- FTX is considering plans to relaunch the exchange – and to give former customers a stake.

- The announcement made the FTT token shoot through the roof.

- FTX attorneys revealed a roadmap, expected customer bar dates, and more.

The bankruptcy of FTX in November 2022 shook the industry to its core, and the ripples are still being felt across the crypto markets today. However, new documents and earlier statements from its lawyers show that FTX is gearing up for a potential relaunch.

Court documents reveal that the new FTX CEO, John J. Ray III, is working on the potential restructuring plan. This means that if the court approves it, FTX could once again relaunch operations and offer exchange services to users.

CEO Spearheads FTX’s Restructuring

Recent court filings suggest that the CEO is spearheading the restructuring and potential relaunch of the troubled crypto exchange.

Sponsored

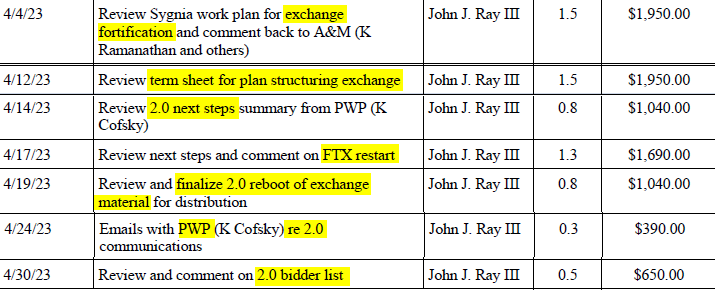

On Tuesday, May 22, FTX filed a staffing and compensation report, which also outlined efforts by Ray. According to the document, Ray is actively planning and evaluating the restructuring and relaunch process.

Ray’s duties include reviewing the term sheet of the restructuring plan, examining its financial structure, and assessing recovery options for creditors and users. His assessment is designed to ensure financial viability and regulatory compliance.

The FTX CEO is also finalizing the materials for the exchange’s 2.0 reboot to provide transparency to the public and the creditors. Finally, Ray also reviewed the 2.0 bidder list, which includes potential investors for FTX’s relaunch.

Sponsored

These efforts suggest that the FTX CEO is taking key steps to ensure a successful relaunch. Moreover, earlier statements from the firm’s lawyers indicate its commitment to relaunching FTX.

FTX Plans – Exchange Relaunch Could Come Soon

In a Wednesday, April 12, hearing at a Delaware bankruptcy court, FTX attorneys discussed what the ignominious exchange’s new management had done to turn things around and unveiled their roadmap going forward.

“The situation at FTX has stabilized,” FTX attorney Andy Dietderich said. “The dumpster fire is out.”

FTX attorney Dietderich revealed that the new management of FTX could soon relaunch the exchange and may even provide users that initially lost money with a stake.

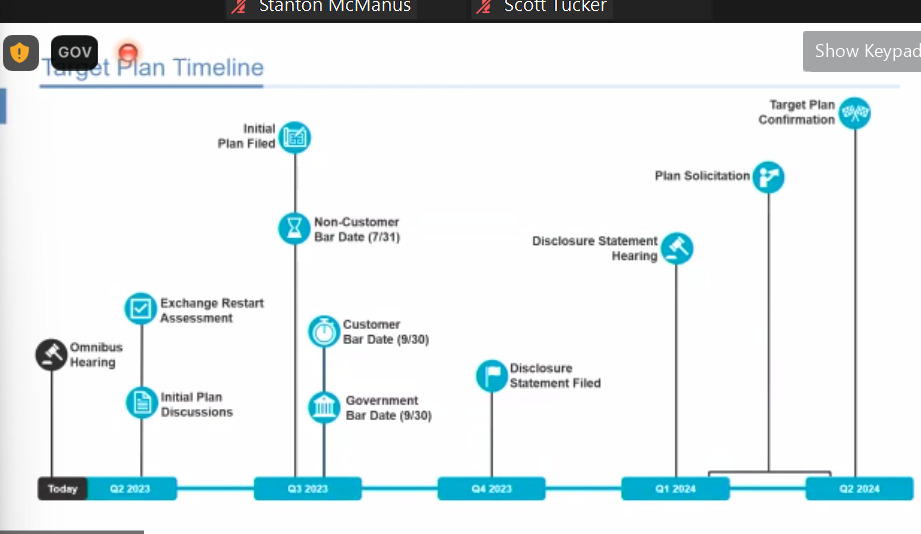

While discussing the updated 2023-2024 roadmap, attorney Dietderich revealed that FTX is actively considering a relaunch, stating that the firm will assess the possibility of restarting the exchange as early as the second quarter of 2023.

At this time, the new FTX management will decide whether relaunching the exchange would be in the best interest of FTX users and creditors.

Delaware Judge John Dorsey, presiding over the FTX bankruptcy proceedings, had questions about how the proposed restart would work. In particular, he asked whether FTX users could withdraw their funds.

“The short answer is, we don’t know,” Dietderich said. However, he did reveal that the plan would require raising significant amounts of capital.

He also revealed that FTX is unsure whether the necessary capital would come from the estate or third parties. In either case, FTX is debating giving former users some interest in the exchange.

