- FTX will assess the relaunch by Q2 of 2023.

- If the court approves the launch, FTX will have to navigate a myriad of pitfalls.

- Attorney Dietderich suggests that users could be given “interest” in the exchange.

The collapse of FTX was a high-profile event that left the industry reeling after the once-great crypto exchange crashed and burned. However, FTX may yet rise from the ashes following a roadmap update provided during a bankruptcy hearing on April 12.

During the Delaware bankruptcy court hearing, FTX attorney Andy Dietderich revealed that FTX’s new management was actively considering relaunching the exchange.

When Will FTX Restart Operations?

Following the hearing, social media users started circulating stories that the exchange would restart operations in the second quarter of 2023. In reality, the restart will likely take much longer.

Sponsored

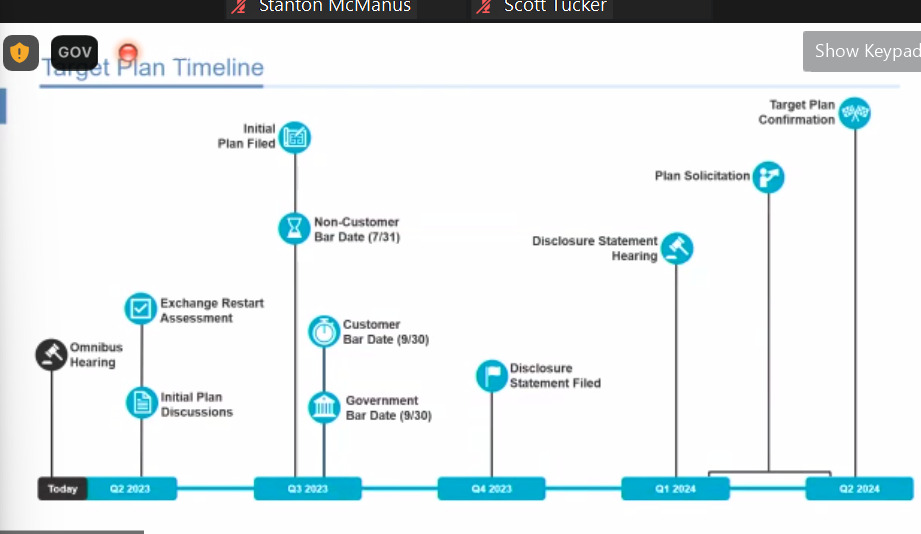

According to its latest roadmap, FTX plans to assess the possibility of restarting the exchange in the second quarter of 2023. That assessment will determine whether the exchange will relaunch the exchange at some point in the future.

Following the probe, FTX aims to file its restructuring plan by the third quarter of 2023. After that step, attorneys expect that the judge will be able to set a bar date for customer claims by September 2023.

Assuming these steps run smoothly, FTX expects to receive confirmation for its restructuring plan in the second quarter of 2024.

Sponsored

FTX and its associates did not put a timeline on the potential restart. In any case, FTX would first have to convince the bankruptcy judge that the relaunch is in the best interest of its creditors.

FTX Japan Most Likely Candidate For Relaunch

One territory in which FTX will restart sooner is Japan, as recent court filings show that FTX Japan may already be preparing to reopen the exchange in the country.

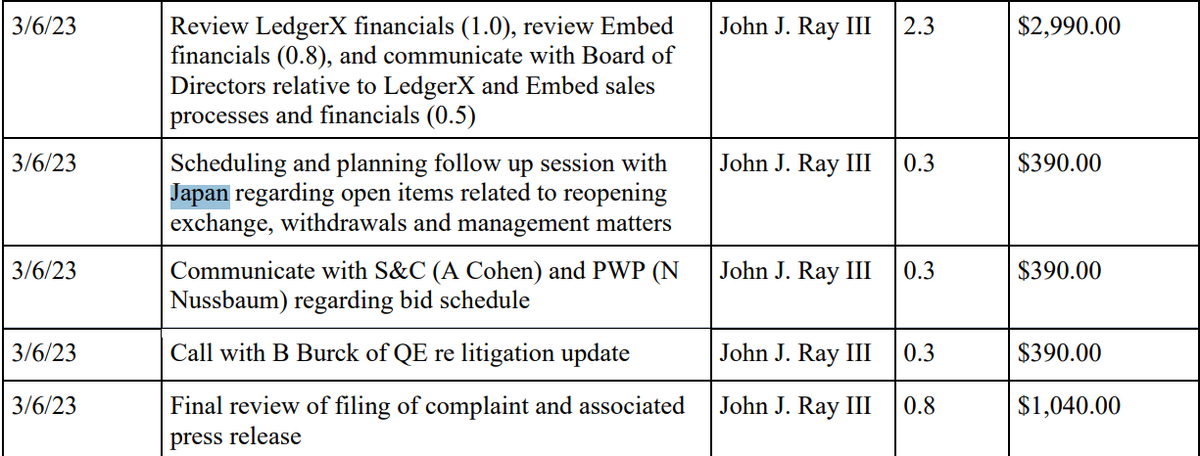

On Tuesday, FTX’s monthly staffing and compensation report to the court revealed that new CEO John J. Ray III contacted Japanese officials about possibly reopening FTX Japan. The report also indicated that Ray prepared for talks about the relaunch in the future.

Thanks to the nation’s robust consumer protection laws in crypto, FTX Japan was the one FTX entity that kept user accounts separate from the company’s. As a result, FTX Japan users could withdraw all their funds on February 21.

Will FTX Restart in the US?

Just like in Japan, US crypto regulations will likely affect the launch in the country. Specific regulatory concerns raise the question of whether FTX will be available in the US on the relaunch, either directly or through a US subsidiary.

So far, US customers have had access to FTX US, a nominally separate platform, due to a tougher approach to securities regulation in the US. According to US regulators, crypto assets fall under securities laws.

Relaunching FTX in the US will likely present unique challenges to the exchange, including potential opposition from regulators.

Should FTX restart in the US, it is unclear whether it would operate as FTX US or as a unified exchange. If FTX were to merge the US platform with the main FTX exchange, the unified entity would have to maintain compliance with US laws.

How Will Ex-Customers Be Affected by the Restart?

In order to incentivize users to return, and to justify using their money to relaunch it, FTX may look to offer some stake in the company; FTX’s lawyers revealed that the exchange’s new management is already discussing the idea.

One proposal is to offer users equity in the exchange. This could involve issuing shares of stock in the new company to former customers, allowing them to participate in any future growth or profits.

Attorney Dietderich further suggested that customers could be provided with options in the exchange, giving them the right to buy a certain number of shares at a specific price at some point in the future. This would allow customers to benefit from any future appreciation in the value of the exchange.

How Will This Affect the FTX Token (FTT)?

It’s unclear whether FTT will play a role in any potential relaunch of FTX. However, if FTX decides to launch a new token, that could be the end for FTT.

It is worth noting that FTX holds a significant amount of FTT tokens. This means it may be in FTX’s interest to see the token’s value recover. In fact, FTT’s price doubled after news broke that FTX may reopen.

Still, FTX’s management has not announced concrete plans for FTT’s role in a potential relaunch. Moreover, any attempts to engage with the token will invite scrutiny by US regulators, which have previously named FTX a security.

On the Flipside

- FTX Japan suffered relatively less reputational damage due to successful withdrawals than the other FTX entities. This makes a potential relaunch more likely in that region.

- Despite FTX’s bankruptcy, the FTT token still has a market cap of $741 million. The most likely reason for this is that retail investors are holding the bag.

Why You Should Care

FTX relaunch will have significant implications for both former customers and the broader crypto space. It could either help users recover a larger share of their assets or further erode the trust in both crypto and traditional financial institutions.

Read more about the FTX collapse from the latest report by its new management:

Latest FTX Report Shows How Bad Things Really Were

Read about the latest FTX announcements and the updated roadmap: