- Crypto.com is one of the first blockchain-based ecosystems to offer the range of connected cryptocurrency services.

- It offers a variety of services: mobile app, MCO Visa card, cryptocurrency exchange, non-custodial wallet, staking.

- Crypto.com is not regulated. The CEO has a controversial past.

- Crypto.com review verdict: Love it, but not head over heels – ★★★★☆

The crypto space is full of digital asset service providers. It could be a challenge to find the right one. Well, if you do your homework, the process might be easier. But do you want to spend hours searching online? We have a better idea.

We will do your homework for you. DailyCoin will help you to find the best digital asset service provider, be it the payment network, cryptocurrency exchange, or simply a wallet. We shall make thorough research and provide all the necessary details to make your own decision. Sounds nice? Let’s start with crypto.com review and have a look at one of the biggest crypto industry players.

| Pros | Cons |

|---|---|

| Wide range of services | Full service unavailable in some jurisdictions |

| Variety of deposit/ withdrawal methods | A limited number of trading pairs |

| Competitive trading fees | Not regulated by the financial authority |

| Stop Loss / Stop Limit trading available | |

| 2% bonus (CRO) for new user deposits | |

| Syndicate: 50% discount for new tokens | |

| Token swap option | |

| 20% yearly return on CRO staking | |

| MCO Visa card: up to 8% cashback + discounts | |

| 24/7 customer support | |

| 100% funds in cold storage |

What is Crypto.com?

Crypto.com is the cryptocurrency payment and financial services firm with the global ambition to put cryptocurrency in every wallet. Founded as Monaco in 2016, crypto.com is one of the first blockchain-based ecosystems to offer the range of interconnected cryptocurrency services.

With more than 3 million current users worldwide, the platform offers a variety of crypto-related features. However, it is best known for its mobile application with multiple functions and an MCO Visa card, that enables real-time crypto spending across 40 million places worldwide.

Sponsored

The platform raised over $26 million in an initial coin offering (ICO) in 2017 and currently is led by the team of 17 staff members. Its CEO and founder Kris Marszalek, however, comes with a controversial reputation due to the suspicious bankruptcy of Ensogo in 2016.

Promising Southeast Asia’s e-commerce firm Ensogo was also run by Mr. Marszalek at the time. The company mysteriously disappeared one day without warning its partners, employees, and customers. After a short period of time, the same person founded Monaco, which later encountered a lot of critique due to the struggling MCO Visa card deliveries. The industry rumors claim that rebranding to crypto.com was done to cover up the failure.

Is crypto.com safe?

Security is always the main priority in terms of financial services. And with the questionable reputation of its founder in mind, trust is even more relevant.

Sponsored

Here crypto.com has an issue to overcome. It is a payment and financial service provider that is not regulated by institutional authorities. Regulations protect investors from frauds, scams, and address their concerns over the safety and stability of the certain company.

On the other hand, crypto.com provides dedicated AML and KYC compliance and risk management functions, which include deposit and withdrawal control, transaction screening and fund access control. It also holds 100% of the user funds in cold storage and partners with Ledger to provide institutional-grade custody and multi-signature technologies.

The platform claims all the fiat funds of its users are held in regulated custodian bank accounts. Moreover, crypto.com secured the $360 million in insurance for digital assets against physical damage, destruction, or third-party theft.

Crypto.com key features

The ecosystem of crypto.com supports a wide variety of crypto-oriented services and is one of the biggest in the cryptocurrency industry. All of these features are connected together and allow users to purchase, trade, store, or lend cryptocurrencies on a single platform. Moreover, crypto.com is one of the rare digital asset-related platforms that offer rewards and cashback for its users.

The features of the crypto service giant, however, can be categorized into leading and most popular ones, that include:

- Mobile app

- Exchange

- Staking

- Wallet

- MCO Visa cards

Below in this crypto.com review, we will look closer into each one of those main categories.

Crypto.com app review

This means that the app accepts fiat deposits into its wallet by standard payment methods, which include bank account, credit, or debit card transfers. Transfers from credit cards come with a 3.5% card processing fee + 10 cent transaction authorization fee. Meanwhile, deposits in cryptocurrencies are also available.

At the time of publishing the crypto.com users can buy and sell 70 cryptocurrencies that are accepted by the platform. These include:

- Crypto.com Coin (CRO)

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Binance Coin (BNB)

- Litecoin (LTC) and more

The platform allows cryptocurrency withdrawals to external wallet addresses, however, they come with a fee. These costs vary depending on the currency (e.g. 0.0004 for BTC, 0.003 for ETH, and 1 for USDT and other stablecoins). Meanwhile, sending any digital assets among crypto.com user wallets is free.

