- The Ethereum Dencun upgrade has gone live on the mainnet.

- The Dencun upgrade brings several key changes to the network.

- Developers are already considering the network’s next major upgrade.

After months of anticipation and initial delays, the Dencun upgrade is finally live on the Ethereum mainnet, much to the relief and excitement of users. The upgrade marks a significant step in the Ethereum scaling vision and promises to immediately bolster the scalability of Layer 2 chains and unlock new use cases.

In this article, DailyCoin explores how the recent upgrade has altered the Ethereum network to achieve the heralded outcomes and what’s next for the blockchain.

Blobs, A New Fee Market, and Other New Cool Features

At 13:55 UTC on Wednesday, March 13, the Dencun upgrade went live on the Ethereum mainnet without glitches.

The most discussed aspect of the Dencun upgrade has been the impact on the transaction fees of Layer 2 chains, as it promised two to ten times declines in cost. Starknet, for example, has reported a 99% drop in fees from around $2 to between $0.01 and $0.04 following the upgrade.

This massive fee drop is made possible by introducing cheap, temporary data bundles called blobs, designed to hold information from Layer 2 transactions. Verifying these blobs is faster than verifying entire blocks, which speeds up Layer 2 processing. Since the blobs are temporary, they don’t overload the Ethereum network with data, further driving down costs.

To further ensure that fees on Layer 2 chains stay down even during peak network congestion, Ethereum now also has a separate fee marketplace for blob-carrying transactions.

Beyond dramatically lower Layer 2 fees brought on by blobs, Dencun also introduces new features like transient storage to temporarily hold things like transaction data, a feature Uniswap asserted it would leverage to introduce “flash accounting” with its v4 upgrade.

Sponsored

At the same time, the Dencun upgrade also introduces programmable staking exits, allowing validators and stakers to exit their positions using instructions stored in smart contracts.

So what’s next for the “DeFi king?”

The Dawn of “The Surge”

