- Crypto investment funds have extended their spot Bitcoin ETF-inspired inflows streak for a ninth week.

- Last week’s inflows represent the highest crypto funds have received since the 2021 bull run.

- Still, U.S. investor participation remained low, likely in anticipation of a spot Bitcoin ETF approval.

Following BlackRock’s entry into the spot crypto ETF product race, expectations that the U.S. SEC will finally approve the product have reached a fever pitch. Fueled by these hopes, crypto investment funds are rolling back the years. Last week, net inflows to these investment products extended a two-month streak while hitting a two-year milestone that further signals a crypto market comeback.

Crypto Funds See Largest Inflows Since 2021

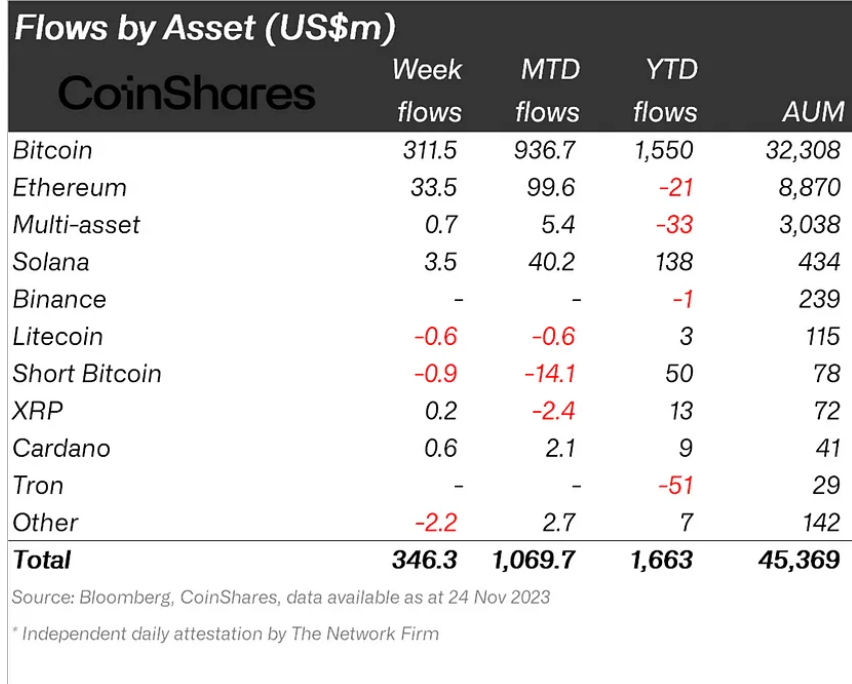

Last week, crypto investment funds recorded net inflows totaling $346 million, the largest since the late 2021 bull market, in a move that extended the recent streak of inflows for a ninth consecutive week, according to CoinShares’ most recent report published on Monday, November 27.

With last week’s inflows, the total value of assets under management (AuM) on crypto investment funds has surged to a one-and-a-half-year high at $45.3 billion.

As is typically the case, Bitcoin investment funds saw the largest inflows with $312 million, bringing year-to-date inflows to Bitcoin funds to over $1.5 billion. Continuing a recent trend, trading volumes on Bitcoin funds remain well above typical levels relative to the total spot Bitcoin volumes at 18%. CoinShares explained that the metric suggests these products are becoming increasingly popular for investors seeking Bitcoin exposure.

Sponsored

Following Bitcoin investment funds, Ethereum funds recorded the second highest inflows with $34 million, extending a positive four-week run, totaling $103 million. With the recent inflows streak, Ethereum investment funds have almost completely canceled out a previous run of outflows witnessed earlier this year. The reversal marks a significant sentiment shift, according to CoinShares, and is undoubtedly linked to BlackRock’s recent Ethereum ETF filing.

Funds related to other altcoins, including Solana, Polkadot, and Chainlink, also recorded inflows of $3.5 million, $0.8 million, and $0.6 million, respectively.

Sponsored

Regionally, investment funds in Canada and Germany received 87% of the total inflows last week, with $199.1 million and $101 million, respectively. CoinShares noted that inflows to U.S. funds remained low at $30 million “presumably as investors wait for the ETF launch.”

Wen Spot Crypto ETFs in the U.S.?

Amid the SEC’s continued delays, the question of when a spot crypto ETF product will be approved in the U.S. continues to linger. While there has not been much in the way of predictions for the approval of spot Ethereum ETF products, predictions for the timeline of a spot Bitcoin ETF product abound.

Most recently, on November 8, Bloomberg analysts James Seyffart and Eric Balchunas asserted that there was a 90% chance the SEC would approve a spot Bitcoin ETF by January 10, 2024.

The crypto community will be watching closely to see what happens, as just over a week ago, the SEC pushed pending decisions on crypto spot ETF applications based on Ethereum and Bitcoin to January 2024.

In a November 21 interview, SEC Commissioner Hester Pierce asserted that the agency had no reason to say no to spot Bitcoin ETF applications.

The consensus within the crypto community is that spot crypto ETFs will open the crypto markets to trillions of dollars in capital from institutional and traditional investors.

On the Flipside

- The near approval of a spot Bitcoin ETF is not guaranteed as the SEC still reserves the right to deny recent applications.

- Most crypto asset prices remain far below highs formed in the 2021 bull run.

Why This Matters

The most recent crypto fund flows suggest that crypto investment sentiment is nearing levels seen during the peak of the last crypto bull run.

Read this to learn more about the recent streak of crypto fund inflows:

Crypto Fund Inflows Hit 2-Month Streak as ETP Volumes Soar

Learn more about Polygon zkEVM’s recent strides:

Polygon zkEVM Transactions Spike as DeFi Activity Soars