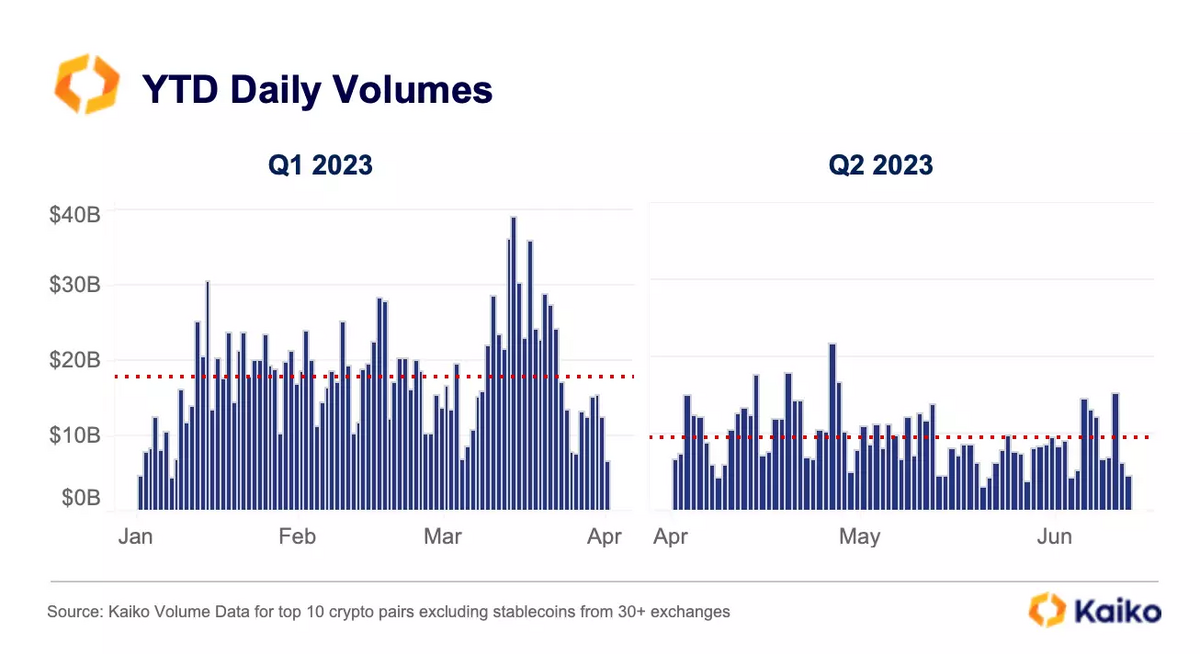

- Crypto trading volumes have hit yearly lows in Q2 2023.

- Average daily volumes for the top 10 tokens dropped to $10 billion.

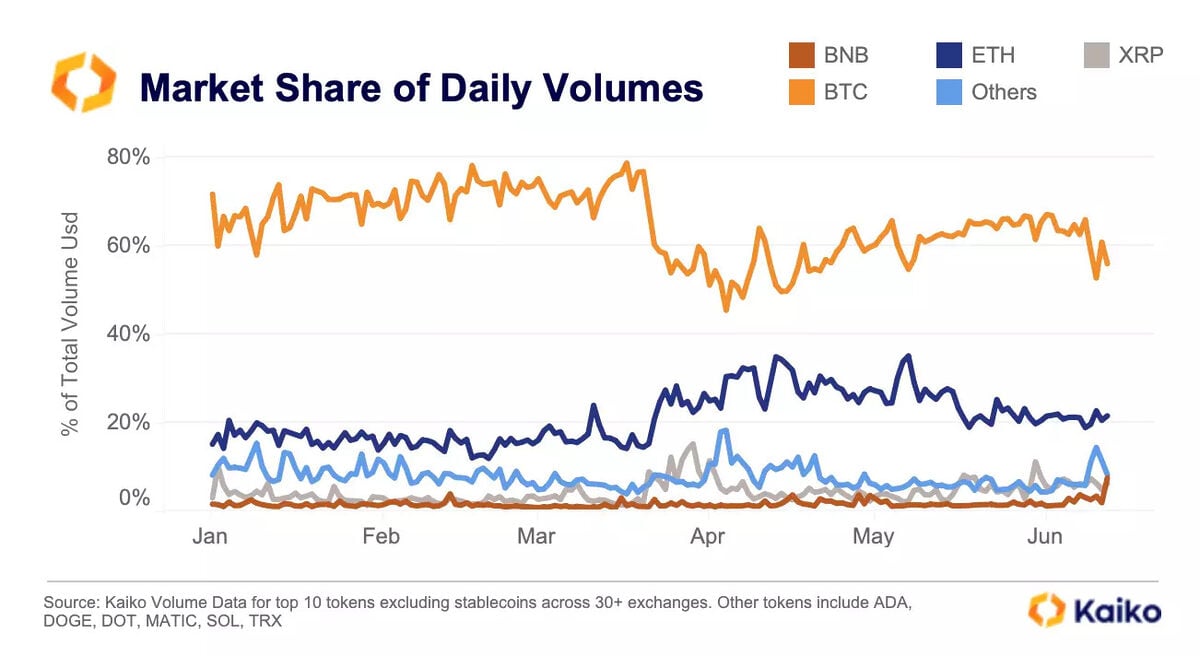

- Bitcoin was a major loser in trading volume share.

As the US regulatory crackdown continues, crypto markets have seen a pullback from market markers. The resulting drop in trading volume continues to fuel volatility in the crypto markets.

On Thursday, June 15, crypto analytics firm Kaiko revealed a startling drop in crypto markets trading volume. This collapse has had a particular impact on Bitcoin’s trading volume.

Regulatory Risk Hits Exchange Volume, Bitcoin

According to data from Kaiko, average daily volumes for the top 10 tokens (excluding stablecoins) were $10 billion. This is a significant drop from average volumes in the last quarter, at $18 billion.

This downturn comes amidst a heightened regulatory crackdown, which prompted market makers to cut their exposure to risky exchanges. This applies especially to Binance, which received a lawsuit on June 5 from the US Securities and Exchange Commission.

Sponsored

The drop in volume hit Bitcoin the hardest, which saw its share of trading volume drop 20% from the peak in March. On the other hand, Ethereum and BNB saw their share of trading volume rise by 5%. In particular, BNB rose from 2% of trading volume to 7%.

Low Liquidity Prompts Changes to Delist Projects?

The startling drop in liquidity is a concerning development for crypto investors. Amid these developments, one investor revealed even more concerning details about how exchanges handle this situation.

Sponsored

Trading activity has reached its bottom, Andrei Grachev, head of the market maker and investment fund DWF Labs warned. “Even solid coins are almost not traded on exchanges,” he added.

Grachev revealed a worrying trend among major exchanges. In response to low liquidity, exchanges are making crypto projects manage their own liquidity. If they can’t do that, they delist them.

“Behind the scenes, exchanges started asking projects to manage trading volumes, liquidity, etc., otherwise – delisting,” Grachev revealed.

Grachev further highlighted a drop in retail activity, contributing to higher volatility. Despite this, a portion of retail investors remains active, he added. This combination of low volatility and bursts of activity are fueling 20-30% price swings “even for large coins,” Grachev explained.

Even amidst such worrying signs, Grachev emphasized that this is a good time for those that are in crypto for the long haul. Nightmarish times, he explained, are usually the best instances to close deals.

On the Flipside

- There is no way to know if trading volumes or token prices bottom out at any point.

- Retail investors are becoming an increasingly important part of the crypto market. This is especially true after the mass institutional exit after the FTX collapse.

Why This Matters

A collapse in trading volume usually indicates a bearish sentiment among major players in the market.

Read more about the SEC crackdown fueling concerns among investors:

Exchanges Were Warned: SEC Chair Gensler Defends Crypto Crackdown

Read more about the latest crypto-AI integration: