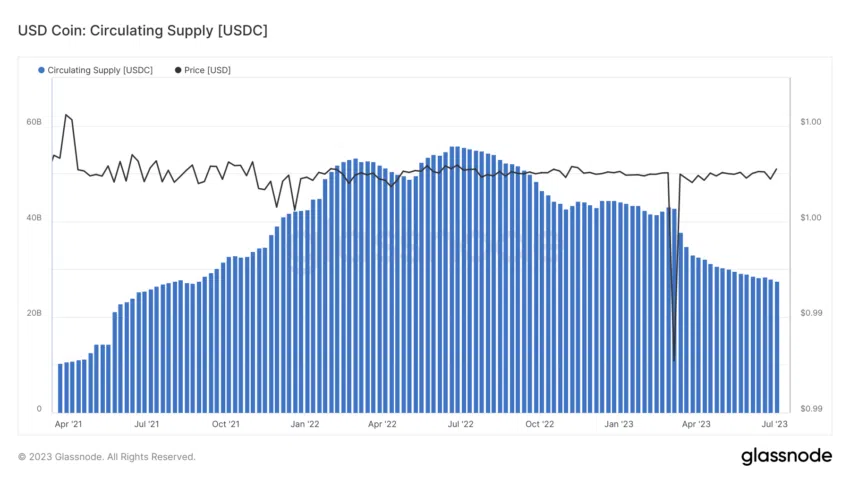

- USDC has faced challenging times as its circulating supply has taken a significant hit.

- A downward trend in USDC’s circulation has resulted in a substantial reduction in market capitalization.

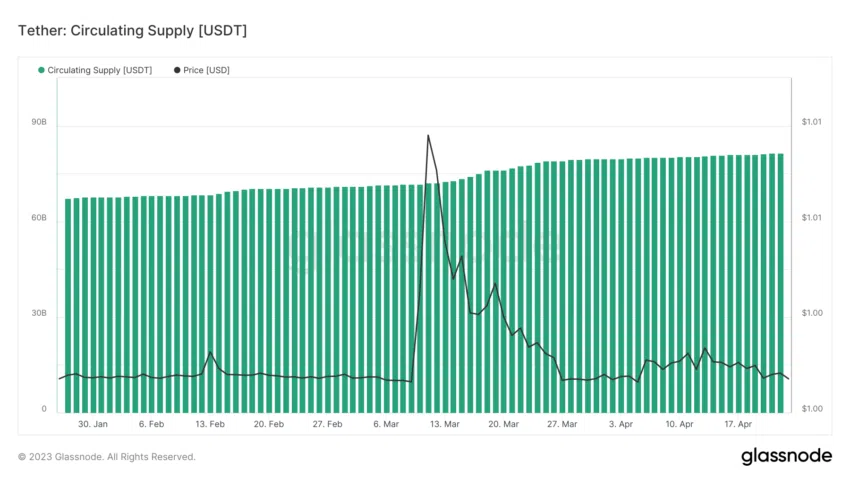

- Tether’s dominance has strengthened with a remarkable increase in circulation.

As the world’s second-largest stablecoin faces a series of declines, concerns emerge regarding its ability to maintain its position as a recent development of Circle’s USDC stablecoin has brought light to a notable decrease of approximately $100 million in its circulating supply over the past week.

USDC Struggles as Redemptions Soar to $1.4 Billion in a Week

Surpassing the issuance of new coins, USDC redemptions reached a substantial $1.4 billion within a seven-day period, as reported by Circle. These developments prompt questions about the stablecoin’s resilience and raise doubts about its future standing.

Sponsored

While the reduction in USDC circulation during the previous week is striking, it is not an isolated event. Over the past month, a significant $4.6 billion has been redeemed, while a comparatively lower $3.6 billion in new stablecoins has been issued.

This downward trajectory has persisted for a year and has resulted in a substantial reduction of approximately $28 billion in USDC’s market capitalization.

The supply of USDC experienced a contraction of $10 billion in March alone. During that time, investor concerns regarding Circle’s exposure to a Silicon Valley bank triggered a temporary disruption in the stablecoin’s peg to the US dollar. Although the disruption was short-lived and USDC’s value temporarily dropped to $0.97, the subsequent loss in market share has endured.

Tether Gains Momentum as USDC Supply Dips

While the supply of USDC has been diminishing, Tether, Circle’s primary competitor, has made significant strides over the past year, consolidating its leading position. On-chain data indicates an impressive surge of approximately $17.8 billion in USDT circulation throughout the past year, with the majority of this growth occurring in 2023.

Sponsored

Moreover, in the same week that USDC’s supply decreased by $100 million, the total amount of USDT in circulation expanded by $22 million.

USDT’s dominance has witnessed substantial growth in recent months, currently standing at over 7%. Over the course of the past year, Tether’s supply as a percentage of the total market capitalization has consistently surpassed 8%.

In contrast, USDC’s market dominance dipped below 5% in January and has not recovered since, presently hovering around 2.3%.

On the Flipside

- Despite the decline in USDC circulating supply, stablecoin redemptions are a common occurrence in the market, and it doesn’t necessarily indicate a long-term trend.

- Circle’s USDC has maintained its peg to the US dollar, and while there was a temporary disruption in March, it quickly regained its value.

- Tether’s growth in circulation doesn’t necessarily mean it has outperformed USDC in terms of stability or trustworthiness. Market dominance is just one metric to consider.

Why This Matters

This development underscores Tether’s dominance and raises questions about USDC’s ability to maintain its position. These dynamics can potentially impact market dynamics and investor sentiment, making it crucial for the crypto community to monitor the evolving stablecoin landscape closely.

To learn more about Circle’s workforce reduction and its global aspirations, read here:

Stablecoin Giant Circle Shrinks Workforce but Eyes Global Prospects

To stay updated on the recent breakthroughs in the Bitcoin market, amidst the frenzy and introduction of weekly options, read here:

DailyCoin Bitcoin Regular: Resistance Breakthrough? Market Frenzy and Weekly Options