- Stablecoins have experienced a sharp decline in market capitalization, with one standout exception.

- Investors have been accumulating stablecoins at an unusual rate.

- The average age of coins held by whales and sharks has been steadily increasing.

In the rapidly evolving landscape of cryptocurrencies, one digital asset stands out as a reliable anchor amidst the turbulent seas of market volatility: stablecoins.

These unique cryptographic currencies are intricately pegged to other assets or currencies, offering a safe haven for investors and enabling seamless trading within the crypto realm. In the face of tumultuous price swings that plague the crypto markets today, stability has become an invaluable commodity.

A 15-Month Rollercoaster as Stablecoins Take a Bumpy Ride

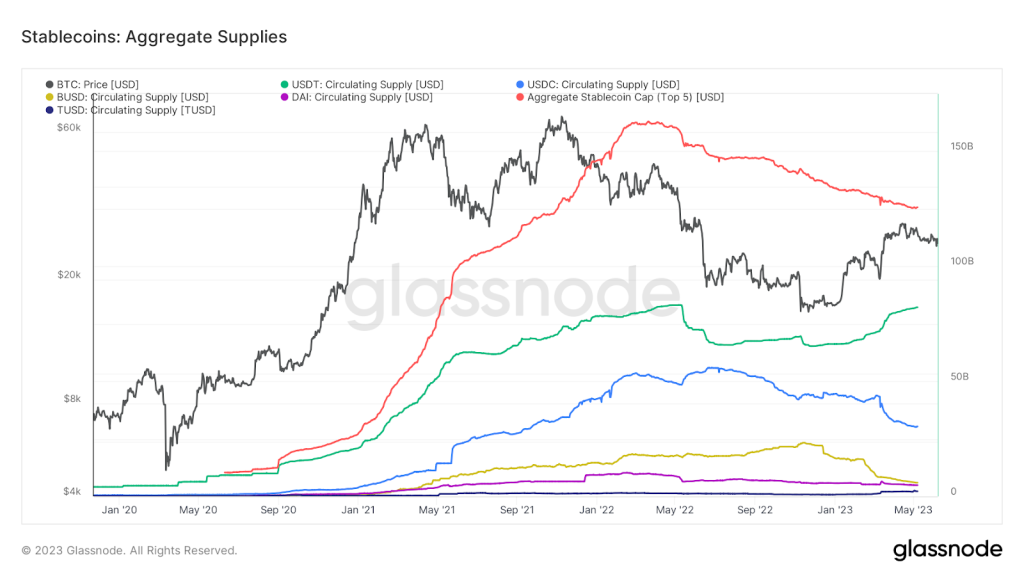

However, stablecoins have recently experienced a nosedive in their market capitalization, a trend that has persisted over the past 15 months. Before the collapse of the Terra ecosystem in May 2022, stablecoins reached an impressive market cap of $164.29 billion, with USDT alone accounting for nearly 50% of that total, amounting to $80 billion.

Sponsored

Unfortunately, the market collapse has taken its toll, and the market capitalization of stablecoins continues to dwindle. Despite this overall decline, an interesting phenomenon has occurred with USDT, as it has managed to maintain its value and even witnessed a surge in market cap.

Throughout the year, Bitcoin has been subject to extreme price fluctuations, keeping the entire crypto market on edge. Altcoins typically follow Bitcoin’s lead, resulting in a consolidated trend for most of them.

Time is Money as Coins Mature in Whales’ Wallets

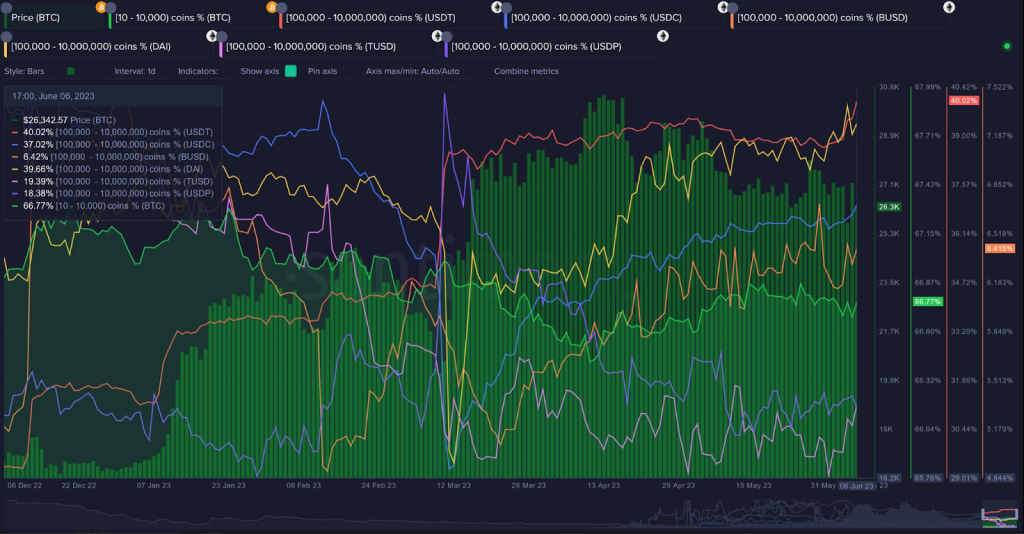

Meanwhile, influential investors, known colloquially as “whales” and “sharks,” have accumulated stablecoins at a higher ratio than usual. This suggests that these entities are possibly preparing for the next bullish market phase, prudently safeguarding their funds within stablecoins.

Notably, over the past two months, the number of addresses holding significant quantities of USDT, USDC, BUSD, DAI, TUSD, and USDP has steadily increased. Among all stablecoins, DAI has witnessed the highest accumulation, closely followed by USDT, USDC, BUSD, and others.

Sponsored

Furthermore, according to data from Santiment, whale transactions involving USDT, USDC, and BUSD have experienced a notable rise since the beginning of the month.

Additionally, the mean dollar invested age, which represents the average age of coins on the chain-weighted by their purchase price, has steadily increased. This indicates that these tokens are maturing in the wallets of whales and sharks without any immediate risk of liquidation.

On the Flipside

- While stablecoins offer stability, concerns remain regarding their regulatory compliance and potential impact on the broader financial system.

- Despite stablecoins experiencing a decline in market capitalization, they still hold a significant share compared to other cryptocurrencies.

- The accumulation of stablecoins by prominent investors, often called “whales” and “sharks,” raises concerns about market concentration and the potential for these entities to exert undue influence over the crypto market.

Why This Matters

The growing accumulation of stablecoins, particularly by influential investors, signals a potential shift in market sentiment and a strategic move to protect funds during volatile times. This trend highlights the increasing importance of stablecoins as a preferred choice for investors seeking stability and a reliable store of value within the crypto ecosystem.

To learn more about the implications of the SEC vs. Binance condemnation on BUSD and its impact on USDT, read here:

Does SEC vs. Binance Condemnation of BUSD Make USDT a Commodity or Security?

To stay updated on the recent $104 million liquidations and how the crypto market is defying SEC troubles, read here: