Cardano staking gives ADA holders and investors the best of both worlds. Thanks to the network’s novel Proof-of-Stake consensus mechanism, staking ADA benefits both the Cardano blockchain, and the stakers’ portfolio.

However, trying to stake your ADA tokens for the first time leaves a lot of cryptocurrency newcomers scratching their heads. How can I start staking ADA, and what are the risks?

In this guide, we’ll help teach you about Cardano staking and help you stake your ADA tokens safely.

Table of Contents

What Is Cardano Staking?

Cardano is a Proof-of-Stake (PoS) blockchain network. That means that new blocks, or packages of blockchain data, are created and verified by energy-efficient validator nodes instead of intensive mining rigs with Bitcoin (BTC).

Sponsored

Cardano’s Ouroboros protocol randomly selects a node based on how much ADA each validator has committed to the network to choose which validator is responsible for creating the next block.

But why would a validator want to lock up their ADA and commit it to the network?

Why Should You Stake Your ADA?

There are two main benefits to staking your ADA tokens. While one is considered a noble, valiant cause for the good of the Cardano network, the other provides financial rewards for the staker.

Sponsored

Primarily, staking ADA to a validator helps to secure and decentralize the Cardano network. You see, the Cardano blockchain relies on hundreds of decentralized validator nodes worldwide to ensure its industry-leading uptime.

Even if dozens of nodes were to suddenly go offline simultaneously, the network would remain running thanks to the vastness of its validator network. This wide distribution also provides diversity in governance. Stake pool and validator operators from all over the world can vote on governance proposals that shape Cardano’s future.

While this is certainly a noble cause that befits the ethos of cryptocurrency and blockchain technology, there’s no denying that most crypto stakers are more interested in the second staking benefit: Crypto rewards.

As a reward for committing ADA tokens to the network, stakers receive ADA emissions distributed with each new block. This is where crypto’s coveting staking rewards come from, distributing newly emitted cryptocurrency tokens to those who support the network.

What are the Risks?

Cardano fans rejoice! In some cases, validators who misbehave and act against the network’s best interests will have their stake slashed, including any tokens committed by depositors. Cardano’s architecture avoids this problem, meaning there is no risk of losing your stake to slashing penalties.

What’s more, your ADA never leaves your wallet while you’re staking, which gives you an added layer of protection and security.

However, that doesn’t mean that Cardano staking is completely risk-free. You’re still at the mercy of market dynamics and volatile price movements.

The biggest risk with Cardano staking is that your ADA tokens are unavailable while they’re committed in staking pools. If you’re staking through a crypto exchange, this could mean that it might take a long time for your stake to become available. This might be a problem if you’re trying to sell quickly.

You can avoid this delay by staking your ADA directly through a Cardano wallet. While your initial stake will be returned almost immediately, it will take longer for your staking rewards to be delivered to you.

How to Stake Cardano: 2 Methods

Now that we’ve better understood what Cardano staking is and how it works, let’s take a closer look at how to stake our ADA tokens and reap the benefits.

The easiest ways to stake ADA are through a crypto exchange, like Binance or Coinbase, or directly staking ADA using a Web3 wallet.

Stake ADA Through a Cryptocurrency Exchange

This is probably the easiest way for crypto beginners to stake Cardano and begin earning ADA rewards.

Visit Your Chosen Crypto Exchange

The first thing you’ll need to do is head to your preferred crypto exchange platform. Let’s use Binance, the world’s most popular digital currency exchange, in this example.

Before staking, you’ll need to ensure you have some ADA tokens in your account. You can buy them through the exchange or deposit them from another crypto wallet.

Choose a Staking Subscription

After acquiring some ADA tokens, head to your chosen exchange’s crypto-staking platform. In most cases, this will be called the ‘Earn’ section.

