Since coronavirus pandemic spread over all kinds of markets last week and Bitcoin witnessed a sudden free-fall, volatility was the real headache for cryptocurrency traders.

But with the digital asset prices and volumes spiking again, the new opportunity to capture a profit emerges for arbitrage traders.

Arbitrage is a form of trading, that profits by exploiting the price difference of identical or similar financial instruments on different markets. When assets are differently priced by multiple institutions, such as cryptocurrency exchanges, traders can seek profit from buying and selling simultaneously on different platforms.

Last Thursday Bitcoin (BTC) declined by 40% within hours with the lowest point of $3 800 being recorded on some virtual currency exchanges.

However, major cryptocurrency exchanges also registered a significant rise in volumes the same day, when daily volumes reached an all-time high, recording $47 billion worth of contracts traded in a day.

It seems that “buy the dip” trader’s motto became very accurate in term of past week, as the cryptocurrency markets already show the signs of recovery and go green after the massive last Thursday’s sell-offs.

Since Monday, Bitcoin’s price is showing a constant upward direction. The worl’d leading crypto asset is seeing an increase of nearly 20% within the last 24 hours, hitting $6 600 at the time of the press, according to the Coinmarketcap.

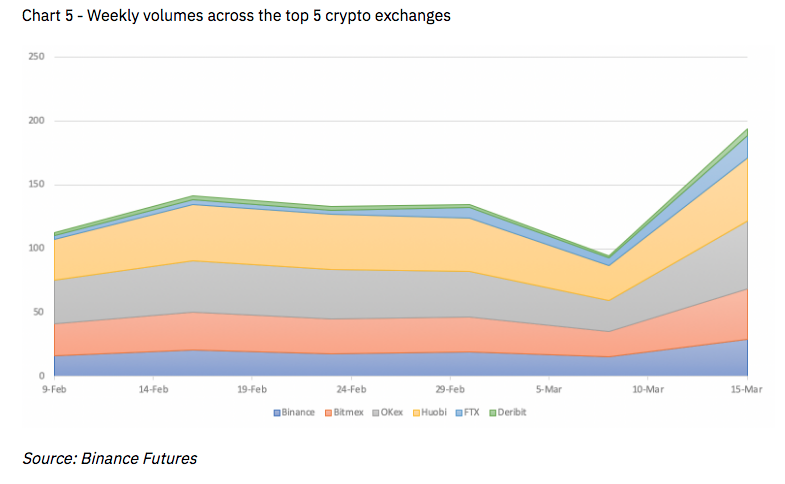

Yesterday was a green day for traditional top market indexes as well. While the unprecedented correlation of digital asset markets and traditional indexes is still a puzzle for the experts, the trading volumes at cryptocurrency exchanges have risen. The major virtual asset exchanges also witnessed nearly 20% growth in the last 24 hours.

The increasing volumes indicate traders are back on track to make money. While the price volatility is high, there are opportunities to take profit from trading across different platforms.

Trading at Binance cryptocurrency exchange began with a price spurt at 03:00 UTC yesterday, when the Bitcoin (BTC) price was $5267, nearly 20 USD lower than on the other digital asset exchanges, such as Bitfinex, Coinbase or Bitstamp.

With Bitfinex selling Bitcoin at around $5290, the price difference opened the possibility to arbitrage traders, as they could buy bitcoins cheaper on Binance and simultaneously sell on other exchange for the better price.

The tendency continued as traders could play on $10 price differences within Bitfinex, which was trading Bitcoin for $6113 and Bitstamp, that traded for $6123 on 01:40 UTC tonight.