- Bybit now verifies reserves for 40 crypto tokens, the highest in the industry.

- The exchange secured a 10/10 Trust Score from CoinGecko.

- The move comes amid widespread calls for transparency from the community.

In recent years, the cryptocurrency exchange market has witnessed a growing call for transparency and security among users. This demand has been partly spurred by high-profile incidents that have shaken investor confidence, most notably the collapse of FTX, whose founder, Sam Bankman-Fried, was recently sentenced to 25 years in prison.

In response to this trend, Bybit, one of the world’s leading crypto exchanges, has taken significant steps to demonstrate its commitment to these principles. Its latest move expanded its proof-of-reserves audit to include 40 cryptocurrencies.

Bybit’s Proof-of-Reserves Audit Breakdown

On Friday, April 5, Bybit expanded its proof-of-reserves audit to include 40 cryptocurrencies, making it the most comprehensive audit in the crypto exchange sector.

Sponsored

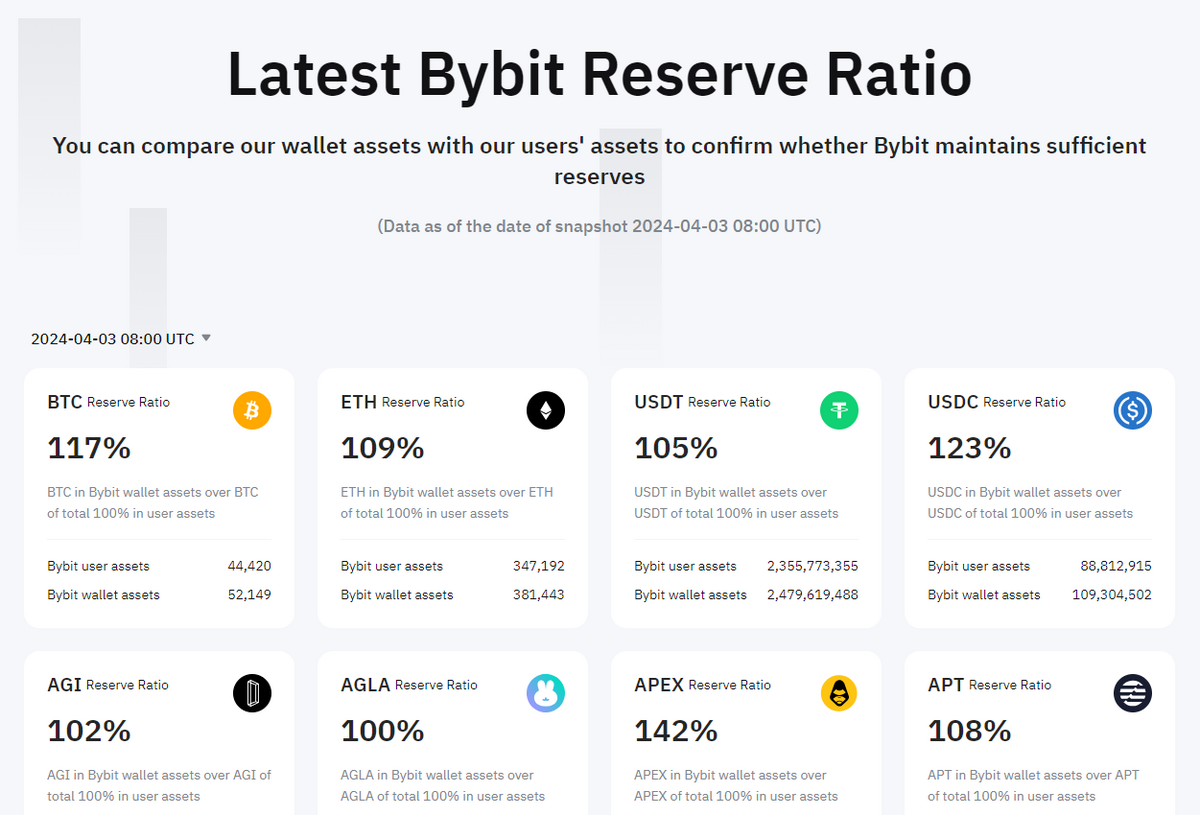

Among the tokens added to Bybit’s audit are several notable cryptocurrencies, such as WLD, AGI, APEX, BEAM, FET, GALA, IMX, RNDR, and SHRAP. According to the audit, all the tokens in question have a reserve ratio ranging from 100% to 150%.

Thanks partly to this initiative, Bybit has secured a 10/10 Trust Score from CoinGecko and an ‘AA’ rating from the recent CCData Crypto Exchange Benchmark Report.

Users Call for More Transparency From Exchanges

In recent years, transparency has become the primary focus for crypto exchange users. This can largely be attributed to the collapse of FTX, a once-prominent crypto exchange that fell due to criminal mismanagement of user funds.

Sponsored

This is why proof-of-reserve audits are increasingly seen as necessary in the crypto industry. These audits serve as a public verification that an exchange holds enough funds to cover all user deposits, effectively proving solvency and bolstering user trust.

Each of the major crypto exchanges has implemented regular audits of their crypto reserves, as a way to demonstrate their financial health. Just after the FTX collapse, nine major crypto exchanges including Binance, Kraken, OKX, Bitget, and Bybit, committed to publishing regular reserve audits.

However, while reserve audits became ubiquitous, questions remain about their effectiveness. One issue is that crypto exchanges rarely reveal who their third-party auditors are, especially since major accounting firm Mazars withdrew from the crypto space.

On the Flipside

- While they are key to rebuilding trust, some critics believe users cannot trust exchanges based solely on their proof-of-reserves audits.

- Despite challenges, centralized crypto exchanges dominate trading in the crypto space.

Why This Matters

Bybit’s initiative to expand its proof-of-reserves audit reflects a broader industry trend toward transparency and accountability. As users are still reeling from the effects of the FTX collapse, these audits are crucial for rebuilding trust in the crypto space.

Read more about criticism over proof of reserves:

Post-Binance Reality: Is Proof of Reserves Idea Compromised?

Read more about Bitget’s new user-friendly staking feature:

How Bitget’s New Staking PoolX Changes Crypto Earnings