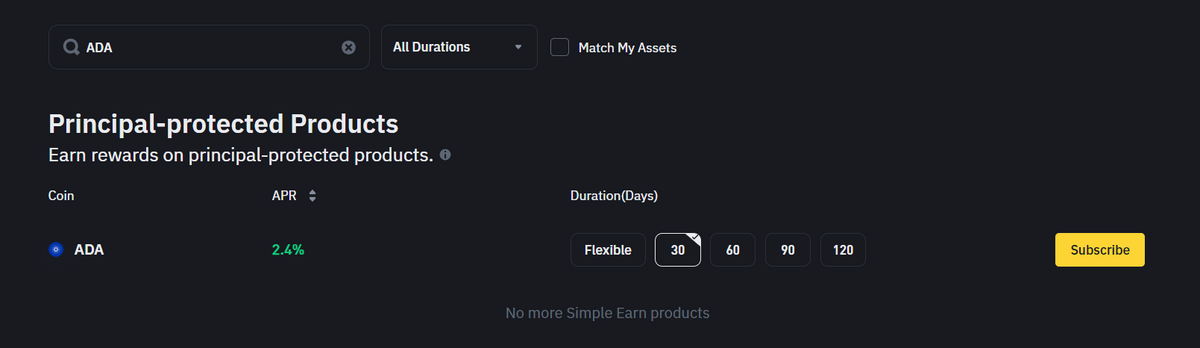

From there, find the list of available staking subscriptions and type ADA into the search bar. Depending on your location, some coins or subscriptions may not be available.

After finding the available options for ADA staking, choose how long you will lock up your digital assets and hit ‘Subscribe.’

Stake ADA Through a Cardano Wallet

If you want greater flexibility over your Cardano staking options, you should consider staking ADA directly through a crypto wallet. It requires a few more steps, but it helps to decentralize the Cardano network further and gives you more control over your tokens.

Withdraw ADA to your Cardano Wallet

After acquiring ADA tokens on a cryptocurrency exchange, withdraw your holdings to a Cardano wallet like Nami, Lace, or Yoroi. Daedalus Wallet is a great option for experienced users, but it requires a bit of technical know-how to use effectively, so let’s stick with the basics for now and use Yoroi.

EMURGO, the commercial arm behind the Cardano blockchain, developed the Yoroi Wallet. Their wallet software is simplistic and easy to use, making it perfect for beginners.

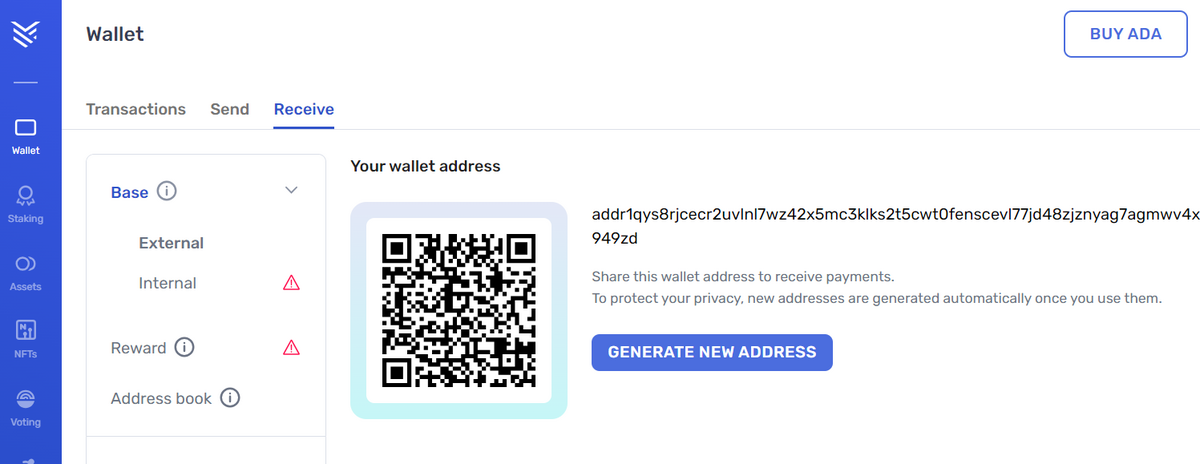

Click ‘Wallet’ in the sidebar, then navigate to the ‘Receive’ tab. The long string of random letters and numbers is your public wallet address. This is where you’ll need to withdraw your ADA tokens.