The application also provides the ability to track over 200 different digital assets. Their price, volume or market cap changes can be monitored on 8H, 1D, 1W, 3M, 6M timeframes.

Crypto.com allows its users to stak digital currencies. In other words, it offers user rewards for locking cryptocurrencies in their crypto.com digital wallets. Furthermore, it also provides its users with cryptocurrency loans and allows accepting crypto payments for selling goods.

And finally, it issues its own MCO Visa cards. The world’s first crypto-related Visa cards work together with crypto.com wallet and allow spending cryptos worldwide with up to 8% crypto cashback option.

The mobile application is by far the key iconic product that opens the entrance to the crypto.com ecosystem. Available for iOS and Android systems, the crypto.com app unites and supports the range of platform’s other services.

The downloadable smartphone app acts like a trading and staking platform as well as the custodial multicurrency wallet. Anyone with a crypto.com application has the ability to buy, sell, store, and track the digital currencies.

For the time of publishing, crypto.com allows buying and selling in 7 traditional fiat currencies, that include:

- United States Dollar (USD)

- British Pound (GBP)

- Euro (EUR)

- Singapore Dollar (SGD)

- Australian Dollar (AUD)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

Exchange

The cryptocurrency exchange option came to life in late 2019. With over 5 million users of its platform, crypto.com has turned into one of the most popular cryptocurrency trading platforms.

The exchange supports a variety of digital currencies, and offers over 50 trading pairs available across three different markets:

- Bitcoin (BTC) market,

- Tether (USDT) market

- Crypto.com Coin (CRO) market

Despite its simple interface crypto.com lacked the advanced trading options and was best suited for the beginners. The exchange only supported spot trading and market orders for some time. However, it added new order types in September 2020. The new order types allow advanced traders to trade more efficiently, cost-effectively, and lower risk on trades. These additional order types include:

- Stop Limit / Take Profit Limit

- Stop Loss / Take Profit

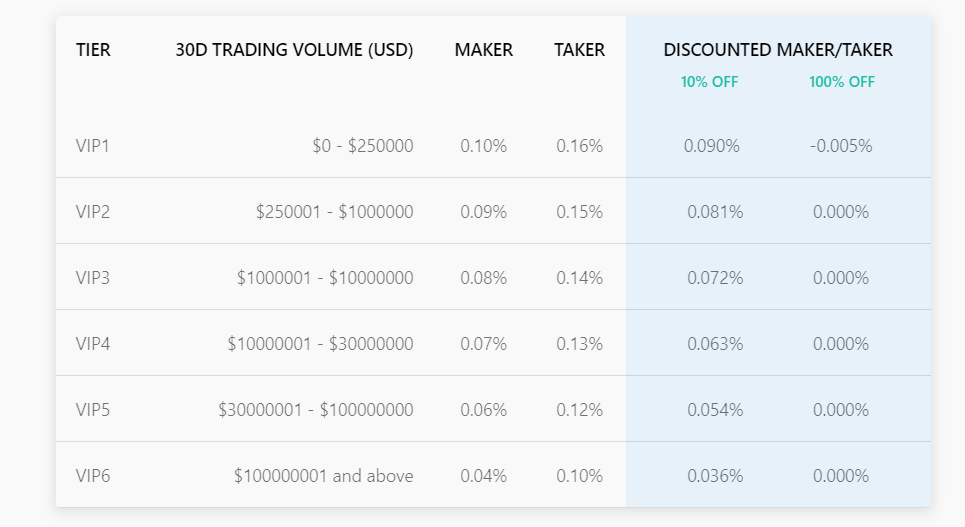

In terms of costs, crypto.com exchange is one of those digital asset trading platforms that offer competitive fees. It applies the fee structure based on trading volume-related tiers and offers additional discounts for paying in CRO or staking CRO.

For all the users that make trades in smaller amounts, the platform applies charges from 0.10% to 0.16%. The fees come even lower according to the higher trading amounts.

Staking

Crypto.com allows staking, the most trendy word in the Decentralized Finance (DeFi) industry in 2020. The process refers to actively participating in transaction validations on Proof of Stake (PoS) protocol when the transaction blocks are confirmed and validators get their rewards.

In other words, staking is lending. The users agree to lock coins in their crypto.com digital wallet. The platform then borrows these funds and later returns them with the interest, which comes as a reward for lending.

