The cryptocurrency markets might have experienced one of the worst declines in history this month, but that doesn’t mean Bitcoin is out of interest. As the volume on cryptocurrency exchanges continue to rise, Bitcoin-related searches are skyrocketing.

The leading search engines around the world show similar trends in the user’s behaviour. Both the US and China face the statistics that people are actually interested in buying Bitcoin despite the market downturn.

The latest report of Baidu, the Chinese analog of American Google, shows the overall Bitcoin search index increased by 183% during the last month. According to the statistics, the growth of Bitcoin-related mobile searches is worth attention, as it rose more than 200%. As for other cryptocurrencies, the Ethereum search index also showed a growing trend within China, though slightly lower.

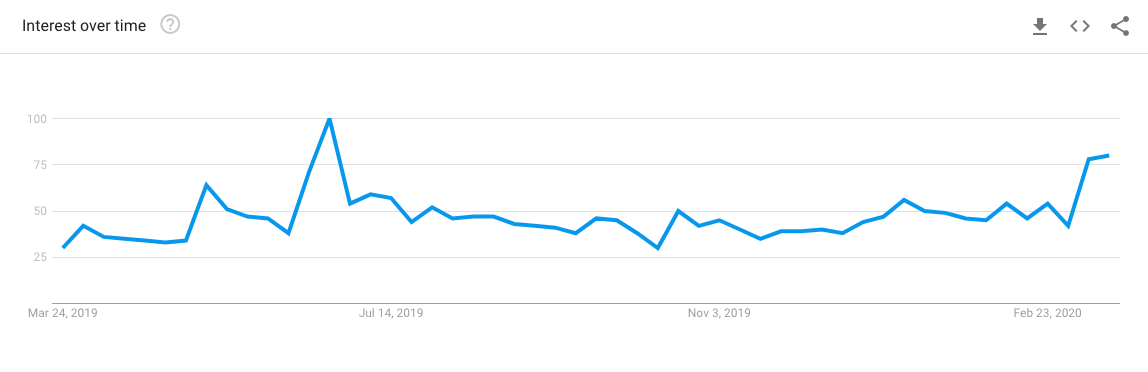

While Bitcoin search is soaring in China, the level of searches for terms related to the most famous digital asset also increased on Google web browser during the last weeks. The term “bitcoin” jumped up nearly 30 positions on Google Trends ranking, settling itself in the 29th place.

The interest in “buy bitcoin” searches peaked on Google the first time since June last year, when Facebook’s Libra was announced to enter the world of the cryptocurrencies.

The googling of “sell bitcoin”, however, remained quite stable during the same timeframe of the past weeks. Although minor swellings were noticed, the tendency was too weak to be significant.

The Bitcoin, which has been long referred to as digital gold and safe-haven during the difficult times, has also surpassed the googling on “buy gold” during the recent global market turmoil.

Increased volumes on crypto exchanges

Together with the search engine statistics, the data from cryptocurrency exchanges also show signs of recovery. The major digital asset trading platforms, such as Coinbase and Kraken witness considerable trade volumes as well as the new user registrations.

Last Friday the crypto exchange Coinbase told the reporters about the significantly increased traffic and trading volumes noticed during the week. Brian Armstrong, the CEO of Coinbase, said the exchange processed a $2 billion worth of crypto trades with 48 hours.

Coinbase was not the only exchange that witnessed a higher interest in trading. Kraken, another San Francisco-based crypto exchange, also saw increased numbers in volumes together with a record number of new registrations. The financial columnist Michael del Castillo recently reported on an 83% increase in new account sign-ups during the week after the black March 12th.