significantly lowers the network’s congestion, speeds up the transaction time, and improves the efficiency.

Since the vast majority of DeFi projects are built on the Ethereum network, its protocol transition may have a significant impact for the whole decentralized finance industry, which is on the rise for the fifth month already and surpassed the milestone of $3 billion of the value locked in its protocols last week.