With the mass decentralized finance demand underneath, the Ethereum seems to be on the verge of booming.

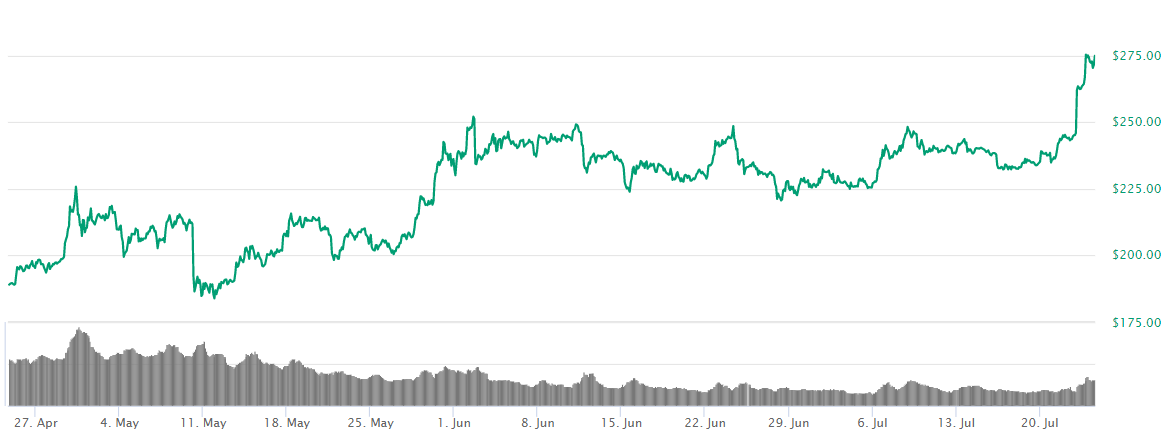

The second-biggest digital asset by market capitalization increased at around 17% within this week. The ETH price even peaked to nearly $277 on Thursday, reaching the highs last seen just a few weeks before the global mid-March market crash caused by the global pandemic and oil wars.

After bumping to the lows of $108 on March 13, the second-biggest cryptocurrency was constantly rising again, reaching the total market capitalization of over $30 billion and covering 10.67% share of total circulating market cap for all crypto assets at the time of publishing.

Sponsored

The positive market sentiment formed the uptrend that brought Ethereum out of the current resistance level of $250, which prevailed for the past few months.