One idea that FTX is considering, Dietderich said, would be to give former customers a form of interest in the company, such as options in the exchange. Options are financial instruments that give holders the right to buy an asset at a certain price.

FTX Roadmap – Customer Bar Dates By September

Following a probe into relaunching the exchange, FTX plans to file its initial restructuring plan by the third quarter of 2023.

Due to the complexity of the FTX case, there is currently no bar date for customer claims. However, attorneys believe that the case will develop at a pace that will enable the judge to set the bar date for non-customers by July 2023 and customers by September 2023.

Assuming the evaluation and submission phases are completed successfully, the roadmap indicates that the firm expects to receive confirmation for its restructuring plan in the second quarter of 2024.

FTX Recovers $7.3 Billion in Liquid Assets

FTX Attorney Dietderich also provided an overview of the exchange’s recovery efforts, including converting billions of dollars worth of FTX property into liquid assets.

According to Dietderich, FTX has recovered $7.3 billion in liquid assets at current valuations. The figure represents a $1.9 billion increase since the January 11, 2023 hearing.

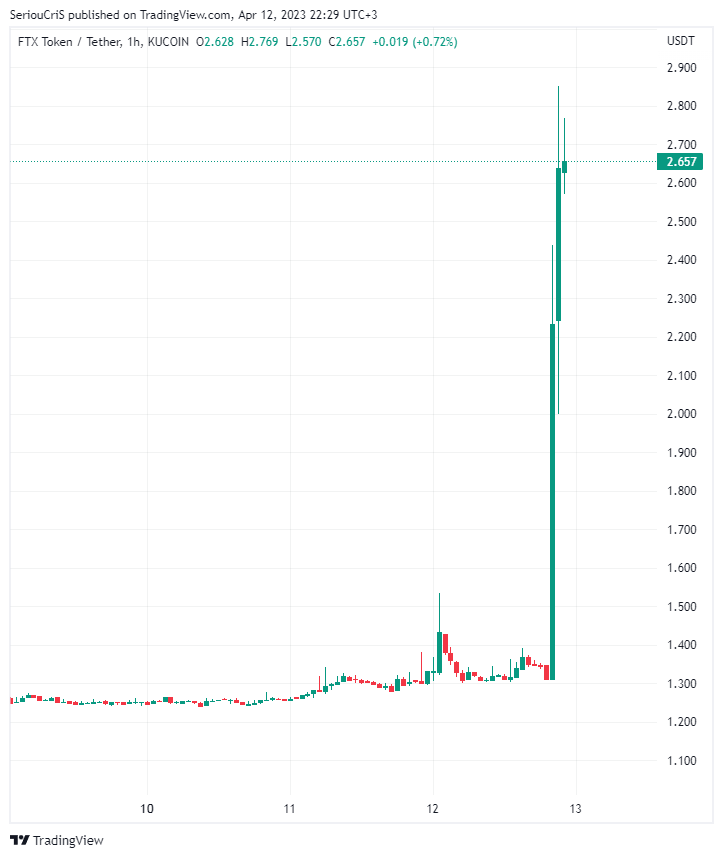

The news about the recovery sparked the price rise of FTT, which gained more than 100% in value immediately after the news, rising from $1.3 to $2.6 at the time of writing.

FTX’s liquid assets include cash, liquid crypto tokens, and stocks. At the time of writing, FTX holds $4.3 billion in liquid crypto assets, such as Bitcoin and Ethereum. An estimated $1.6 billion of these funds are held securely in cold storage.

The attorney further took the opportunity to highlight the successful restart of withdrawals by FTX Japan. Thanks to Japan’s hardline protections for crypto users, FTX Japan was the only FTX affiliate that effectively segregated user accounts, Dietderich said.

As a result, FTX Japan users could withdraw all their funds from the exchange.

‘FTX Was a Facade, a Video Game’

The success in asset recovery was partly attributed to a “highly complex forensic investigation” by FTX under its new management in cooperation with law enforcement.

Per the report, the company uncovered 1.3 terabytes of data to help it assess the claims of creditors.

The data includes logs stored on company-owned and operated QuickBooks and a high volume of unstructured data in emails and chat logs.

The large-scale investigation was deemed necessary due to how FTX founder and former CEO Sam Bankman-Fried ran the exchange.

Sam Bankman-Fried frequently and “often persuasively” lied to creditors about the state of the exchange, Dietderich said.

Dietderich compared the exchange to a “facade, a Potemkin Village,” or a video game. “The app worked great,” the FTX attorney admitted. However, it bore no relation to the true flow of assets.

On the Flipside

- Executives believe that relaunching the FTX exchange will generate additional revenue, which would help users and creditors to recover assets lost in the initial crash.

- Any restart for FTX carries substantial risk, as the exchange suffered potentially irreparable reputational damage.

- It is unclear where FTX would obtain the outside capital it needs and whether the judge would allow it to use its own money to relaunch the exchange.

Why You Should Care

The outcome of the FTX bankruptcy case will have substantial repercussions, not just for FTX users but for all crypto traders. Depending on how the case develops, the industry could see the implementation of stricter crypto regulations and a loss in overall market confidence.

Read about the extent of the fraud at FTX:

Sam Bankman-Fried and Insiders Took $3.2M from FTX: Filings

Read about the latest findings on crypto’s role in organized crime: