As the crypto market holds its breath, waiting for the SEC’s approval of Bitcoin ETFs early next year, the world’s largest asset managers cash in through their existing blockchain and crypto-related exchange-traded funds (ETFs).

Yet the manner and timing in which they take profits send confusing signals to the crypto community about the volatility of Bitcoin’s price.

Crypto ETFs Calculated Gains

The close of 2023 was relatively successful for the cryptocurrency market, whose capitalization more than doubled, and for the largest ETFs focused around it. All of their annual return rates have risen by double digits at least.

Sponsored

Cathie Wood’s ARK Next Generation Internet ETF (ARKW), famous for its active investments in disruptive innovation companies, made a 67.5% return this year, recovering after a 67% dive in 2022.

BlackRock’s Blockchain and Tech ETF surpassed the 69% total return rate at the end of November. ETFs managed by Fidelity and Bitwise witnessed a similar growth rate, while VanEck’s Digital Transformation ETF calculated even higher 98.25% annual returns.

One of the key reasons behind such growth was an incredible rally of crypto-related stocks. Shares of Coinbase, Grayscale Bitcoin Trust, MicroStrategy, and Marathon Digital soared over 300%, outperforming Bitcoin’s 150% growth. Consequently, investment funds that track price indexes of crypto-related companies bounced back after a brutal 2022.

Investment Funds Took Profits

In such an optimistic crypto market landscape, crypto-related ETFs reshuffle their portfolios and make moves that send mixed signals to retail investors.

Sponsored

Ark Invest, an asset manager behind one of the world’s most actively traded and closely followed crypto ETFs, made the most turbulence recently after heavily offloading Coinbase Global (COIN) and Grayscale Bitcoin Trust (GBTC) shares.

The Florida-based fund sold roughly over $270 million worth of Coinbase shares in December and more than 588,000 shares since June, when Cathie Wood’s fund changed the direction and decreased Coinbase’s weight on its portfolio regularly.

Despite the selloff, Coinbase shares still make up the majority (11.78%) of the ARKW Fund’s portfolio, ahead of Block Inc (8.57%) and Robinhood Markets Inc (4.86%). ARK Next Generation Internet ETF increased COIN shares in its portfolio by more than 7.2% since the end of 2022, managing over 1.153 million shares worth over $279 million.

Although Wood explained the sale of Coinbase shares as a portfolio rebalancing, the ETF likely cashed in by selling a part of its Coinbase shares, which have more than quadrupled in value since the beginning of the year.

A similar explanation could be addressed to ARK Invest’s total liquidation of its Grayscale Bitcoin Trust (GBTC) holdings.

The latter saw a massive, almost $2.5 billion, inflow earlier this year when numerous funds bought GBTC shares at a discount in anticipation of the Grayscale’s Trust transition to a Bitcoin ETF.

Shifting Focus on Crypto Miners

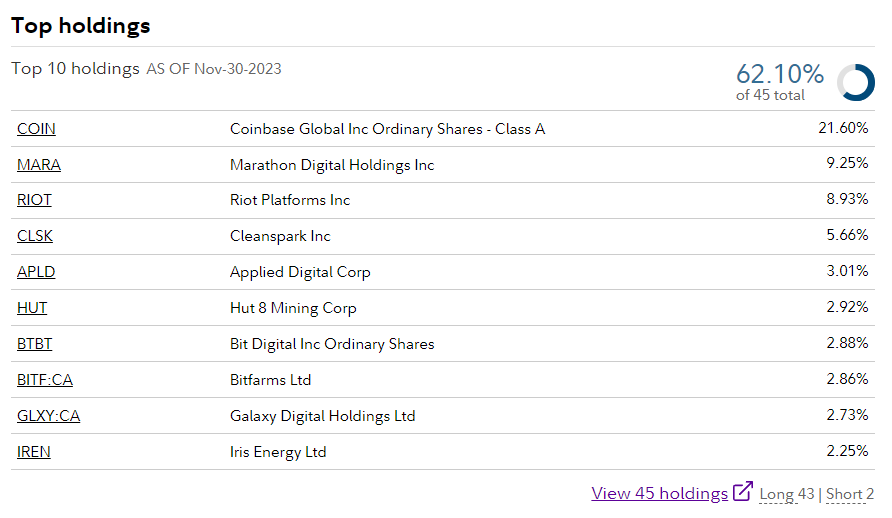

Ark Invest isn’t the only asset manager where Coinbase holds significant sway. Fidelity, a major player in the United States, saw a 5.14% uptick in its Coinbase portfolio within the Crypto Industry and Digital Payments ETF (FDIG) this year.

Coinbase Global shares take the lead in the fund’s portfolio, making the largest portion at 21.6% and surpassing those of crypto mining giants Marathon Digital (9.25%) and Riot Platforms (8.93%).

Marathon Digital (MARA) was also on the radar of BlackRock, one of the world’s largest investment management firms.

In December alone, BlackRock’s iShares Blockchain and Tech ETF (IBLC) boosted its MARA holdings by 6.48%, now constituting the largest share in the portfolio at 17.42%. Since the year’s start, BlackRock has significantly increased its MARA holdings by 9.86%.

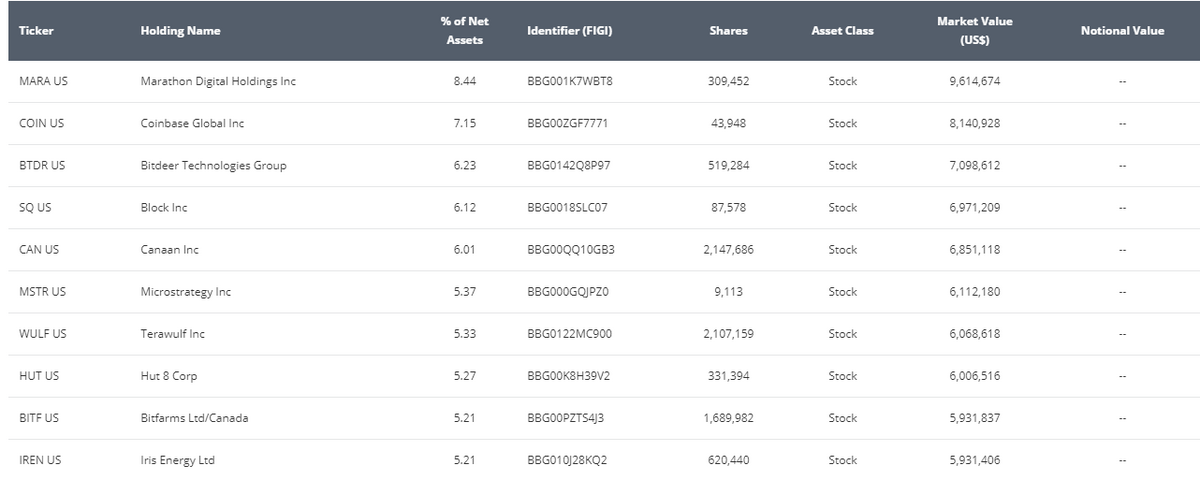

The VanEck Digital Transformation ETF (DAPP) also turned its attention to Bitcoin miners, making Marathon Digital (8.44%) a key asset in its investment portfolio.

The fund, tracking 22 stocks related to crypto and blockchain and generating one of the highest returns this year, made MARA their priority asset after selling 4.01% of its Coinbase shares.

Bitwise Crypto Industry Innovators ETF (BITQ), which tracks a stock price index of crypto-related companies and manages a 29-asset portfolio worth $167.4 million, shows similar tendencies: Mara holding goes up (14.72%), while Coinbase Global declines (8.99).

Fears of Bitcoin Price Drop

Despite major asset managers expressing confidence in crypto mining companies, their Coinbase and Grayscale Bitcoin Trust share selloffs send mixed signals to the broader crypto community.

Almost all major asset managers, like Ark Invest, BlackRock, Bitwise, Fidelity, VanEck, Valkyrie, Galaxy, and others, have submitted their own applications for spot Bitcoin ETFs with the US Securities and Exchange Commission (SEC).

With SEC decisions expected to be announced within the first quarter of 2024, the crypto market worries that ETF approvals would be “sell the news” events that pull Bitcoin’s price down, at least for the short term.

“Is this a known event? Yes. Has this been known for some time? Yes. Has the market used this time to price in the event? Has the price pumped? Yes = it is “sell the news” event,” claims crypto user@fewseethis on X.

On the other hand, the crypto community fears that the approval of Grayscale Bitcoin Trust to transform into a spot Bitcoin ETF could result in significant outflows from the crypto market, consequently pushing Bitcoin’s price down further.

GBTC manages assets exceeding $26 billion and has applied for its Grayscale Bitcoin Trust to be converted into an ETF.

Crypto market participants are concerned investors of over $2.5 billion in discounted GBTC may take profits ahead of the anticipated SEC ETF approval.

Not to mention that the insolvent crypto exchange FTX owns a sizable holding of around $417 million of Grayscale’s Bitcoin Trust, and its current management plans to return funds to creditors in fiat currency rather than in digital assets.

Finally, the nuances of asset managers’ inner policies raise additional concerns ahead of their expected sport ETF approvals.

Earlier this month, BlackRock, the world’s biggest investment firm with $9 trillion in assets under management, agreed with the SEC’s key condition and preferred method of fiat currency redemptions for its spot Bitcoin ETF.

This means that the new share of the ETF will be only created by using fiat currencies and not Bitcoin or any other digital currency. According to the SEC, such a mechanism guarantees that only the ETF issuers will be handling BTC and not an intermediary.

“Cash creates are worse for taxes because cash changes hands,” says ETF analyst Eric Balcunas. Trading without using fiat involves a trade and no cash exchanges. If the SEC only allows cash trades, it eliminates tax efficiency, a significant advantage of ETFs.

Higher Volatility, Bitcoin Above $30K

The SEC is anticipated to announce its decision on a spot Bitcoin ETF by January 10, 2024. However, it would initially apply only to Ark Invest’s ETF if approved.

A broader set of decisions for spot Bitcoin ETFs from BlackRock, Bitwise, Fidelity, VanEck, Galaxy, and Valkyrie is scheduled for no earlier than March 14, 2024.

The timeline practically coincides with the Bitcoin halving event at the end of April, which cuts BTC supply by half and eventually pushes the asset’s price to new highs.

We may expect increased volatility due to macroeconomic slowdown and global recession concerns. Yet, VanEck fund analytics predict that the Bitcoin price is unlikely to drop below $30k in Q1 2024.

Learn how to avoid withdrawal suspensions on crypto exchanges:

Crypto Withdrawals Frozen? Here’s What You Must Know

Read about burn wallet, which actively sends stablecoins further:

Burn Wallet on Tron Moves Stablecoins In and Out