- Financial literacy is insufficient for the bigger part of the world’s population.

- The pandemic democratized the world of finances.

- Younger generations prefer gamified ways to learn about finances.

Financial education is largely absent from public school programs worldwide. But the brave new world of digital money, blockchain, artificial intelligence, virtual reality, and metaverse gaming is changing the status quo.

Sponsored

Generation Alpha, the first digitally native generation born after 2010, often starts to get acquainted with financial topics with digital money.

Two-Thirds Lack Skills in Financial Literacy

Generation Alpha, the kids born in or after 2010, is the youngest generation today. Millions of them are still to be born. However, surveys expect GenAlpha will make up to 11% of the global workforce by 2030.

Experts also predict that “Alpha Kids,” the current children of Millennials, will be the wealthiest and most highly-educated generation.

At some point o their life, they will need to start building up financial literacy skills, which often play a critical role in a person’s financial security.

Sponsored

It is said that knowing how to manage personal finances, planning, budgeting, and investing often contributes to one’s lifelong success.

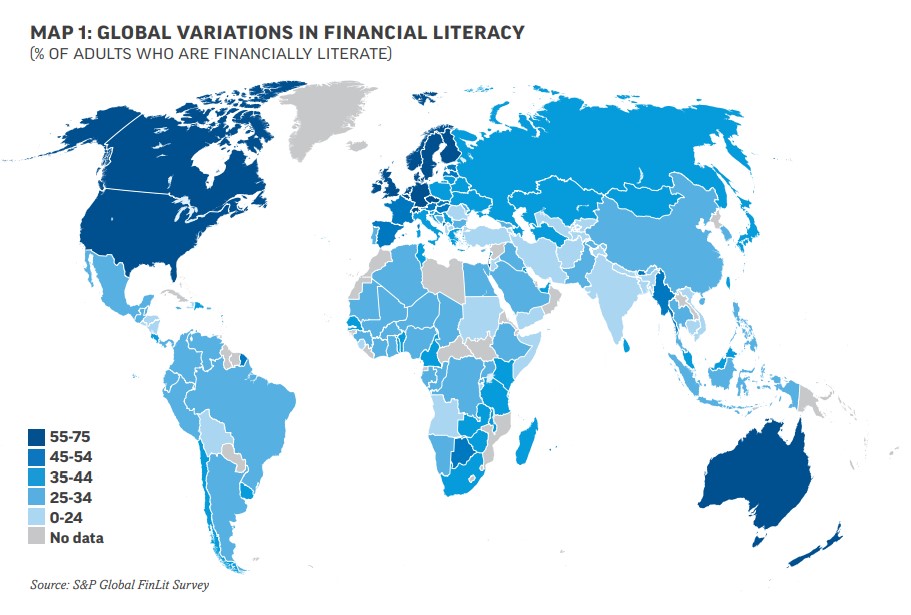

In the meantime, the world’s widest financial literacy survey revealed that just 33% of the planet has sufficient skills and knowledge to make sound decisions with their finances. The results were very similar (35%) when speaking about the second youngest age group, Generation Z, born between 1997-2010.

Source: Gflec.org

Despite that, Investopedia’s 2022 survey reported that although various age groups admit to having gaps in financial literacy, they all have investments in various financial products, including digital currencies.

Millennials, the parents of Generation Alpha, comprised the largest part (38%) of respondents with crypto investments. 23% of Gen Z said to be invested in digital currencies. They also named cryptocurrency the second most often investment choice after stocks.

Meanwhile, T. Rowe Price’s Parents, Kids & Money Survey of 2022 stated that 57% of the youngest generation, children from 11 to 14, are already familiar with cryptocurrencies. Nearly half of their parents confirmed that they have more conversations about money due to cryptocurrencies with their kids.

The Pandemic Opened the World of Investing

The Covid-19 pandemic brought global economic uncertainties. At the same time, it laid the background for the new financial products that democratized investing. It also accelerated the adoption of cryptocurrencies among retail investors.

The world of investing and trading, which once was mostly known for professionals, suddenly opened for everyone with a smartphone.

