- Friend.tech’s trading volume surged over the weekend.

- Despite the surge, other metrics suggest the protocol is in a downward spiral.

- The project’s decline comes amid fresh complaints of user lockouts.

Friend.tech’s trading volumes surged over the weekend in what appeared to indicate a resurgence amid a recent growth decline. A deeper dive considering other metrics, however, paints a dire picture of the blockchain-based social media platform that took the industry by storm in August 2023.

Is this the beginning of the end for friend.tech?

Potential ‘Exit Behavior’

On Monday, November 20, independent crypto news reporter Colin Wu highlighted that trading volumes on friend.tech had surged over the weekend to their highest point in over two weeks with a combined $10.98 million. Specifically, 21.co’s friend.tech Dune Analytics dashboard suggests that the trading volumes recorded on November 18 and November 19 were the highest since October 24.

While high trading volumes can suggest protocol growth and excitement, Wu notes that this does not appear to be the case in this instance. The analyst suggested that the recent volume spike “may be exit behavior.”

Sponsored

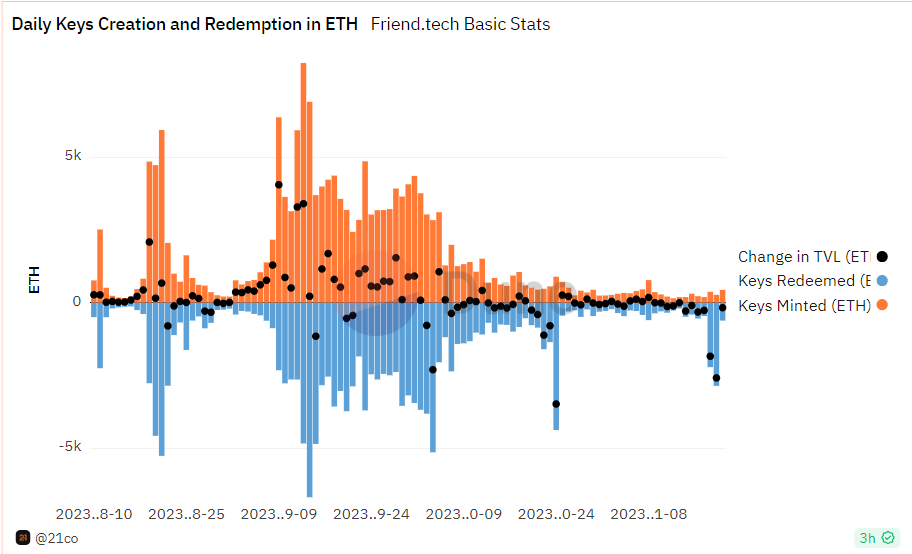

Users withdrew 5.07k ETH from friend.tech within this period of high volumes with only 647.31 ETH coming in, per 21.co’s friend.tech Dune Analytics dashboard. The data suggests users are redeeming their friend.tech keys at a significantly faster rate than they are minting new ones.

The rush of withdrawals has seen the protocol’s TVL slump 21.3% from 21,529 ETH (worth $42.26 million) on Friday, November 17 to 16,935 ETH (worth $34.03 million) on Monday, November 20, the lowest since September 2023.

Will Friend.tech End Up As Another Passing Crypto Fad?

Like the dot-com bubble, the early growth stage of the crypto industry has witnessed several fads. friend.tech’s recent decline suggests that the project might soon join the list.

Sponsored

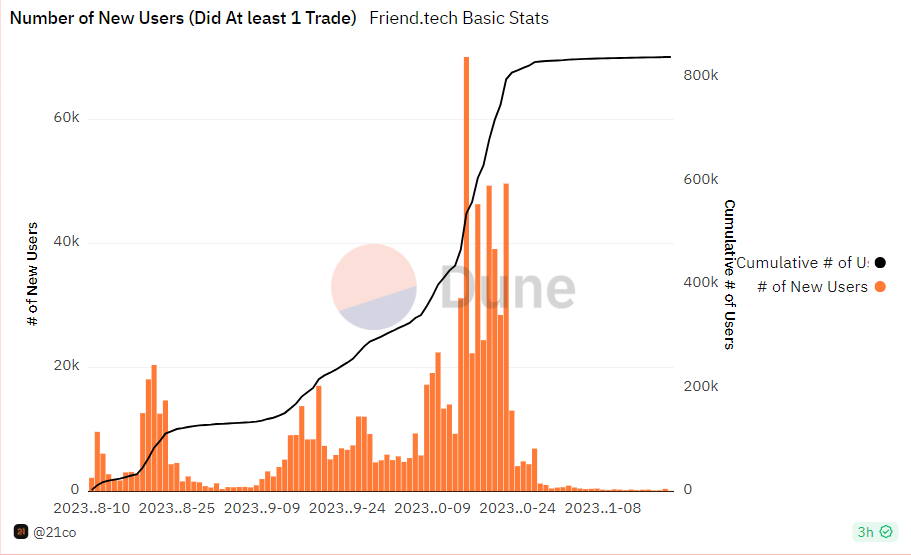

Besides the declining TVL from users potentially exiting the project, data suggests it has also struggled to attract new users in recent weeks. On October 15, the protocol attracted 70,037 new users, its highest on record. On November 19, however, the protocol attracted only 389 new users amid a multi-week decline.

This decline comes as prominent members of the crypto community complain about being locked out of their accounts in addition to privacy and security concerns. Alex Krüger, one of the affected parties, bashed Friend.tech developers as “absolute scum.”

Meanwhile, reacting to the TVL slump over the weekend, “tmnxeq” contended that friend.tech’s downward spiral would happen faster if it did not have an exit fee. The sale or purchase of keys charge a 10% fee with 5% going to the platform and the other 5% going to the channel owner.

On the Flipside

- friend.tech developers took action to enhance security by implementing two-factor authentication and a bug bounty program.

- The friend.tech platform is only three months old.

Why This Matters

The recent decline in friend.tech’s fundamentals suggest that the project risks falling into obscurity like several other Web3 projects before it that sparked early excitement, but lacked an enduring value proposition or working model.

Read this to learn more about friend.tech’s recent decline:

Friend.tech Hype Fizzles to Crawl, Daily Transactions Vanish

Learn more about how whales reacted to the news of SEC’s decision to delay spot Ethereum ETFs:

Ethereum Whales Dump Holdings as SEC Delays Spot ETF Rulings