- Bitcoin has increased nearly 300% within the past 3 months.

- Deutsche Bank survey says investors think Bitcoin is in bubble territory.

- A survey from BofA shows Bitcoin is in the most-crowded trade.

Bitcoin has been on an impressive bull rally since October 2020. In the past three months, its price grew almost four times, reaching the new historic high of $41,940.09 on January 8. However, the concerns of Bitcoin becoming a market bubble strengthened accordingly.

Deutsche Bank survey

A Deutsche Bank survey shows that Bitcoin is currently seen as one of the biggest market bubbles together with some of the United States tech stocks.

A bubble is a stage of an economic cycle that forms when the asset price is skyrocketing rapidly and outpacing its actual worth. Investors pay more for than they can justify, resulting in surging prices. When they realize the price is too high, they cash out. A massive sell-offs lead to a price drop and pop of the bubble.

Sponsored

The bank interviewed 627 investors on January 13-15. The vast majority (89%) of the respondents believe financial markets to be in bubble territories. As reported on Reuters, nearly half of the interviewed investors rated Bitcoin at a maximum of 10 on a 1-10 bubble scale.

The respondents accordingly stated that both Bitcoin and stocks of Tesla are more likely to drop by half than double in prices over the upcoming year.

Sponsored

Bitcoin has lost nearly 15% of its value from its latest all-time high price and trades at around $35.900 at the time of publishing. It is still nearly 800% up from its mid-March 2020 lows when Bitcoin dumped below $4.000.

Bank of America survey

At the same time, the latest data from the Bank of America (BofA) says Bitcoin is the world’s most crowded trade. As Bloomberg reported on Thursday, the world’s largest crypto surpassed the highly crowded sector of tech companies’ stocks.

The BofA’s Global Fund managers Survey was conducted on January 8-14 and involved corporate clients managing over $560 billion in wealth. Reportedly, many of them believe Bitcoin’s long positions “are reaching unprecedented levels”.

Long positions indicate bullish sentiments, as the investors acquire assets and wait to sell them when the prices go up. Meanwhile, Bitcoin is seeing the biggest capital inflow with more and more institutional investors choosing it as a hedge against inflation.

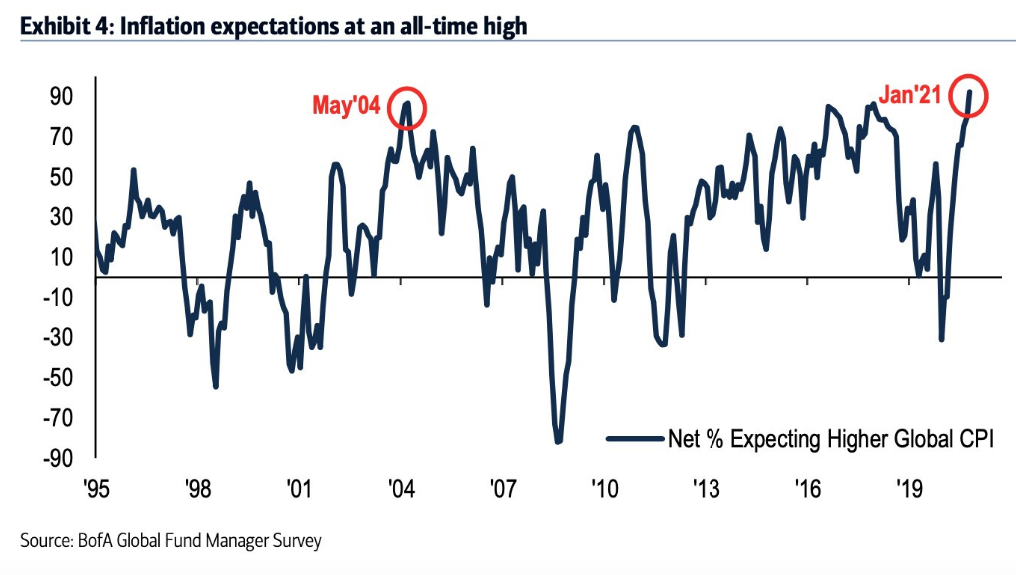

Inflation expectations are at record highs, according to BofA’s survey, as 92% of investors expect higher inflation within the upcoming year.

Accordingly, the biggest-ever percentage of investors (19%) were taking on more risk than normal in their investment portfolios, the survey’s data revealed. They are the most optimistic about profit growth since 2002.

On the flipside

However, the “extremely bullish” market sentiment increases the risk of “imminent” market correction, stated chief investment strategist at BofA Securities Michael Hartnett.

The strategist called Bitcoin a “mother of all bubbles” earlier this month. According to him, the BTC gains during the past few years far more outreached the gains from other assets that have been highly bullish on decades.