Decentralized exchanges (DEX) are on hype, as trading volumes continue to rise by reaching the all-time high last month.

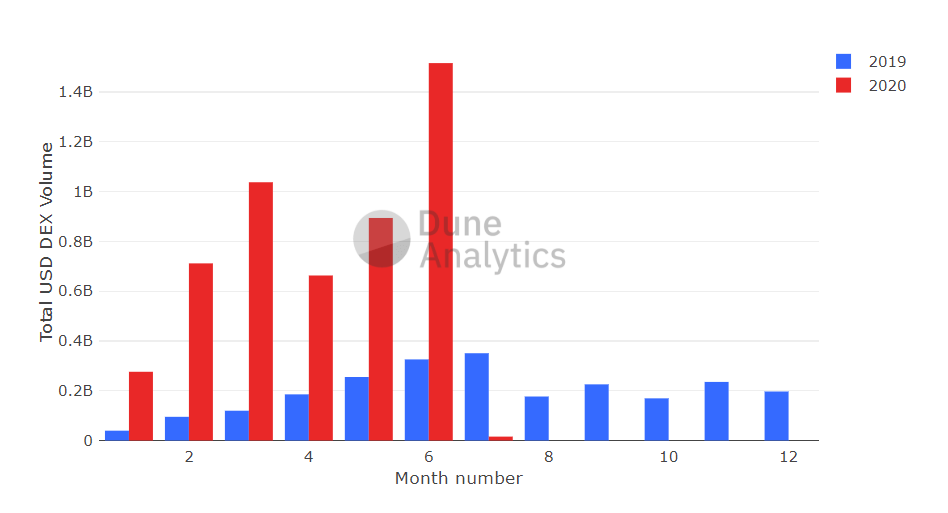

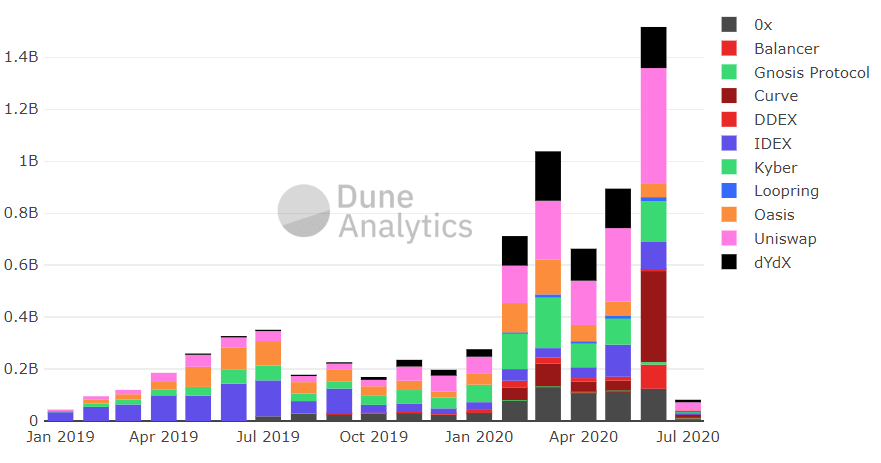

The data from Dune Analytics show that DEXes processed the total trading volume of more than $1.5 billion in June. The number reached the highest point ever and is 4.6 times bigger compared to the same month a year ago when decentralized P2P exchanges traded $326 million.

Decentralized cryptocurrency exchanges, differently from their centralized counterparts, do not hold user funds in a third-party account and use automated systems that allow direct peer-to-peer (P2P) transactions between the users.

The significant rise in trading volumes at decentralized exchanges started this February when circulation more than doubled within a month from $276 million in January to over $711 at the end of February.

The intensive trade in June marked the record highs and the 70% increase compared to May when the monthly volume sat at nearly $900 million. Furthermore, the first month of the summer even outrun the former all-time high of March, when the total DEX monthly transaction volume surpassed $1 billion.

Sponsored

The decentralized exchanges were one of the rare sectors booming during the mid-March market crash when both traditional and cryptocurrency markets went down due to the global COVID-19 pandemic.

The whole DeFi industry is growing

The continuous growth is a result of the current uptrend and the booming interest in the decentralized finance (DeFi) sector. The whole DeFi industry witnessed a historic growth this year, when it doubled in market capitalization within a few months and surpassed the mark of $2 billion in the first days of summer.

Sponsored

Although there are various DeFi projects that contribute to the growth of the whole sector, the leading and most promising ones are the lending services and decentralized exchanges.

Furthermore, the tokens of decentralized exchanges are thriving accordingly and recently outperformed the ones from the centralized exchanges, according to crypto analytics Messari. The tokens even have chances to become some of the best-performing assets of the year due to their year-to-date returns that nearly 5 times exceeded the profit of centralized cryptocurrency exchanges.