- Voting analysis dispels allegations of whales rigging Project Catalyst.

- Examination of whale voting preference showed leanings towards particular types of proposals.

- Some are calling for changes to the voting system.

Project Catalyst is an incubator solution offered by Cardano that aims to provide funding to promising ideas and help transform them into impactful real-world projects. The tenth round of Project Catalyst funding closed last month amid allegations that voting was rigged by ADA whales.

However, an independent analysis of the voting results has since eliminated fears of whales hijacking the funding allocation process, validating the integrity of Cardano’s decentralized voting system.

Cardano Whales Innocent

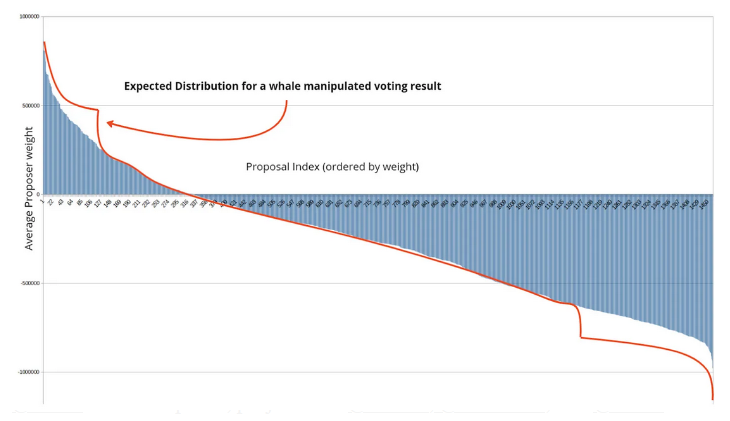

Analysis conducted by risk rating protocol Xerberus cleared up speculation that Cardano whales colluded to manipulate the outcome of the voting. The investigative methodology employed by Xerberus relied on inferring the average vote power per voter. This was used to plot the distribution of the actual voting pattern versus the expected voting pattern.

Sponsored

“If there was a clear-cut manipulation attempt, we would expect to see certain proposals with an unusually high or low average proposer weight,” explained Xerberus.

Xerberus researchers found that the actual voting distribution fell in line with expectations, as denoted by a smooth distribution between the highest and lowest weight, which is “indicative of a random distribution in voting sentiment and weight size.”

Xerberus examined voter preference and discovered that whales tended to favor proposals from established projects, while non-whales generally opted for “fresh teams” with innovative ideas.

According to the researchers, whales’ voting preference toward established teams makes sense as their proven track record would make their proposals more likely to succeed, thereby strengthening the Cardano ecosystem. However, the unfortunate reality of this is an inherent unfairness for up-and-coming projects.

Project Catalysts is Not Perfect

To redress inherent unfairness within the Project Catalysts voting system, Xerberus proposed balancing the wants of whales and non-whales by categorizing proposals by new teams and established teams, and proposals that add to existing infrastructure and those that offer innovation. That way, support can be adjusted depending on market trends, such as backing innovation from new teams during bull markets.

Sponsored

Additionally, Xerberus researchers suggested that a fairer system could be attained by reducing the weight of downvotes to encourage upvoting for promising proposals while lessening the influence of whales.

On the Flipside

- Giving new teams with innovative proposals a leg up is not true democracy.

- Losing proposals may have overlooked the sustained marketing and networking strategies needed to win Project Catalyst funding.

- Crypto governance remains an experimental process that requires fine-tuning.

Why This Matters

It is unlikely that Cardano whales are colluding to manipulate the Project Catalyst voting system. However, underdogs face a distinct disadvantage given that the voting system appears to favor marketing and popularity over merit.

Learn more about the Project Catalyst whale manipulation allegations here:

Cardano’s Catalyst Funding Round Ends With Cheers and Jeers

Discover the community’s reaction to a recent tweet purportedly from Bitcoin’s creator here:

Satoshi Nakamoto Breaks 5-Year Hiatus, But Is It Really Him?