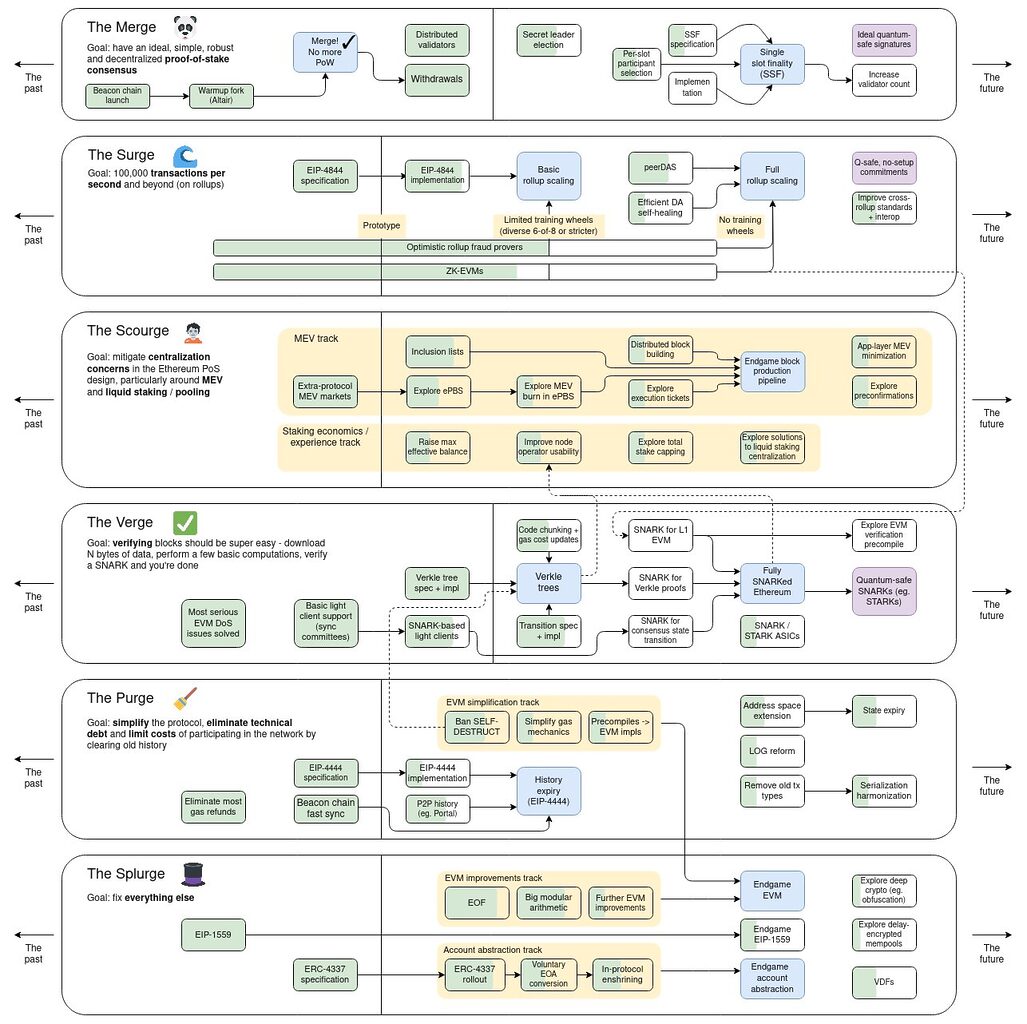

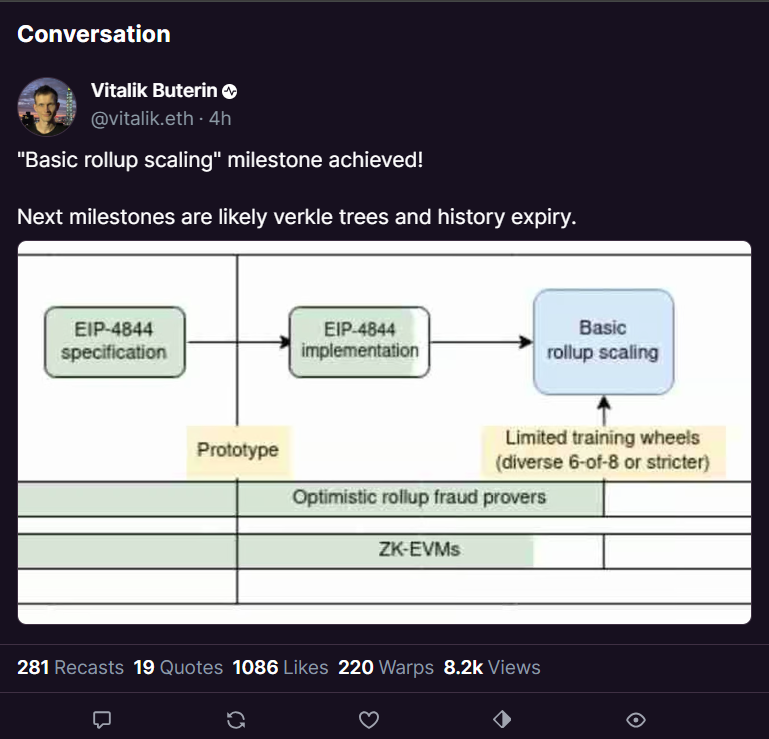

The Dencun upgrade sets the stage for the second phase of the Ethereum roadmap, “The Surge.” As disclosed by Ethereum co-founder Vitalik Buterin in 2022, this phase is focused on scalability with a goal of hitting a throughput of 100,000 transactions per second.

After Dencun, the next major Ethereum upgrade has been dubbed Petra, a portmanteau word combining Prague and Electra. Among changes tipped to come with this upgrade are “Verkle Trees,” a new, more efficient system of organizing data on the blockchain for faster verification.

Verkle Trees will set the stage for “The Verge.” This phase of the Ethereum roadmap aims to make verifying blocks “super easy.”

On the Flipside

- Despite the excitement surrounding the Dencun upgrade, the price of ETH has remained flat, trading near $4,000.

- Several Layer 2 chains have yet to complete the required upgrades to enjoy the benefits of blobs.

Why This Matters

With the buzz surrounding the Dencun upgrade, it is necessary to understand how it changes how Ethereum functions.

Read this to learn more about what the Dencun upgrade is and why it is important:

What Is the Ethereum Dencun Upgrade, and Why Is It Important?

Learn more about Jamie Dimon’s recent statements on Bitcoin: