- Stagnant price action has fostered frustration from some Litecoin holders.

- The Litecoin Foundation wants all stakeholders to pull together.

- On-chain LTC metrics show a mixed picture.

As one of the earlier altcoins dating back to 2011, Litecoin holds a special status in cryptocurrency. Dubbed the “silver to Bitcoin’s gold,” Litecoin aimed to overcome Bitcoin’s shortcomings as a medium of exchange by incorporating faster confirmations and cheap transaction fees.

More than a decade on, Litecoin continues to innovate, including the rollout of MimbleWimble privacy features in 2022. However, recent times have seen a muted market response, leading to stagnant price action and frustration among LTC holders.

Litecoin Foundation MD Calls on Holders to Help

Responding to the mounting frustrations around the price, Litecoin Foundation managing director Alan Austin acknowledged the disappointment, saying, “No one feels this as much as those” working to drive Litecoin adoption daily.

Sponsored

However, Austin explained that the Foundation is hampered in that its principles focus on “sound money,” meaning LTC does not use dubious strategies employed by other projects, such as VC/founder token manipulation or implementing artificial supply constraints.

Austin added that Litecoin operates on a small staff of passion-driven professionals earning below their market worth because they believe in the project’s potential. With that, he flipped the price stagnation criticisms back on LTC holders, asking what they were doing to help the situation, and called on all stakeholders to pull together.

“If you’re relying on any single organization or individual for Litecoin’s success, you’re missing the point on what it takes for a decentralized project to become successful," declared Austin.

Despite the reality of flat LTC price action, Austin stated that “price typically catches up with value at some point” while highlighting that most on-chain metrics showed “exceptional growth in terms of activity and usage.”

On-Chain Metrics Show a Mixed Bag

Despite Austin’s claims, an analysis of several on-chain metrics showed mixed results in terms of growth in Litecoin activity and usage. It was noted the number of transactions (by 30-day moving median) hit an all-time high (ATH) of 660k on January 11, and the network’s hash rate reached a 1.03 PH/s ATH on February 8, to support Austin’s statement.

Sponsored

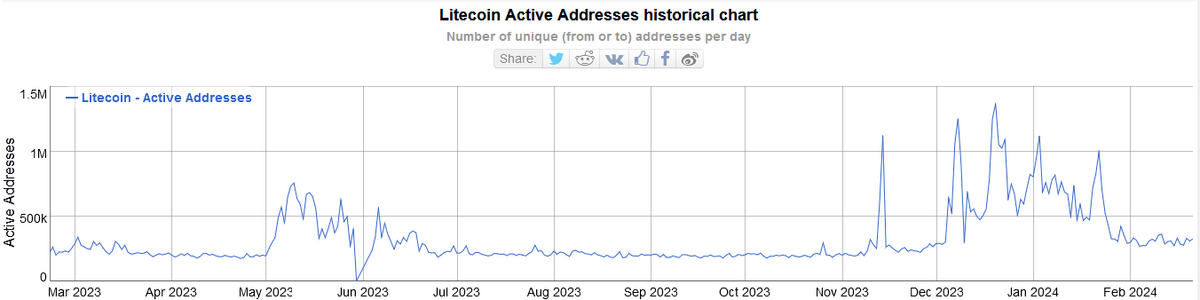

However, transfer volume (by 30-day moving median) peaked at 113.4 million LTC in January 2022 and has fallen significantly since, to 36.2 million LTC on January 19. Likewise, active addresses hit 1.37 million in December 2023, dropping to 329k on February 21.

On the Flipside

- Litecoin founder Charlie Lee sold all his LTC in 2017 at the market top. To this day, some continue to attribute Litecoin’s falling relevance to this action.

- Litecoin remains a strongly supported cryptocurrency with an active social media following.

- LTC grew 5% since Q4 2023. By contrast, BTC grew 83% over the same period.

Why This Matters

Litecoin’s determination to stick to the “boring” path is likely a factor in the token’s price stagnation. This scenario underscores the disproportionate and arguably unwarranted influence hype wields over cryptocurrencies. Nevertheless, projects should strike the right balance between their guiding principles and economic considerations.

Read about Litecoin’s MimbleWimble integration here:

Litecoin Activates the MimbleWimble (MWEB) Upgrade, LTC Surges

Find out more on Justin Sun’s response to USDC leaving Tron here:

USDC Exits Tron: Justin Sun Optimistic Despite Circle Snub