Choose a Stake Pool Operator

After withdrawing your ADA tokens to the wallet, it’s time to delegate your holdings to a validator.

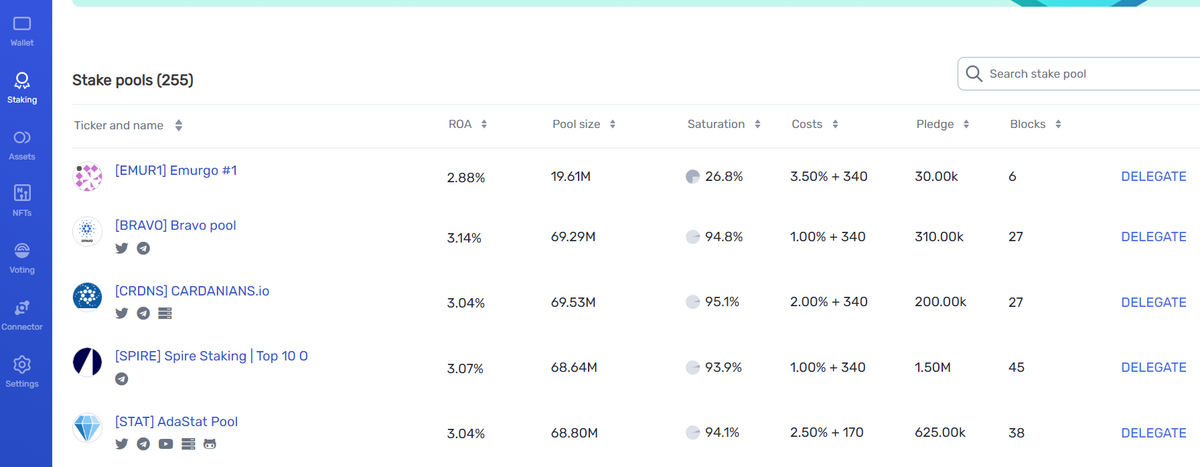

Hit ‘Staking’ in the sidebar, then scroll through the available options. You can sort the enormous range of staking pools by metrics like ROA (Return on ADA), Saturation, and fees.

Once you’ve found a pool you’re happy with, click ‘Delegate’ and confirm the pop-up transaction with your wallet password.

Congratulations! You’ve just staked your ADA tokens directly with a stake pool operator and will begin earning ADA rewards within 2 epochs, or roughly 10 days.

Pros and Cons of Cardano Staking

Like anything in the crypto market, Cardano staking comes with its share of perks and flaws. Let’s recap the pros and cons.

Pros

- Secure and decentralize the Cardano network – By staking your ADA tokens, you’re helping further to distribute the network and make it more resilient and safe.

- Earn staking rewards – In return for committing their tokens, stakers earn emissions of ADA tokens.

Cons

- Unstaking periods – When staking on centralized exchanges, you may be unable to unstake your tokens immediately. Due to market conditions, this might be problematic if you need to sell quickly.

On the Flipside

- Cardano staking rewards mean that more ADA tokens are entering the circulating supply. Some could argue that this increases selling pressure.

Why This Matters

In terms of efficiency and decentralization, Cardano’s staking protocol is one of the best in the crypto industry. Learning how to stake your ADA tokens will teach you about the Cardano network and help you earn ADA rewards.

FAQs

Staking Cardano is considered low risk because your ADA tokens stay in your wallet, and there is no risk of slashing penalties. However, if you stake your ADA, you may not be able to sell quickly if you need to.

Whether or not Cardano staking is worthwhile for you depends on your own crypto strategy. You will earn ADA rewards at up to 5% per year, but you may be unable to access your tokens quickly.