- Crypto derivatives dwarf spot volumes.

- Coinbase seeks to expand its derivatives presence in the EU.

- An acquisition deal for a MiFID–licensed entity will open up the EU market.

The crypto derivatives market accounts for 75% of the total cryptocurrency trading volume. In a bid to expand its presence in this lucrative sector, Coinbase is in the process of acquiring an unnamed Cyprus-based company that holds a European Union (EU) Markets in Financial Instruments Directive (MiFID) license to grow its derivatives business in the region.

Coinbase Eyes EU Expansion

Coinbase recently revealed that it is in the process of acquiring a MiFID-licensed entity based in Cyprus. The entity acquisition intends to unlock access to Coinbase derivatives products for certified customers within the EU market.

“The EU’s MiFID is one of the world’s most highly regarded licensing regimes governing investment services and activities,” commented Coinbase.

The company stated that its “Five Point Global Compliance Standard” already makes it a good fit for operationalizing the MiFID license and serving EU customers. The standard focuses on vetting staff, adhering to AML and KYC standards, sanctioning compliance, following governance best practices, and meeting monitoring and reporting requirements.

Sponsored

The acquisition deal is subject to regulatory approval, with completion expected sometime this year. It forms part of Coinbase’s “Go Broad, Go Deep” global expansion plan, which aims to increase Coinbase’s presence in major financial hubs that have made strides toward regulatory clarity for crypto. The immediate priority markets include the EU, the UK, Canada, Brazil, Singapore, and Australia.

Despite these ambitious plans, Coinbase has a long way to go in capturing derivatives market share from Binance.

Increasing Derivatives Market Share

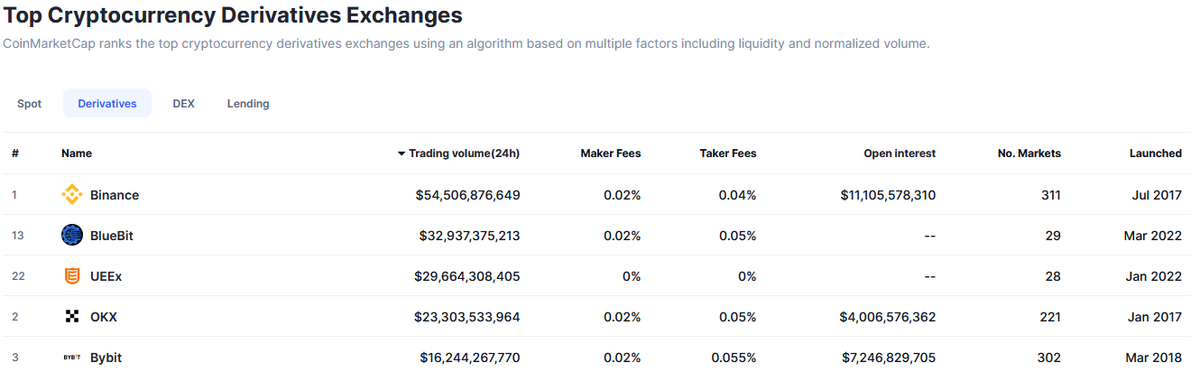

Binance is by far the biggest player in the crypto derivatives market, turning over $54.5 billion in volume over the last 24 hours, according to CoinMarketCap data. This is followed by BlueBit, UEEx, OKX, and Bybit at $32.9 billion, $29.7 billion, $23.3 billion, and $16.2 billion, respectively.

Sponsored

During the same period, Coinbase’s derivatives volume amounted to $166.6 million, ranking it the 52nd biggest exchange by derivatives trading volume. The significant difference from the leading derivatives exchanges indicates that Coinbase has a mountain to climb to match the market leaders.

On the Flipside

- Derivatives allow for more sophisticated trading strategies, including shorting and hedging, which appeal to professional investors and institutions.

- Coinbase’s “Go Broad, Go Deep” plan to expand in crypto-friendly jurisdictions appears to be driven by perceived regulatory hostility in its domestic US market.

Why This Matters

The acquisition deal shows Coinbase’s willingness to achieve compliant growth in the face of regulatory complexity. If executed properly, it provides a pathway for the company to access the billions in revenue the EU crypto derivatives market presents.

Read about Coinbase’s stance on the FCA’s financial promotion rules here:

Coinbase UK Shows Full Cooperation to FCA’s Stringent Rules

Find out more on Bitcoin extending its dominance over altcoins here:

Altcoins Tumble as Bitcoin Holds Steady on ETF Hope