- The Bears are overpowering the Bulls as they look to drive ADA to $0.25.

- Investors now hope for intervention from the Whales, who previously foiled the Bear’s attempts.

- Given current market conditions, things may not be looking good for ADA.

Cardano Bears are in the driver’s seat, trying to drive ADA further into the depths while the Bulls sit in the backseat. Since losing support at $0.30, ADA has tumbled by over 11% and has yet to show strength as it gradually spirals toward the next liquidity zone.

The Bears’ dominance has spread havoc among retail investors looking to exit their positions. As Cardano enthusiasts grapple with mounting apprehensions about their beloved ADA’s trajectory, a pressing question looms: Will the Whales intervene to reverse the tide, or will the Bears continue their drive?

ADA Trader Exodus and Dwindling Volume

After ADA lost the critical $0.30 mark, the Bears have maintained their pressure, with sights firmly set on liquidity under $0.25. Although the Whales thwarted the Bears’ previous attempts by significantly ramping up accumulation to levels last seen in 2022, such an event is unlikely to happen again.

Sponsored

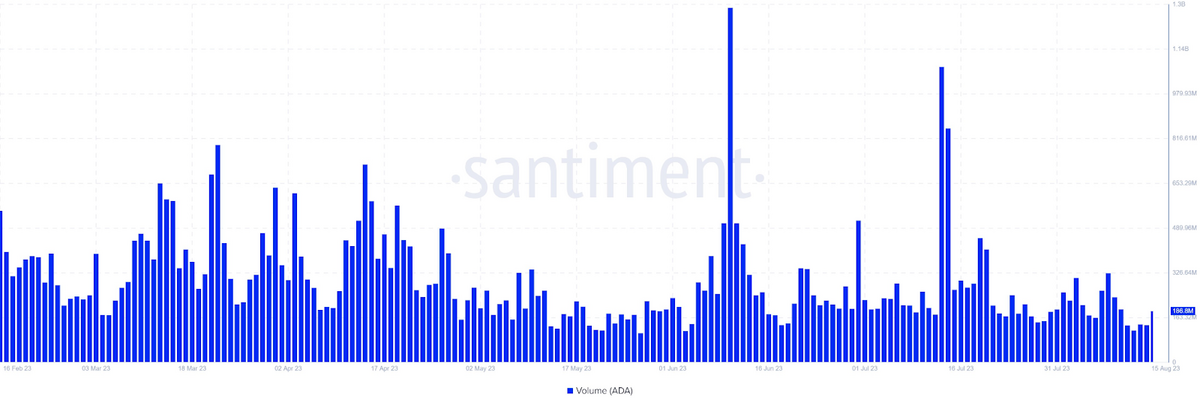

As investors eagerly monitor each candle, Cardano’s daily trading volume has significantly plunged, plummeting from its usual range of $250 million to $100 million, marking a 60% drop. Given the diminishing volume and prevailing bearish sentiment, the Bears could guide ADA toward the $0.25 mark without intervention from the Whales.

The bearish sentiment was evidenced by data from IntotheBlock, which reports that investor sentiment across exchanges and derivatives remained mostly bearish, signaling dwindling demand and bearish pressure.

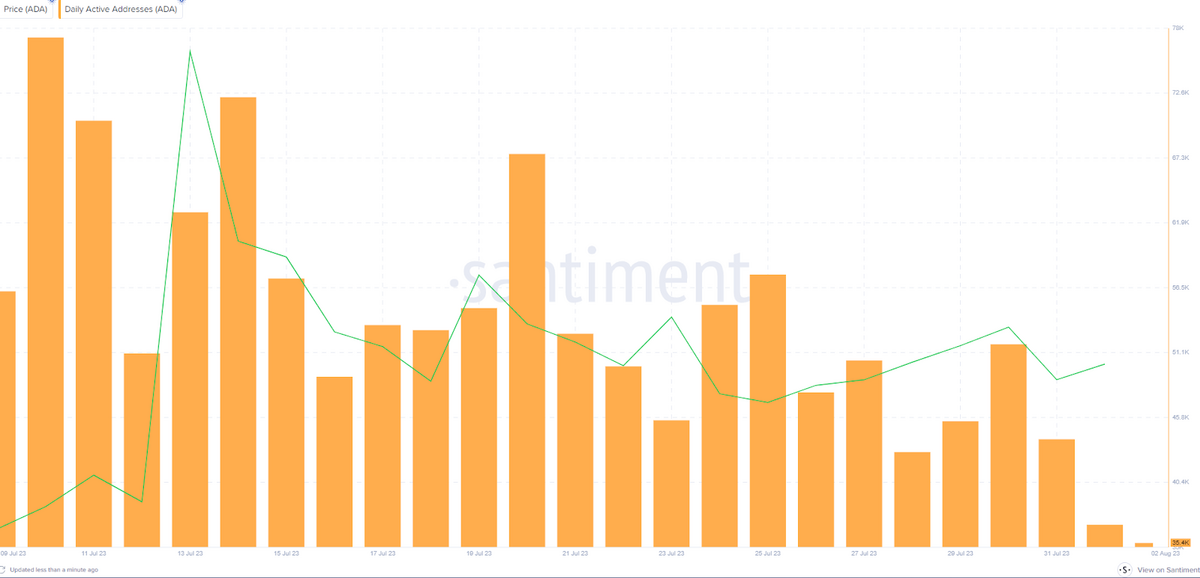

Making matters worse, Cardano’s slow decline also triggered an exodus of retail investors, who lost over $2.5 million in long positions over the past week. Santiment data revealed that since Cardano lost its support, the network experienced a 52% decline in Daily Active Addresses, leaving it with 36,000 active wallets.

Considering the current market landscape, the Bears will remain in control for the rest of the year unless the Bulls stage a comeback. However, it’s worth noting that for the Bulls to regain dominance, they must reclaim the $0.30 level, which stands 6% above current market levels.

Sponsored

ADA exchanged hands at $0.28 at press time with a trading volume of $180 million.

On the Flipside

- Market dynamics can be unpredictable, so it is essential to consider alternative perspectives and opinions when evaluating the potential future performance of Cardano.

- Despite its solid performance in the DeFi sector, ADA has only managed a modest 13% increase this year.

Why This Matters

Dwindling trading volume and price could lead to ADA ranging under $0.3 for the rest of the year, leading to holders growing concerned and potentially exiting out of frustration.

More on Cardano:

Cardano Bulls Botch Support, ADA Drops 11%

More from Charles Hoskinson:

Cardano’s Charles Hoskinson Blasts Ethereum’s Staking Process