- Ethereum supply is now inflationary.

- The recent asset supply shift follows a recent network activity and fees drop.

- Interest appears to be shifting to Layer 2 networks.

Ethereum‘s “ultrasound money” status is under threat. The asset has turned inflationary as fees have plummeted in recent weeks.

Ethereum Loses Deflationary Status

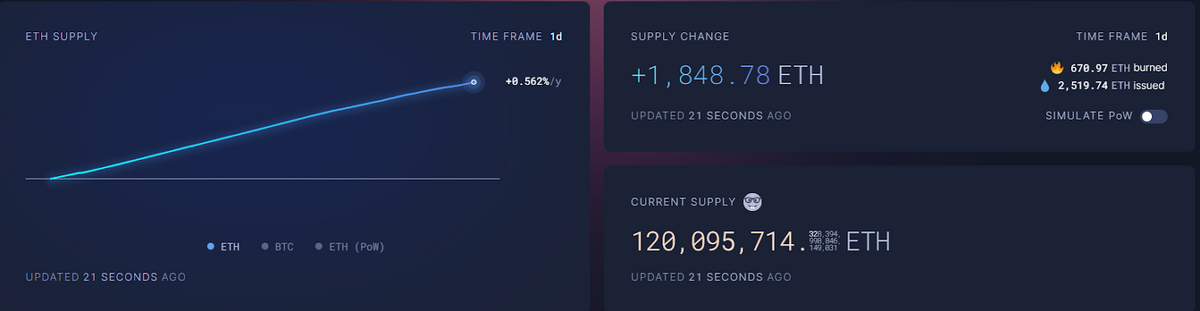

According to data from ultrasound.money, Ethereum’s supply is now inflationary, with a growth rate of 0.56% per day.

The recent supply shift comes as low fees have led to a decrease in Ethereum burns, the primary means by which the asset reduces its supply. Over the past 24 hours, the network has burnt only 670 ETH, a new low for 2024, down from an average of over 2,500 in the first four months of 2024.

Sponsored

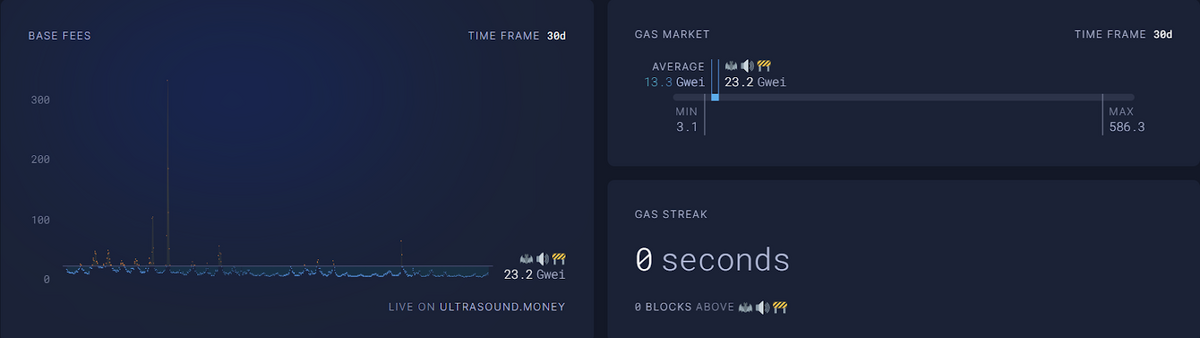

These burns come from the base fee paid by Ethereum users per transaction. This fee is determined by network activity, rising when the activity is high and dropping when the activity is low.

Over the past 30 days, Ethereum has averaged a base fee of 13.3 gwei, far below the 23.2 gwei ultrasound.money identifies as the minimum level required for the asset to achieve deflationary status, signaling low network activity on the leading DeFi network.

Ethereum’s low activity comes as Layer 2 chains and competing networks like Solana are gaining increased attention. The former results from the recent Dencun upgrade, making fees significantly lower on Ethereum scaling solutions.

Sponsored

Unlike Bitcoin, the largest digital asset by market capitalization, Ethereum has no finite supply, implying that its value can theoretically be diluted over time. This feature makes the asset’s deflationary mechanism essential to preserve and support value increase over time.

On the Flipside

- Ethereum will likely turn deflationary again when activity picks up.

- Low fees are favorable for the everyday Ethereum user.

Why This Matters

Ethereum’s deflationary status is a key point of interest for long-term investors seeking to preserve and gain value from holding the asset over time.

Read this for more on Ethereum:

Michael Saylor Warns SEC to Flag ETH, ADA, SOL as Securities

Learn more about Bitcoin’s recent price action:

BTC Wows With Incredible $10K Jump: Will the Rally Continue?