- Institutions on Bybit nearly doubled Bitcoin holdings in 2023.

- Traders, especially institutions, showed declining interest in altcoins.

- Ether holdings dropped post-Shapella upgrade.

In 2023, the cryptocurrency market has seen significant volatility, influenced by macroeconomic factors and sector-specific events. This unpredictability has profoundly impacted asset allocation strategies among traders and investors.

To shed light on these changes, crypto exchange Bybit has extensively researched how its users have adjusted their investment strategies in response to these market fluctuations.

Bybit Showcases Asset Allocation Trends in 2023

Bybit’s research, covering the period from December 2022 to September 2023, offers invaluable insights into the behavior of its users during a period marked by significant market ups and downs.

Sponsored

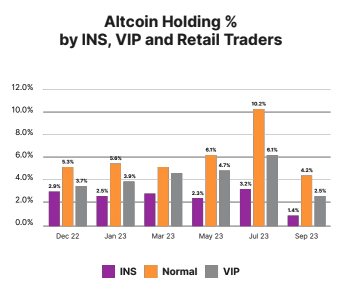

The analysis focuses on active traders, categorized as Institutional Traders (INS), VIPs, and retail traders.

During this period, institutional traders on Bybit exhibited a strong bullish stance on Bitcoin (BTC). By September 2023, they had nearly doubled their BTC holdings, with half of their assets allocated to Bitcoin.

In the realm of altcoins, a cautious approach was evident. Both institutional traders and whales showed skepticism towards these more volatile assets. Bybit noticed a general decline in altcoin holdings, especially since August 2023.

Ether (ETH), following the Ethereum blockchain’s Shapella upgrade, saw a mixed response. While there was an initial increase in ETH holdings earlier in the year, the trend reversed post-upgrade, with most traders, including institutions, reducing their Ether positions. However, an unusual surge in institutional Ether holdings was recorded in September, suggesting a shift in sentiment.

What Drives Changes in Institutional and Retail Investor Strategies?

Institutional traders’ pronounced shift towards Bitcoin in September 2023 reflects their confidence in its potential. This shift can be attributed to the positive sentiment in the market and the anticipation of the U.S. SEC approving a spot BTC ETF. In contrast, retail traders maintained lower BTC holdings, potentially due to their higher leverage levels.

Retail traders have demonstrated a tendency to increase their stablecoin holdings in uncertain market conditions. This behavior highlights their cautious approach and a preference for stability in market volatility.

In contrast, the overall decline in altcoin holdings, particularly among institutional traders, showcases the risks of market volatility for these assets.

On the Flipside

- Amid growing volatility, Bitcoin has kept its place in the crypto market, even increasing its dominance.

- The report covers only Bybit users and may not represent trends among all crypto market participants.

Why This Matters

The asset allocation trends among Bybit users, especially the contrasting strategies of institutional and retail traders, offer critical insights into the broader crypto market dynamics. These patterns reflect current market sentiment and influence future market movements.

Read more about how Binance’s settlement affected Bybit:

Binance Settlement Boosts Coinbase, Bybit Market Presence

Read more about North Korea’s impact on crypto security:

How North Korea Stole $3 Billion in Crypto Over 6 Years