Crypto.com allows CRO staking with a 20% yearly return. Moreover, it supports the so-called soft staking, when coin holders earn interest without locking up their digital assets for a specific period of time. However, the users that agree to lock up their funds on crypto.com exchange additionally get up to 100% discount on trading fees.

DeFi Swap

In addition to staking, crypto.com recently joined the Decentralized Finance (DeFi) craze and launched a new service called DeFi Swap. The decentralized protocol is a fork of decentralized exchanges Uniswap.

The new option allows DeFi users to exchange (swap) their tokens between various DeFi liquidity pools. Furthermore, they do get rewards for the staking app’s native CRO tokens. The higher staking amounts bring higher yields and do increase after each year of staking. Meanwhile, the smallest possible staking amount is 1000 CRO.

At the time of publishing, crypto.com users can swap between any of the tokens listed below. As it is known, more token options will be added in the future. For now, the crypto.com app supports swaps on eight tokens:

- (Wrapped) Ether (WETH)

- Tether (USDT)

- USD Coin (USDC)

- Dai (DAI)

- Chainlink (LINK)

- Compound (COMP)

- Crypto.com Coin (CRO)

- Yearn Finance (YFI)

Crypto.com wallet review

Another service we would like to mention in this crypto.com review is a non-custodial cryptocurrency wallet, launched in May 2020. The wallet is integrated into the crypto.com app and is the place where users may store their digital assets as well as deposit and withdraw them through the blockchain.

The non-custodial wallet means that its users own and have full control of the private keys, that are encrypted on customers’ devices, protected by a passcode, biometrics, and 2 Factor authenticator (2FA).

The main features of the crypto.com wallet include the ability to deposit and withdraw both fiat and digital currencies, tracking balances in real-time, buying and selling dozens of digital assets. The wallet users may also follow their transaction history and all the data on crypto.com rewards and cashback.

DeFi wallet

Another feature that needs mentioning in this crypto.com review is the app’s native DeFi Wallet. Launched a little bit earlier than the new DeFi Swap service, the non-custodial app allows sending crypto at the preferred conformation speed and network fee.

Furthermore, the new wallet enables app users to store their own private keys and access an open-marketplace based on the CRO tokens. This means that users will be able to manage their digital currencies and also to import their existing wallet into the DeFi Wallet.

MCO Visa card

One of the most stand out crypto.com features is its debit card. Called the MCO Visa card, it allows crypto.com users to spend their digital currencies at over 40 million places anywhere in the world, where Visa cards are accepted.

The MCO Visa card is directly connected to the crypto.com user wallet, thus anytime the user makes payment or an ATM withdrawal with it, the card instantly converts the charged amount into cryptocurrency. Likewise, every time the user sells his digital assets, the fiat equivalent drops to his MCO Visa card.

There are five MCO Visa card tiers that provide different benefits accordingly. The lowest tier offers the free card and 1% CRO reward on all card spending. The upper levels require holding CRO tokens in the crypto.com wallet for at least six months. Meanwhile, the benefits are also higher.

The range MCO Visa card privileges include:

- Up to 8% cashback in CRO tokens

- Free Spotify, Netflix, Amazon Prime subscription.

- Bonus interests

- Free access to airport lounges

- No-fee ATM withdrawals

- Other benefits and discounts.

Despite the variety of tiers, all MCO Visa cardholders do get the general benefits, that include zero monthly fees, the cashback, the ability to spend crypto globally, free issuance, delivery and free ATM withdrawals allowed up to the certain tier limit.

At the time of publishing, MCO Visa cards are available in the United States, Singapore and 31 European countries, including 27 European Union member countries. The company claims to add more markets in the near future.

Pros & Cons: verdict on crypto.com – ★★★★☆

The crypto industry is maturing, but it is still young. Plenty of new shiny projects emerge every day, some of them being not what they seem. This is why it is important to have a broader view on the projects you are investing in.

Crypto.com payment and financial service platform gives ambiguous feelings. It is one of the most comprehensive cryptocurrency platforms. It offers a variety of connected cryptocurrency services and the range is still growing. It provides Visa cards to make real-time crypto payments available across the planet. It even offers cashback and allows earning high staking rewards.

But it still has the trail of controversies, following the reputation of crypto.com founder and CEO. And reputation is a fundamental factor in terms of trust. We do respect the platform’s efforts to ensure investors’ financial security. But we also keep in mind that crypto.com is an unregulated entity, which means risk cannot be completely eliminated.

To sum up our crypto.com review, there are more pros than cons in terms of the platform. And while the latter are more fundamental ones, our verdict is “love it, but not head over heels”. Keep the part of your digital funds elsewhere as well.