- Cardano kicks off the new year on a sour note.

- The asset slipped and crashed as anticipations soared for ADA to reach $1.

- However, the whales quickly came to the rescue, pushing ADA back up.

Cardano delivered a historic performance last month, surging over 80% in December after underwhelming its holders for a significant portion of the year. However, just as market participants started getting excited following ADA’s emergence as a standout performer, the market turned to temper the festivities, crashing the altcoin market and setting a somewhat gloomy tone for the start of the year.

With ADA holders now analyzing each candle and wondering what’s next for the market, DailyCoin’s expert, Insha Zia, is here to offer valuable insights into what lies ahead, particularly in anticipation of a potential Bitcoin ETF approval.

Table of Contents

News and Events: Understanding the Impact

Cardano Kicks Off the New Year on a Bad Note

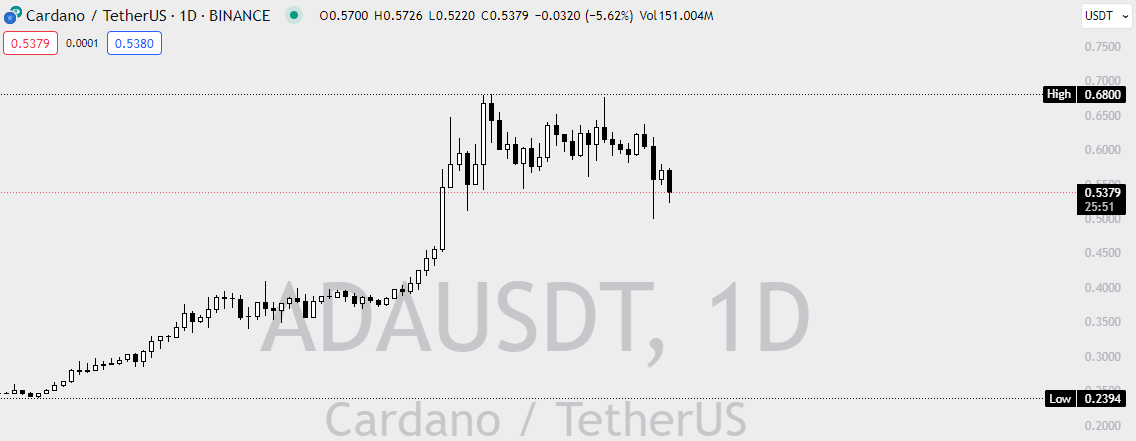

Cardano was on a roll last month, closing in the green for eight consecutive weeks and showing no signs of slowing down. As a result, ADA marked its yearly high at $0.68 in December, tapping the level for the first time since April 2022.

Sponsored

Given Cardano’s remarkable performance, market participants were excited about the token’s long-term prospects, betting big on a sustained bull run as the new year kicked off. However, as unpredictable as it can be, the crypto market decided it was time to shut down the party, sending shockwaves through the altcoin market just as anticipations for a potential Bitcoin ETF soared.

As a result, in just a couple of wicks, the market instantly wiped out approximately $687 million across crypto-tracked futures, which led to Cardano dropping by 18% to 0.49, wiping a fair portion of its gains. However, ADA quickly returned from its fall, immediately surging by 14%, indicating that investors are resiliently standing their ground in support of the asset.

Cardano Whales Splurge Following Crash

Cardano whales swiftly cushioned ADA Cardano’s recent 18% fall. According to Santiment, large Cardano wallets bought over 14 million ADA, worth around $8 million, since the last DailyCoin regular.

The surge in buying activity from wallets holding at least 1 million ADA (approximately $550,000) intensified when Cardano ended its eight-week streak of closing in the green and dipped below the $0.6 mark. Based on Santiment data, whales are strategically accumulating substantial holdings within the $0.49 to $0.52 range.

Cardano Closes Out Year in Top 10 DeFi Protocols

The Cardano DeFi ecosystem has been on an exciting trajectory since last year. Starting at $49 million in January 2023, Cardano’s DeFi Total Value Locked (TVL) has grown exponentially, achieving a remarkable 700% gain by year-end.

For the first time since March 2022, Cardano’s DeFi TVL has surpassed $300 million, reaching a new all-time high in USD on December 15 at $435 million. This remarkable performance allowed Cardano to close out the year snug in the Top 10 DeFi protocols after starting the year much further down on the leaderboard.

Cardano Reclaims Number One Project by Development Activity Spot

While Cardano strives to recover from its fall, the network’s development is progressing at full throttle. DeFi platforms are gradually taking notice of Cardano’s ascent and are keen on building exciting DApps on the network.

As Cardano closes out the year among the top 10 DeFi protocols, crypto intelligence tracker Santiment has acknowledged the thriving development activity on the network, crowning it as the top development platform with over 500 developer submissions on GitHub over the past month.

Surpassing well-established contenders like Polkadot, Kusama, and Avalanche, Cardano’s proof-of-stake (POS) chain has outshone its peers that have historically dominated the ranks.

Current Outlook

Cardano’s bullish structure has received a noticeable dent, making investors and market participants weary of what the year has in store for the digital asset. However, considering how swiftly ADA recovered from its fall thanks to the buying pressure from larger wallets, the consensus maintains an optimistic outlook.

2024 will be quite an exciting year, especially for the crypto market, driven by favorable macroeconomic conditions in the year’s first half. Factors such as a potential Bitcoin Spot ETF approval, Bitcoin halving, and a possible interest rate cut could considerably positively influence Cardano’s price.

In anticipation of the positive events due for the year, ADA could move towards the highly coveted $1 price level. However, at the time of writing, market sentiment tilted slightly on the bearish side and could remain until there’s some certainty in the market surrounding the Bitcoin ETF.

On the Flipside

- Market dynamics can be unpredictable, so it is essential to consider alternative perspectives and opinions when evaluating the potential future performance of ADA.

- Cardano’s yearly growth for 2023 closed at 170%.

- Santiment also crowned Cardano as the top dev platform in 2022.

- Bloomberg analysts forecast a 90% chance of the SEC approving the Bitcoin ETF.

Why This Matters

Although Cardano has wiped out a major part of its December gains, smart money, and large wallets are looking to accumulate heavily, indicating they’re optimistic about ADA’s trajectory for 2024, even in the face of rising fear from retail investors.

Read about Coinbase UK’s new user requirements:

Coinbase UK Shows Full Cooperation to FCA’s Stringent Rules

Learn more about South Korea’s crypto purchase ban:

South Korea Targets Crypto Purchase Ban for Credit Cards