- CFTC’s chief accused Binance of knowingly breaking US laws.

- The agency charged Binance with violations of derivatives laws.

- Binance’s business in the US is under pressure amid legal troubles.

A major US regulatory agency is unrelenting over its accusations against Binance after targeting the exchange in a lawsuit.

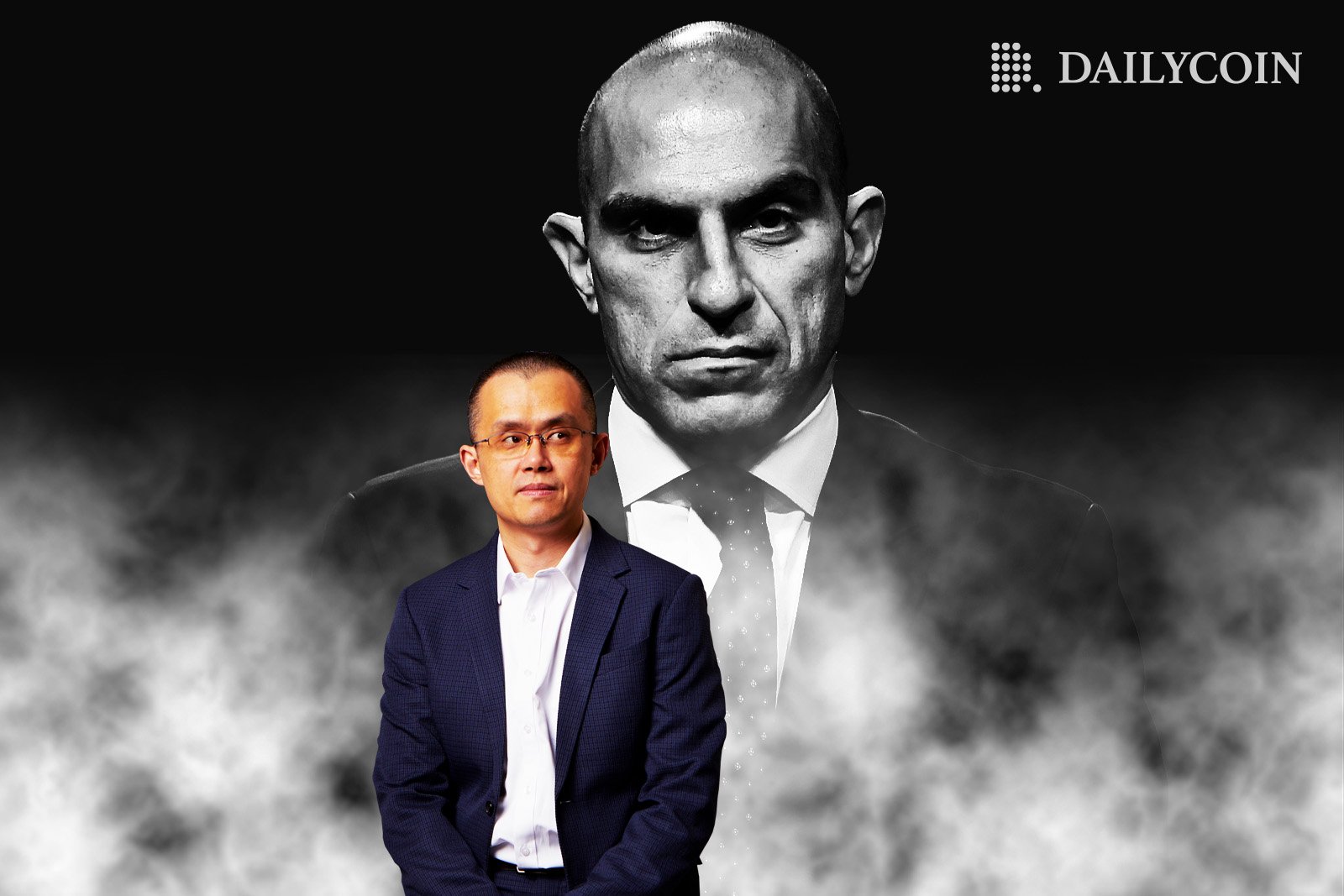

The head of the US Commodity Futures Trading Commission (CFTC), Rostin Behnam, launched another scathing attack on Binance. The largest crypto exchange in the world knowingly broke US derivatives laws, he said.

CFTC Chief: Binance Knowingly Broke Rules

Behnam accused Binance of not keeping Americans off the exchange and failing to register with the agency at a conference held by Princeton University on Thursday.

Sponsored

“These are not unsophisticated individuals,” Behnam said. “They are starting large companies and offering futures contracts and derivatives to US customers.”

The CFTC sued Binance and its CEO in March for multiple violations, including failing to comply with US derivatives regulations.

The agency’s suit alleged that Binance allowed Americans to trade on its global exchange without registering with the CFTC. According to the lawsuit, Binance did so to avoid scrutiny by US regulators.

“If you are going to offer futures contracts in the US, there is a clear understanding that you are registered with the CFTC and comply by the law,” Behnam added.

Sponsored

Since the lawsuit, Binance’s business in the US has been suffering. The exchange struggles to find banking partners after its earlier partners, Silvergate and Signature, went bankrupt. Since then, several banks reportedly turned down Binance due to regulatory risk. As a result, US customers reported issues with withdrawals.

On the Flipside

- CFTC lawsuit against Binance reveals questions of jurisdiction. The CFTC claims that BTC, ETH, and USDT are commodities. At the same time, its chief says that all cryptos except Bitcoin are securities.

- Crypto companies have increased lobbying efforts to receive more favorable treatment for crypto assets from lawmakers. Binance spent just under $1 million on Washington lobbyists in 2022.

Why You Should Care

The CFTC’s lawsuit against Binance will set a precedent for how crypto exchanges deal with US-based traders. Due to the size of the US market, traders worldwide will feel the impact of the lawsuit.

Read more about why the CFTC lawsuit is a big deal:

Binance Lawsuit Explained: Why CFTC Involvement Is a Big Deal

Read about the latest plans to restart the bankrupt exchange FTX: