- Circle’s CEO has revealed the impending integration of USDC into the Base Network platform.

- Bridged USDbC liquidity has been making way for native USDC.

- New dApp opportunities have emerged on the horizon.

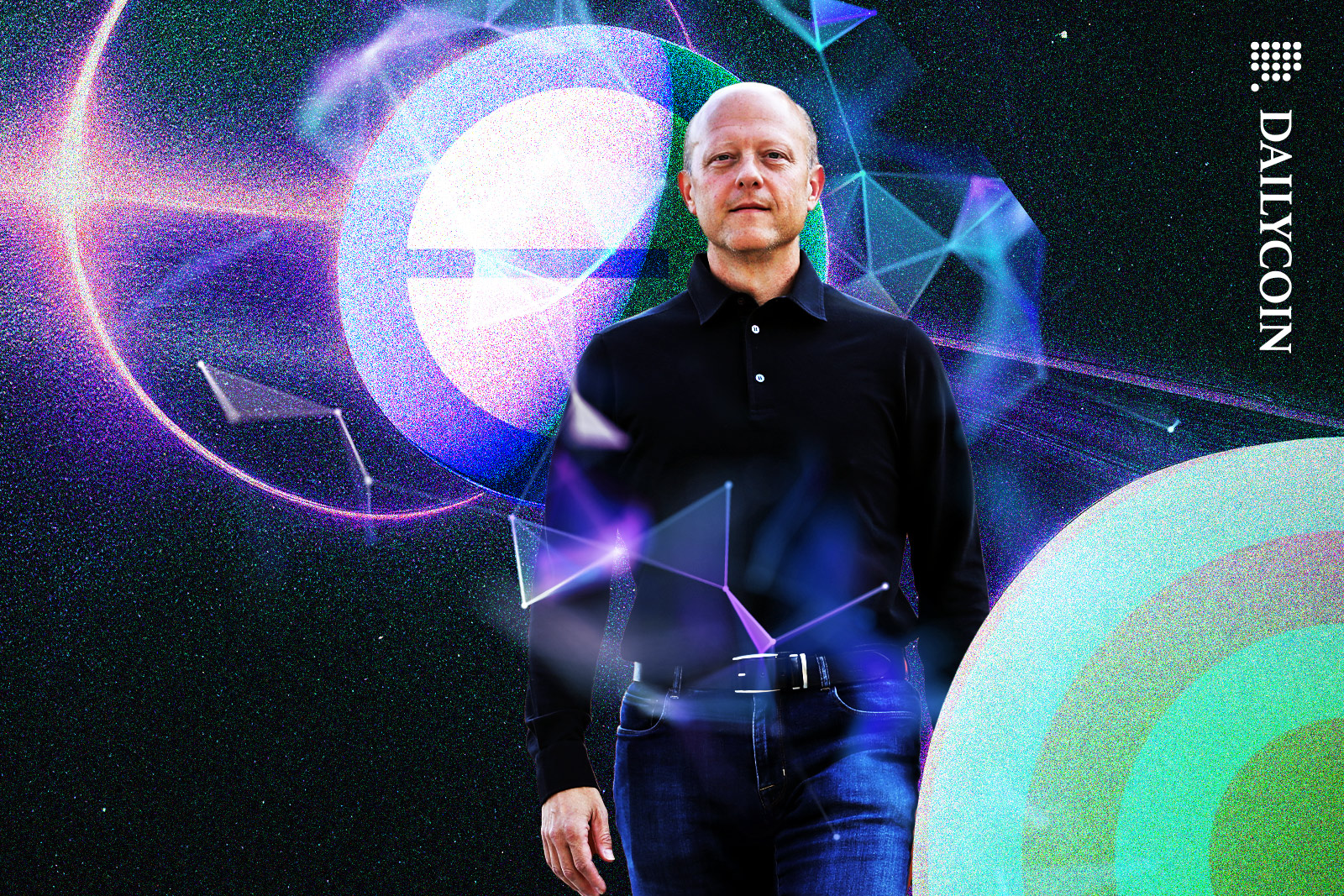

Circle’s CEO, Jeremy Allaire, recently revealed that the native incorporation of USDC into the Base Network platform is set to roll out in the upcoming week. Sharing this news on Twitter, Allaire emphasized the significance and ramifications of this integration.

Base Network and Circle Partner for Exciting USDC Integration

Circle also asserted that the official manifestation of USDC within the Base Network ecosystem will be the variant issued by their establishment. It is worth noting that this integration will eventually lead to the gradual replacement of the presently circulating bridged USDbC (USD Coin on Ethereum) liquidity, which originates from the Ethereum network.

The convergence of native USDC with the Base Network benefits both end-users and developers. Among the many advantages, a prominent highlight is the expansion of liquidity as native USDC becomes progressively entrenched in the ecosystem.

Sponsored

The fundamental objective of the Base Network is to cultivate an autonomous ecosystem where transactions and value transfers are innately conducted within the network itself. Integrating native USDC augments efficiency, security, and scalability by diminishing the reliance on external bridges.

The transition from bridged USDbC to native USDC will be orchestrated by the Base Network in cooperation with ecosystem applications, ensuring an uninterrupted transfer of liquidity.

Coinbase’s Base Platform Boosts Appeal with USDC Inclusion

In addition to its anticipated fortification of the network’s financial framework, the inclusion of native USDC seeks to furnish developers with fresh prospects to harness the capabilities of stablecoins within their decentralized applications (dApps).

Sponsored

This incorporation also holds the potential to simplify the amalgamation of fiat currency and cryptocurrency for institutional investors, further diversifying the appeal and practicality of Coinbase’s Base platform.

Importantly, the integration of native USDC will not immediately impact Base Bridge, which will continue to operate without disruption, guaranteeing uninterrupted functionality for users, as stated in the announcement released on Monday.

On the Flipside

- By reducing reliance on external bridges, the network could become more insular. This could potentially limit exposure to different blockchain ecosystems and hinder cross-network collaboration.

- Dependence on a singular network might create a single point of failure, posing systemic risks in the event of a breach.

- The migration process and adjustments required to accommodate native USDC might strain resources and slow innovation.

Why This Matters

By replacing bridged liquidity and enhancing efficiency, this integration paves the way for a self-sustaining ecosystem where value transfers occur seamlessly. Moreover, it introduces new avenues for developers and institutional investors, cementing the significance of stablecoins in shaping the future of cryptocurrencies.

To learn more about the concerns raised by GOP committee members regarding the Federal Reserve’s stablecoin guidelines, read here:

Fed’s Stablecoin Guidelines Under Fire from GOP Committee Members

To delve into the recent market trend, where the value of stablecoins has reached its lowest point since August 2021, read here: