China is in the global center of attention again. Despite the pandemic, the current floods devastating the country are said to be the biggest within decades.

The heavy rainfall caused the floods in the central regions of China, alongside the country’s longest Yangtze River. With floods becoming more and more severe, hundreds of people are reported dead or missing. The local government applied extreme measures and blasted damp last Sunday to reduce flood water pressure and save living areas from greater damage.

In the meantime, the vast majority of cryptocurrency mining farms, located in the southwestern Sichuan province, haven’t reported any losses. The water-rich Sichuan province is a popular place among cryptocurrency miners, that allows using the hydro-power among the rain seasons to reduce electricity costs.

The vast majority of China’s cryptocurrency mining plants are based in Sichuan, which alone accumulates over 50% of the network’s total power, while the whole country itself is said to generate over 65%.

Sponsored

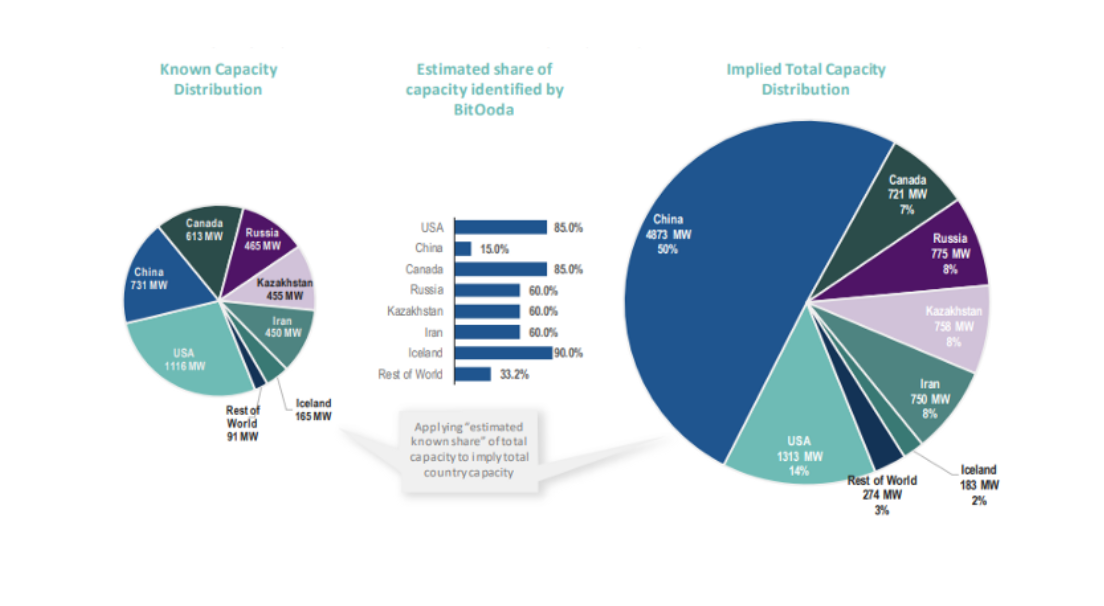

However, the latest data from the crypto research company BitOoda reveals that China has less Bitcoin mining power than expected. According to the survey, China accounts for only 50% of global Bitcoin mining capacity, while the United States increased it up to 14%.

Bitcoin mining statistics

Since Bitcoin mining is a secretive industry, with very little publicly available information, BitOoda included confidential interviews with industry insiders (miners, rig manufacturers and resellers) to provide a full picture of how much Bitcoin mining capacity there is and where it is located.

Reportedly, there is about 9.6 GW of available power capacity for Bitcoin mining with a current total utilization ranging around 67% and increasing around 10% every year.

China alone controls roughly around 50% of this total computing power. According to the report, “a significant portion of Chinese capacity migrates to take advantage of lower power prices during the flood season”. The document added that to this level of capacity, the median cost to mine 1 Bitcoin is around $5000.

Respectively, the second biggest Bitcoin miner – the United States – increased control of up to 14% of total mining power capacity. Meanwhile, Russia, Kazakhstan, and Iran accumulate 8% each, Canada 7%, Iceland 2%, and the rest of the world control 3% in total.

Effect of rain season

The survey further reveals the “surprising conclusions on the relationship between hash rate growth and China’s flood season”.

As already stated, China’s southwest region, rich in cryptocurrency mining plants, is witnessing the rainy season from May till October. This leads to high levels of water in local dams and pressure to hydropower plants to produce energy, which comes in cheaper prices. Respectively, lower electricity prices attract more cryptocurrency miners.

Logically the growing number of miners should indicate the growth of the hash rate during the flood season. However, the BitOoda argues the fact and claims lower electricity prices on the contrary lead to a decrease in Bitcoin sales:

The flood or hydro season shifts the cost curve down for 6 months of the year, leading to lower sales of Bitcoin to fund operating expenses as miners accumulate capital to fund capacity growth.

The survey further reveals the average price gains differ significantly within the rainy and dry seasons, while the Bitcoin network hash rate keeps steadily growing. According to the researchers, the capital accumulation, caused by rain season and lower prices, may contribute to the significant hash rate growth in the future.