Generates more value than Bitcoin

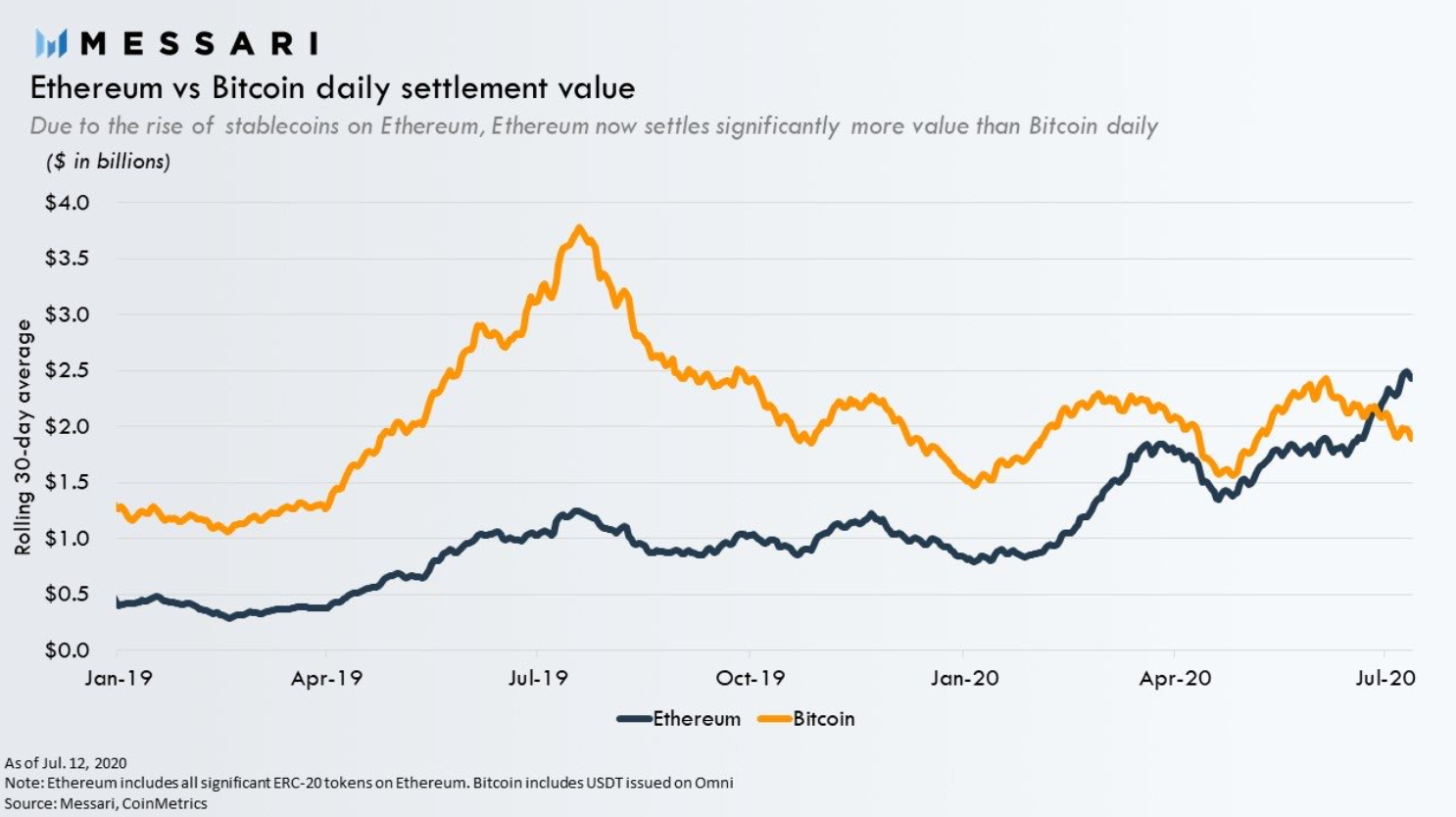

The Ethereum network became the most used blockchain and surpassed Bitcoin in terms of the total daily value transfers. The second-biggest cryptocurrency network generates $2.5 billion worth of transactions on average every day. Meanwhile, the leading Bitcoin currently sits below $2 billion.

According to the latest research from Messari, both Bitcoin and Ethereum are on their way to settle a combined $1.3 trillion in transactions this year.

The growth is highly influenced by the booming decentralized finance (DeFi) industry, built on the Ethereum network and by the demand of stablecoins, which have been living their age of gold within the past two quarters of the year. The liquidity mining trend drove up the issuance of many new stablecoins, which mainly are of ERC-20 standard and built on a dominant stablecoin platform, Ethereum.

Testnet launch announced

Accordingly, the recent price jump may also be influenced by the important announcement the Ethereum developers made this week, claiming the launch of the long-awaited Ethereum 2.0 upgrade testnet launch on August 4.

The launch of Ethereum 2.0 is considered to be one of the most anticipated events in the cryptocurrency industry, marking the network’s transition from Proof of Work (PoW) to Proof of Stake (PoS) protocol, which enables improved security, scalability, and energy efficiency.

However, the increased congestion and massive demand for transactions came with the price. The whole Ethereum network became more expensive to use as the transaction fees climbed up to the new all-time highs.

According to the Glassnode data, the daily gas usage hit the record levels of nearly 74 billion and remained above the 70 billion level for more than a month, signaling an almost double increase compared with the beginning of the year.

The high gas cost might have a double effect on the Ethereum network. Despite the fact that the utilization and thus the security budget of the network increased, the risk of potential users backing off is also high due to the expensive transactions, claims Wilson Withiam, the researcher at Messari.

According to the expert, the transition to Ethereum 2.0 protocol will be the go-to solution for the network in order to cut the high gas costs and thus offer cheaper transactions. The launch date of Ethereum 2.0, the protocol upgrade of the ETH blockchain, is not announced yet. However, it is expected to happen not earlier than in the third quarter of the year or even at the beginning of 2021.