- Lawsuits and allegations against Alex Mashinsky are piling up.

- The SEC is the latest regulator to file a case against Celsius’ Founder.

- This string of events could hinder Celsius’ recovery plan.

The SEC’s crypto crackdown continues to rage on. After shaking up the industry with its high-profile lawsuits against Binance and Coinbase, the regulator has a new target in its crosshairs: Celsius Founder Alex Mashinsky.

Mashinsky, who previously came at odds with the CFTC and the FTC, now faces a barrage of fresh but similar criminal charges from the more strict SEC. With the regulatory spotlight on Celsius, will the bankrupt crypto-lending platform be able to make its creditors whole again?

Celsius Lawsuits Pile Up

On Thursday, July 13, Alex Mashinsky, the founder and former CEO of defunct crypto lender Celsius, was arrested and charged with fraud following lawsuits from major US regulators.

Sponsored

The SEC is the latest plaintiff against Mashinsky, following earlier lawsuits from the FTC and CFTC, both of which reportedly uncovered multiple violations of US regulations by the former CEO before the collapse of Celsius in 2022.

In its official complaint, the SEC alleged that from 2018 through 2022, Celsius and its founder Mashinsky “raised billions of dollars by orchestrating a scheme to defraud Celsius customers.”

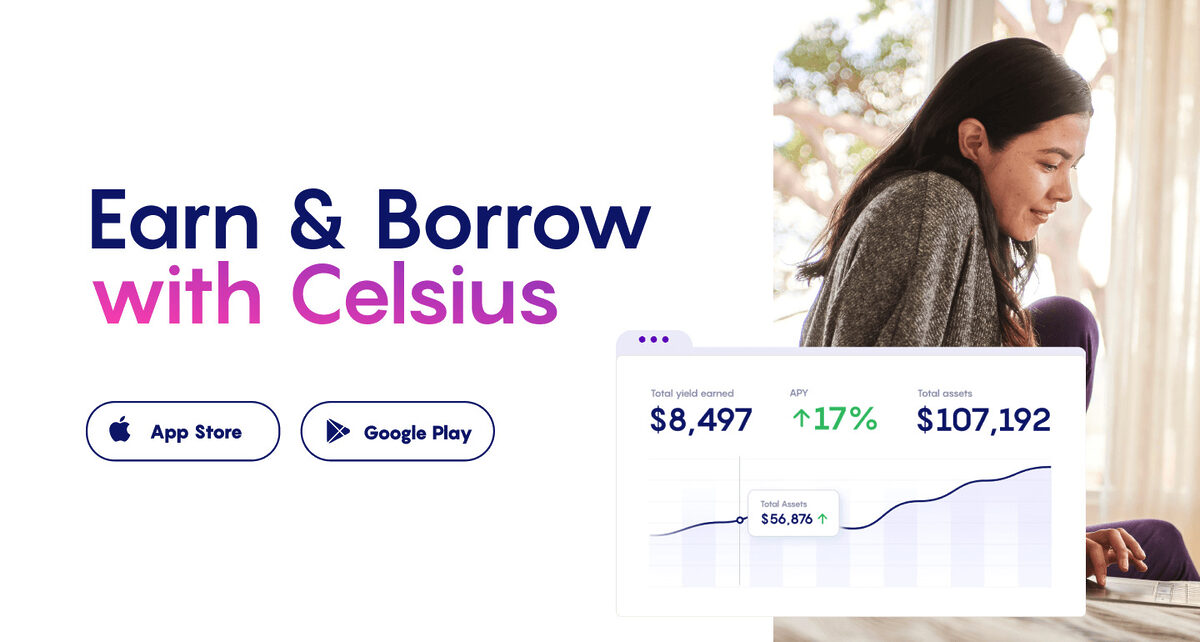

The regulator accused Mashinsky of making fraudulent promises of a safe investment with high returns, up to 17%, through the platform’s “Earn Interest Program.” Additionally, the SEC claimed that Celsius and its executives manipulated the price of the CEL token by issuing misleading statements to entice investors into purchasing the token and participating in the program.

Sponsored

One example cited by the SEC involves Celsius misrepresenting its financial success, falsely claiming to have made $50 million from its initial coin offering (ICO) when it actually fell short of its goal by 40%.

As a result of lawsuits piling up, Mashinsky now faces charges on seven criminal counts, including securities fraud, commodities fraud, and wire fraud. Similarly, Celsius’ former Chief Revenue Officer, Roni Cohen-Pavon, is facing charges on four criminal offenses.

With Mashinsky locked up, the question looms, will Celsius go through with its restructuring plan?

Will Celsius’ Recovery Plan Continue?

As lawsuits and allegations continue to rise against Celsius, the defunct lender worked on a plan to compensate its creditors. Recently, the platform was given the green light to sell or convert some of its crypto holdings starting in July.

However, in a recent filing, the SEC said it “reserves its rights to challenge transactions involving crypto assets. As we obtain additional information, we will consider regulatory implications and raise them with the Court and the Debtors as appropriate.”

Now with the SEC’s case set in stone, the future of Celsius and its Chapter 11 plan remains uncertain in the following weeks. At press time, Celsius didn’t immediately respond to DailyCoin’s request for comment.

Following the founder’s arrest, Celsius’ CEL token rallied by 10%, exchanging hands at $0.17 at press time. Additionally, Its daily trading volume skyrocketed by 142% to $2 million.

On the Flipside

- The New York Attorney General was the first to sue Mashinsky on January 5, alleging that the former CEO misled investors and caused billions of dollars in losses.

- Celsius noted that it has $167 million in cash on hand that it would use to restructure its company.

Why This Matters

Celsius was one of the many high-profile crypto firms that collapsed last year. The company reportedly built its reputation by misleading investors with astronomical gains. However, now with billions of dollars of investor money lost, the regulator’s action could provide some reprieve to its investors.

Follow up on the CFTC’s case against Celsius:

Binance-Investigating CFTC Finds Celsius CEO Mashinsky Guilty

Will Cardano break through $0.3?:

Cardano (ADA) Gears up for $0.3 Resistance Push: Will It Break Through?