- Bitcoin has experienced a recent surge following weeks of relative calm.

- Controversial news has set the stage for an intriguing backdrop.

- A legal battle and conflicting trader sentiments have added complexity to the ongoing narrative.

With a notable uptick of 7.55% since the last DailyCoin Bitcoin Regular, BTC is showing signs of a resurgence. Nevertheless, as we transition into the weekend, Bitcoin appears to temper its volatility, indicating a potential return to a more subdued price trajectory.

Sponsored

A fortnight ago, news arrived, but the market stood still. Now, news is abundant, and prices have surged. As we look into this market, we aim to find interesting events that might show the market is about to get shaky. To do this, we offer you the Bi-Weekly DailyCoin Bitcoin Report, put together by our expert, Kyle Calvert.

News and Events: Understanding Impacts

Fake News: BlackRock Bitcoin ETF Approval Debunked

Cointelegraph, a crypto news outlet, made a mistake that stirred up the crypto community. They wrongly reported that the SEC had approved a BlackRock spot Bitcoin ETF in the US. But later, it turned out the SEC hadn’t decided yet.

Tesla Holds Tight Ahead of BTC ETF Approval

Tesla has released its Q3 2023 quarterly report. To the delight of cryptocurrency enthusiasts, this latest report confirms that Tesla’s substantial BTC holdings remain unaltered. Currently, the company possesses 9,720 Bitcoins, which translates to a market value of approximately $287,556,480 as of the time of this report.

SEC Won’t Appeal Decision in Grayscale’s Spot Bitcoin ETF Case

Grayscale sought SEC approval to convert its Bitcoin Trust into a spot Bitcoin ETF but was initially denied. They went to court, and in late August, the court ruled in favor of Grayscale, stating the SEC was wrong in rejecting the application. Surprisingly, the SEC chose not to appeal.

Community Sentiment

For his analysis, Trader Jelle, well-known in the crypto community, shared a post expressing optimism for a $30,000 price point in the lead-up to the surge. “Bitcoin filling the wick, slowly but surely. Let’s go for that $30k tap,”

Sponsored

On the same day, another trader, CrypNuevo, added intrigue to the situation, stating, “Today it’s going to be a very interesting day for trading… They have hit exactly $29400 where there were many liquidations,”

CrypNuevo, in several X posts, substantiated their claim by presenting historical data on liquidations from recent days. They issued a cautionary note, revealing that long positions significantly outnumber short positions and speculating that Bitcoin might experience a retracement during the U.S. trading session.”

Current Outlook

On October 20, Bitcoin surged past the $29,500 mark following a highly eventful 24-hour period. Bitcoin’s price trajectory experienced a remarkable upswing during this time, surpassing $28,700 with a sharp, upward candlestick pattern. As a result, Bitcoin reached its highest value in two months at $30,100 before slowly settling at $29,540.

This surge in Bitcoin’s value is a direct result of several factors. First and foremost, Bitcoin managed to maintain its position above the crucial $28,000 threshold. Simultaneously, retail investors are brimming with anticipation due to the impending Bitcoin supply halving narrative. This convergence of factors has contributed to Bitcoin’s impressive price increase.

Fear and Greed

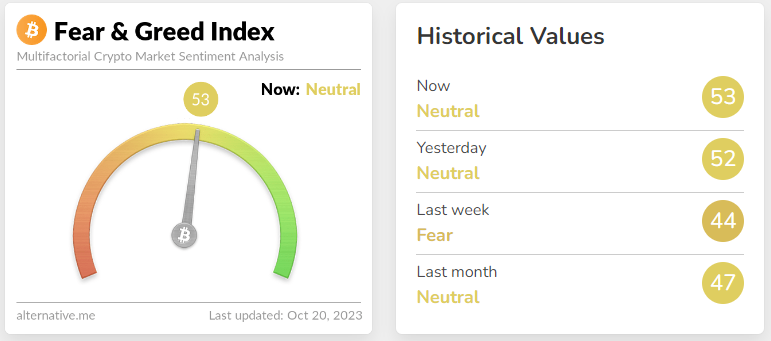

The way people feel significantly impacts the cryptocurrency market. The Fear and Greed Index plays a crucial role in navigating these emotions. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 53, indicating an increase of 3 points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- It’s essential to remember that the cryptocurrency market is inherently volatile, and prices can fluctuate rapidly.

- Grayscale’s legal victory in its pursuit of a spot Bitcoin ETF underscores the evolving regulatory landscape for cryptocurrencies.

- Trader sentiment can be influential, but it’s crucial to recognize that the crypto market is susceptible to sudden shifts driven by a myriad of factors.

Why This Matters

As a leading indicator in the cryptocurrency realm, Bitcoin sets the tone for market sentiment and investor confidence. The recent upswing in Bitcoin’s value and the pivotal regulatory decisions underscore its role as a bellwether, signaling potential shifts and opportunities in the broader crypto landscape.

To learn more about the impact of a false Bitcoin ETF report on the market, read here:

False Bitcoin ETF Report Rockets Price Before Reality Strikes

For insights into the recent developments surrounding Bitcoin’s holdings by Tesla, read here:

No Bitcoin Sold: Tesla Holds Tight Ahead of BTC ETF Approval