Millions of people faced plenty of spare time when locked down at home, while financial markets widely swung up and down, offering profits for those who traded.

Low-cost and easy-to-navigate trading apps stepped into play, offering ways to invest on a small scale in seconds. Volatile markets allowed for making money fast.

Inspired by the success of trading platforms like Robinhood and the growing engagement from the young generations, a whole ecosystem of financial services gradually emerged.

It focused on digitally native age groups and brought more gamified ways of dealing with finances than ever before.

Teen-focused Neobanks Opened Way to Web3

The global pandemic has brought out a new youth banking trend. Numerous fintechs and digital neobanks launched financial products and tools for teenagers and kids as young as eight.

Contrary to traditional banks, which allowed teens to have banking cards and savings accounts under the name of their parents, neobanks made such services fun.

They offered mobile accounts and accessible mobile services for the tech-savvy audience, gamified banking services, and rewarded users for completing simple tasks.

Neobanks offered cryptocurrency-related services, like a child’s crypto wallet. Young users became able to buy digital assets with a parent or other adult’s assistance, as the

According to teen neobank GoHenry’s report, “13% of kids in the UK made money from investing in cryptocurrency” in 2021.

Play-to-Earn Games Merged Investing and Gaming

The boom of non-fungible tokens (NFT) and blockchain-based play-to-earn (P2E) games like CryptoKitties, Splinterlands, or Axie Infinity played a critical role in young generations entering the crypto space.

They offered a whole new concept of gaming. Contrary to traditional video games, where in-game assets had no real-world value, P2E games allowed players to earn money for playing games.

P2E games rewarded players with NFTs and digital currencies that they could later use for inside-the-game purchases or cash out their earnings for real-world money.

Although there is a lack of precise numbers of which part of P2E game players was under 18, P2E games pushed the trend of monetizing the hobby to incredible highs at the end of 2021.

Millions of people calculated hundreds of thousands of earnings via play-to-earn games. Many even made a living playing games like Axie Infinity in emerging economies.

Finfluencers Filled the Void of Lacking Financial Content

Over the past few years, the growth of financial products and services for users under 18 has largely been driven by the active role of social media.

The pandemic created favorable conditions to start investing, and teenagers took advantage. Social media exploded with financial topics, which went viral and interested young audiences in learning and experimenting.

Surveys of that time revealed that more than two-thirds of GenZs valued financial content from self-taught investors like themselves. Their preference has resulted in the rising numbers of financial influencers – or “finfluencers” – on popular social media channels.

Influencers filled the void of a lack of financial education content attractive to young audiences. Young guys of twenty-something advised crypto investors of the same, generating hundreds of thousands of followers on their Youtube channels.

Hashtags like cryptocurrency and investing gained over two billion and 3.7 billion views on TikTok in September 2021. Hashtag investing appeared in almost 12 million searches on Instagram at that time.

Crypto-to-Kids Initiatives Focused on Education

With GenZ willingly exploring the crypto space, industry players continued making steps into the world of the younger audience, Generation Alpha.

Over the past few years, numerous educational initiatives for the underaged have emerged. YouTube provided videos explaining cryptocurrencies to children. Thousands of books were printed to teach kids about blockchain, Bitcoin, NFTs, and investing.

TV studios broadcasted NFT-based children’s series and TV shows. Even crypto-centered children’s camps appeared, aiming to educate the next generation about cryptocurrency and Web3.

With the increasing awareness and adoption of cryptocurrencies, over 60% of parents in the United States said last year that they would like their children to be educated about cryptocurrencies in high school.

Final Thoughts

Money is no longer solely handled by adults. Young people start investing earlier than previous generations. Easily accessible financial products and tools, simple user interfaces, and gamified features act as an encouraging start for digitally native age groups.

Rapid technological progress changed the ways how we learn about money and where. Crypto has also played its role in revolutionizing the status and educating young people early on in the key skills of digital finance.

Learn about crypto in a world after the pandemic:

Crypto in a Post-Covid World: How the Pandemic Influenced the Market

Read more about the most popular NFT games:

Top 12 NFT Games to Play in 2022