- A group of U.S. lawmakers have raised concerns about proposed tax reporting rules.

- The lawmakers faulted the treasury for its “unworkable definitions’ of some terms.

- Per the lawmakers, the proposal would inhibit innovation in the crypto ecosystem.

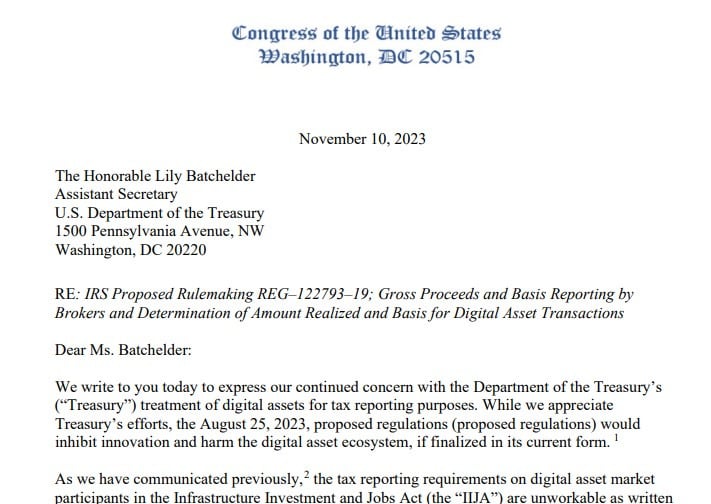

A group of U.S. Congress members led by the Financial Services Committee’s Chairman of the House, Patrick McHenry, have expressed concerns about the crypto tax regime enshrined in the Infrastructure Investment and Jobs Act.

In a November 10 bipartisan letter addressed to the Assistant Secretary U.S. Department of the Treasury, Lily Batchelder, the lawmakers argued that the tax reporting requirements on digital asset market participants are “unworkable as written” and would inhibit innovation.

Concerns About “Unworkable Definitions”

Notably, the lawmakers faulted the Treasury’s definition of “Broker,” arguing that the standard was too broad and would encompass entities that do not embody the characteristics of a traditional broker, such as decentralized finance (DeFi) protocols.

Sponsored

According to the lawmakers, DeFi protocols will be caught up in the treasury’s extrapolated definition of “Broker,” which reads “persons that are in the position to know the identity of the party.”

“This new interpretation will sweep up DeFi protocols in the definition of broker because the “position to know standard” encompasses more entities compared to the “ordinarily would know” standard. There is no evidence indicating DeFi protocols “ordinarily would know” the identity of the party.” The letter read.

Further, the lawmakers submitted that the Treasury’s definition of a broker would cause crypto-focused companies to file duplicative reports to both the Internal Revenue System (IRS) and the American taxpayers.

Sponsored

Lawmakers believe this is unnecessary and would only raise the IRS’s cost of doing business while inundating the agency and American taxpayers with unnecessary information.

Based on these and other arguments, the lawmakers had specific requests, including urging the Treasury to revise and extend the regime’s implementation period.

Stay updated on why U.S. Lawmakers want the government to combat crypto-funded terrorism:

U.S. Lawmakers Press Biden to Combat Crypto-Funded Terrorism

Read why Coinbase CEO believes crypto will take center stage in 2024 U.S. elections:

Coinbase CEO: Crypto to Take Center Stage in 2024 US Election