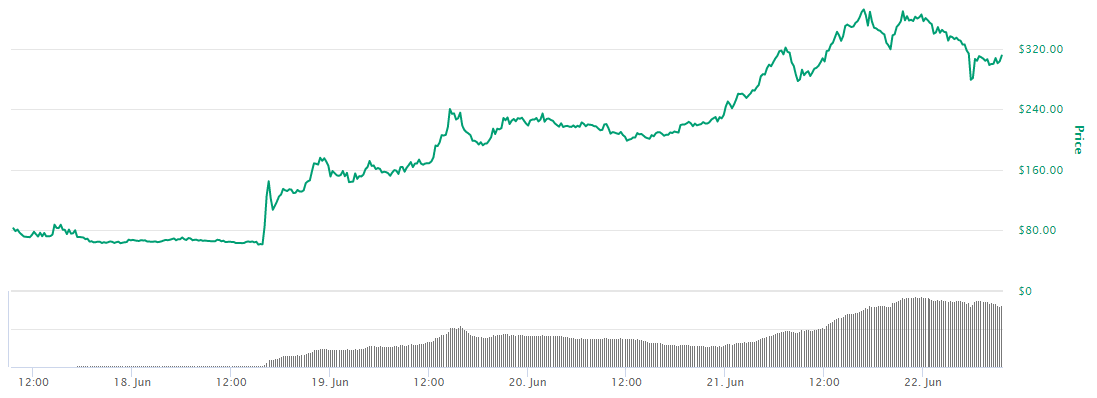

The value of Compound token COMP increased enormously within a week since its launch bringing the project on top of the DeFi list.

The impressive surge in Compound token price ascended the top this Sunday as it reached the all-time high of $381.89. The token, which was first listed on the exchange last Monday, became the biggest DeFi project by market capitalization and overtook the leading protocol MakerDAO.

The COMP token is now a top decentralized finance cryptocurrency with a total value of $611,71 million, according to the data of DeFiPulse. In the meantime, the MakerDAO was left the second and has a total value of $453 million.

Wow! @compoundfinance is now 🏆 #1 total value locked in #DeFi! https://t.co/zqMQAGYCJ8

— DeFi Pulse 🍇 (@defipulse) June 20, 2020

Yield farming sure has kicked things up a notch as people scramble to lock assets into intricate knots to farm more yield like $COMP, $CRV, $SNX and $REN. pic.twitter.com/xvfeiivVLd

The price of the asset stands at $310 at a time of writing, according to CoinMarketCap. This marks the correction after its peak of $381 heights this Sunday. The price, however, increased over 450% within a week, compared to the starting price of $82.74 on June 15, when the token was first listed for trading.

The decentralized project (DeFi) project Compound is Ethereum-based cryptocurrency lending and borrowing platform that allows users to lend and borrow funds from the protocol, earning and paying the interests.

Sponsored

Its ERC-20 token COMP is the native governance token that allows holders to propose and vote on all changes to the Compound protocol. On top of that, the token allows every Compound user to increase their capital. This means that every user of the Compound platform receives a COMP token as a bonus for making any kind of transaction. And since the donation for using a platform increases the capital of every Compound protocol user, the total value locked in Compound protocol increased accordingly.

The reason however could not be the only factor for the incredible price growth. Historically, the new tokens usually see a surge in their prices shortly after the listing on the exchange. And since COMP token was announced to be listed on Coinbase last week, the positive effect on its price might be a logical outcome. So at least this happened to the MakerDAO (MKR) token, as its price surged around 50% days after its listing on one of the biggest digital asset exchanges.

Data from Compound website show that the platform currently holds over $872 million worth of assets earning interest across 9 markets. Ethereum (ETH) , USD Coin (USDC) and Basic Attention Token (BAT) are the leading lending and borrowing markets of the Compound protocol at the time of publishing. The BAT token in the meantime performs like the one that earns as high as 25.47% interest.

Sponsored