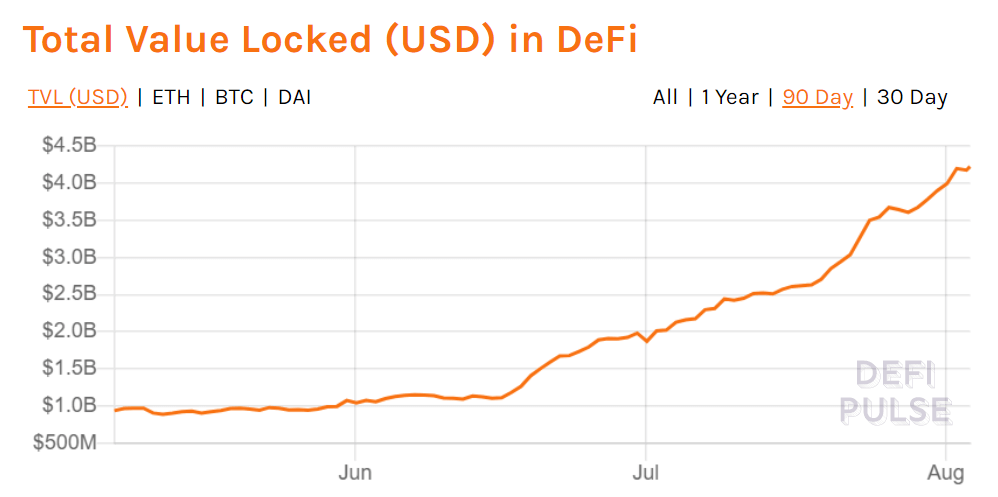

The booming decentralized finance industry (DeFi) increased threefold since the first days of summer and doesn’t seem to slow down.

The decentralized finance sector continues to prove the saying that the 2020s will be the golden year of DeFi. The industry that became a phenomenon a few months ago due to its massive growth, hit the milestone mark of $4 billion on the first day of August.

As shown in the statistics of crypto data aggregator DeFiPulse, the total value locked in various decentralized finance projects is $4.24 billion at the time of publishing.

The whole DeFi industry increased nearly 6.4 times since the mid-March market crash when its total value locked declined twice to $560 million. The sector however witnessed rapid and steady growth since then as it doubled its total value up to $1 billion in nearly two months. Moreover, the industry has run rampant since then hitting another billion marks almost every month.

The blockchain-based decentralized finance, which in general is the alternative to the traditional financial system and services, refers to various kinds of smart contracts, protocols, and decentralized applications (dApps). The industry became highly valued and trendy during the last few years .

Lending protocols take the lion’s share

The major part of the volume comes from the currently booming lending sector, as well as from derivatives and Decentralized exchanges (DEXes). According to DeFiPulse, MakerDAO is the indisputable leader with a solid volume worth of $1.30 billion.

The lending platform is the first-ever DeFi protocol that hit the $1 billion mark just a week ago. With a remarkable amount of capital locked in its blockchain protocol, Maker is the dominant DeFi protocol with over 30% market share at the time of publishing.

Sponsored

Competing lending protocols Compound and Aave are the following DeFi market leaders with the $776 million and $529 million capital locked in the projects respectively.

Decentralized lending is currently the darling of the DeFi sector. The process, which is a total hype at the moment, enables digital asset holders to borrow funds from each other and earn additional digital assets on that. The processes accelerated even further after one of the leading lending protocols Compound issued its COMP governance token in mid-Junr that soon became the largest DeFi token by market capitalization and contributed a lot to the growth of the entire sector as well.

The massive growth in the DeFi sector raised concerns though that the sector is at the risk of becoming a bubble. However, despite the suspicions, the sector is still worth 1.5% of the entire cryptocurrency market.

As DailyCoin reported a week ago, despite the intensive growth of up to $4.24 billion the DeFi still takes a small part in the cryptocurrency market that is worth $340.7 billion at the time of publishing.