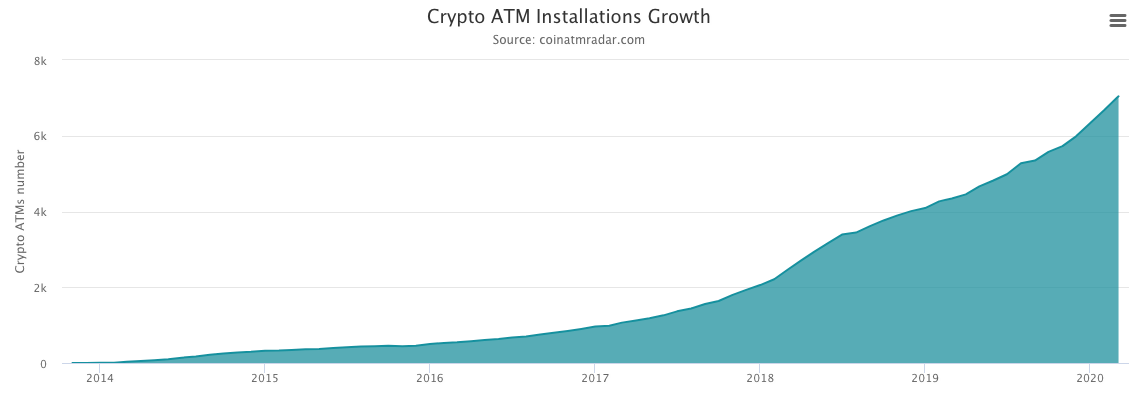

With virtual currencies becoming more and more of daily use, users are turning their attention to convenient ways to cash out their bitcoins. The number of crypto ATMs has increased impressively during the last few years and even months.

The total number of cryptocurrency ATMs installed around the globe has currently reached 7 041, according to the statistics of Coinatmradar, the global crypto ATM monitor website. The number marks a rise of around 50% during the year, compared with the 4 345 ATM installations last March.

The virtual currency ATMs installations crossed over 700 even during 2020. This means, over 350 cryptocurrency ATMs being placed within each month. To be even more precise, the world gets around 11,8 of crypto ATMs every single day.

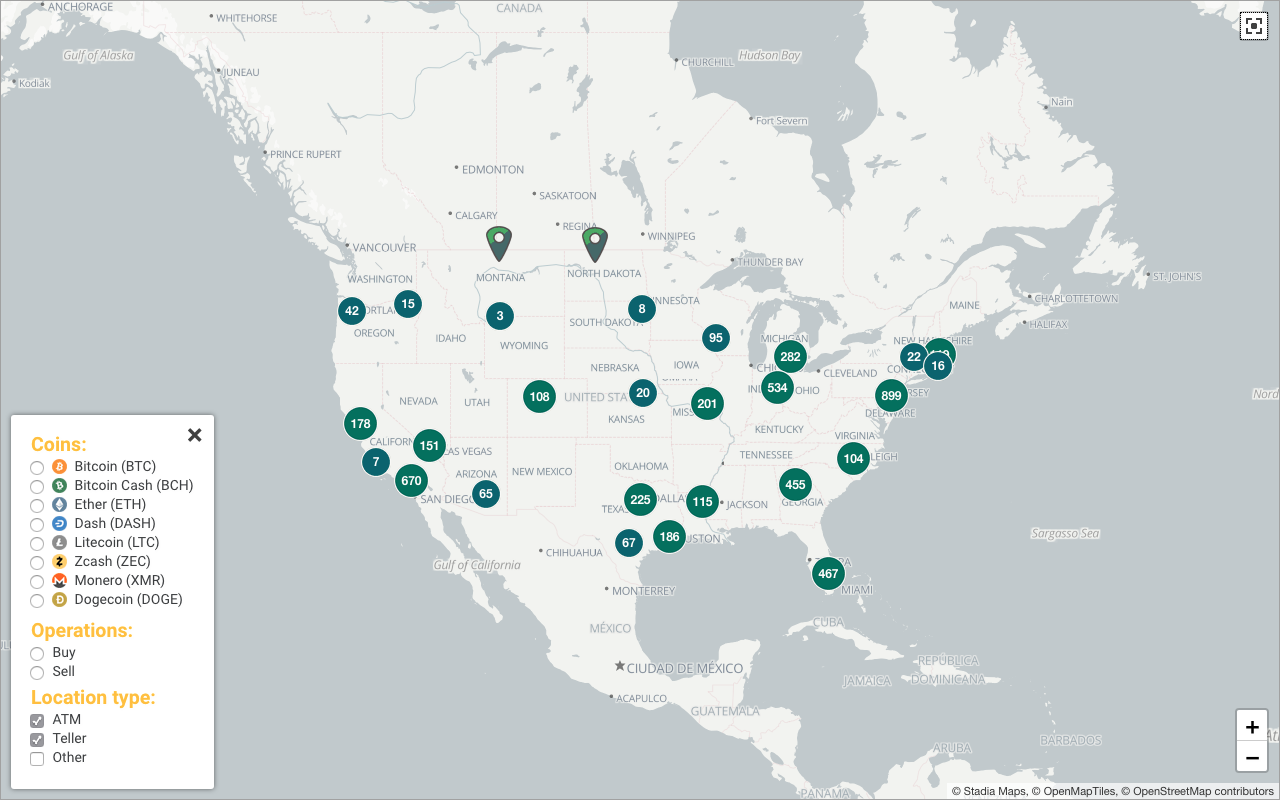

The numbers include ATMs and tellers, hosting digital currencies such as Bitcoin (BTC), Bitcoin Cash (BCH), Ether (ETH), Dash (DASH), Litecoin (LTC), Monero (XMR), Zcash (ZEC) and Dogecoin (DOGE).

The US dominates crypto ATMs market

Although the world’s first Bitcoin ATM was launched in 2013 in Vancouver, today’s absolute leader of cryptocurrency cash machines is the United States with its 68,9% market share. Converted to the numbers, this would cover 5063 crypto ATMs on the US soil.

With crypto ATMs currently operating in the 75 countries around the world, Canada is the next giant market showing the growing demand for crypto ATMs, already operating 755 crypto-cash machines (10% market share).

The following top countries with crypto ATMs are United Kingdom (303 locations), Austria (146) and Spain (82). In terms of non-European countries, statistics depict Colombia with 58 crypto ATM locations, Hong Kong (54) and Australia (19).

How do they work

A crypto ATM is much like the traditional ATM that issues cash when debit cards are used for withdrawals. Nevertheless crypto ATMs can help to convert some digital assets into fiat currencies, they do also have some key differences. The machines connect users with the cryptocurrency exchanges and allow them to buy and sell bitcoins or other cryptocurrencies by transferring funds to and from a crypto address, which can now be replaced by the usernames.

There are several types of cryptocurrency ATMs. The most common ones are those that only have the buy function, while some allow to both sell and buy BTC.

Crypto ATMs may support KYC (Know Your Customer) requirements, which vary dependant on the ATM provider and location country. Some machines allow transferring coins anonymously, while others will require ID or even fingerprint scanning.

A common transaction fee at cryptocurrency ATMs mainly varies with 7-15%. The limits of withdraws or deposits usually are between $1 000-$10 000.