- Fidelity’s spot Bitcoin ETF has attained a milestone in net inflows.

- The firm’s FBTC fund reached over $1 billion worth of inflows.

- All spot Bitcoin ETFs witnessed the largest net outflows since their launch.

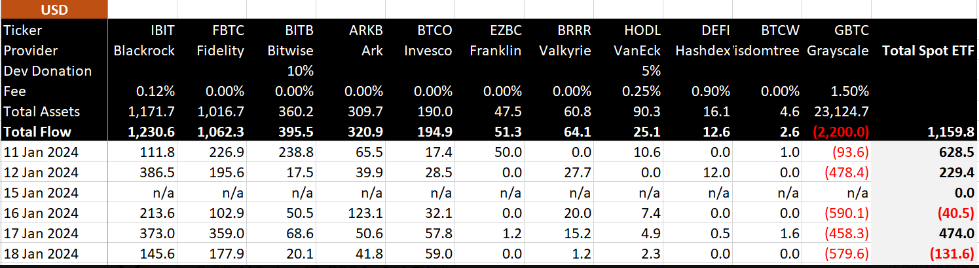

The Fidelity Wise Origin Bitcoin Fund (FBTC) has become the second spot Bitcoin ETF to hit over $1 billion in inflows following five days of trading.

Per JPMorgan data, BlackRock’s iShares Bitcoin Trust (IBIT) was the first of the newly approved BTC ETFs to reach the $1 billion assets under management (AUM) milestone as of January 17. Fidelity’s FBTC had garnered $874.6M in inflows during this period.

Fidelity’s FBTC Hits $1B Inflows

According to “provisional data” shared by BitMEX Research’s Twitter (X) page on January 19, Fidelity’s FBTC has joined BlackRock’s IBIT in the $1 billion-plus inflows club, ahead of Bitwise’s BITB fund, which saw $395.5 million worth of inflows.

Sponsored

Fidelity’s total inflows stood at $1.062 billion on day five of trading, behind Blackrock’s $1.2 billion.

Other spot Bitcoin ETFs with relatively impressive performance since trading began on January 11 include Ark Invest/21Shares’ ARKB and Invesco’s BTCO, with 320.9 million and $194.9 million worth of inflows, respectively.

While 10 out of 11 ETFs have garnered almost $3.4 billion in total inflows, all funds besides BlackRock’s, Fidelity’s, Ark’s, and Invesco’s witnessed less than $100 million.

Sponsored

Overall, day five of trading saw all spot Bitcoin ETFs witnessing the largest outflow since their launch, totaling $131.6 million, with Grayscale notching up $2.2 billion in outflows.

Read about Bitcoin ETFs’ $10 billion historic sale:

Bitcoin ETFs Historic $10 Billion Sale Lauded by Experts

Stay updated on the latest Bitcoin ETF filing by ProShares:

Bitcoin ETF Lineup to Expand as ProShares Files 5 New Funds